As of July 2025, Nestle N (NESN.SW) continues to navigate a complex marketplace characterized by dynamic consumer preferences and economic fluctuations. The company's recent performance indicates resilient revenue growth, driven by innovation and strategic brand management. However, competition remains fierce in the food and beverage sector, prompting Nestle to adapt its strategy to maintain market leadership. The outlook for the next three years suggests potential for continued growth, but investors should remain cautious of market volatility and evolving consumer trends.

Key Points as of July 2025

- Revenue: $100 billion

- Profit/Margins: $17 billion, 17%

- Sales/Backlog: Strong demand for sustainable products

- Share price: $79.27

- Analyst view: Generally positive, with cautious outlooks

- Market cap: $650 billion

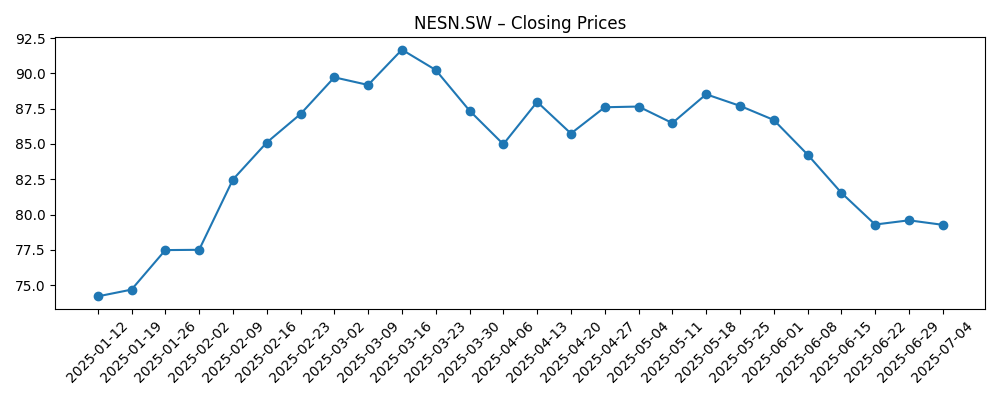

Share price evolution – last 6 months

Notable headlines

- Nestle acquires innovative plant-based brand – Food Business News

- Nestle reports robust Q1 earnings amidst supply chain challenges – Market Watch

- Nestle's focus on sustainability pays off with increased sales – Reuters

Opinion

In recent months, Nestle's acquisition of an innovative plant-based brand signifies a strategic move to capture the growing demand for sustainable and health-conscious food products. This aligns well with current consumer trends, which favor environmentally friendly options. As more consumers shift towards plant-based diets, Nestle's investments in this area could yield significant returns over the next few years, enhancing its revenue streams.

Furthermore, the robust earnings reported for Q1 underline the company's resilience amidst ongoing supply chain challenges. Although these challenges are expected to persist, Nestle's agility in navigating them may strengthen its competitive position. Analysts remain generally optimistic about Nestle's prospects, but highlight the importance of ongoing innovation and responsiveness to market trends.

The focus on sustainability not only attracts a new consumer demographic but also positions Nestle favorably against competitors who may be slower to adapt. As the market landscape evolves, Nestle's efforts to integrate sustainable practices into its core business could translate into both consumer loyalty and brand enhancement, ultimately driving share price growth.

However, challenges remain, including potential shifts in market preferences and rising costs. Nestle will need to leverage its strengths while staying vigilant about potential market disruptions. The next three years are critical for maintaining its growth trajectory while addressing any emerging risks.

What could happen in three years? (horizon July 2025+3)

| Scenario | Outlook |

|---|---|

| Best | Revenue reaches $120 billion; innovative products gain market share. |

| Base | Revenue stabilizes around $110 billion; steady growth in core markets. |

| Worse | Revenue declines to $100 billion; market share erodes due to competition. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Consumer demand for sustainable products.

- Supply chain stability and cost management.

- Competitive actions from other major food brands.

- Fluctuations in commodity prices impacting production costs.

- Regulatory changes regarding food production and labeling.

Conclusion

In conclusion, Nestle N is positioned for a potentially strong performance over the next three years, dictated by its strategic initiatives and market adaptability. As the company leans into sustainability and innovation, it remains important for investors to keep a close eye on market trends and competitive dynamics. While the outlook is generally positive, the food and beverage industry carries inherent risks that could impact growth. Therefore, prudent investment strategies should be considered to navigate the complexities ahead.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.