Mitsubishi UFJ Financial Group (MUFG) is Japan’s largest financial services group, spanning retail and corporate banking, investment banking, trust banking, securities, and asset management. It competes domestically with Sumitomo Mitsui Financial Group and Mizuho Financial Group, and globally with universal banks such as HSBC and JPMorgan.

Recent metrics point to solid profitability and balance sheet depth: profit margin 23.10% and operating margin 38.26%. Trailing twelve‑month revenue is 5.44T and diluted EPS is 159.43, with ROE at 5.94% and ROA at 0.31%. Shares are up 59.80% over the past year, testing a 52‑week high of 2,376.50; the forward annual dividend yield is 2.95% on a projected rate of 70 with a payout ratio of 40.12%, and the next ex‑dividend date is 9/29/2025.

Key Points as of September 2025

- Revenue and growth: Revenue (ttm) 5.44T; quarterly revenue growth (yoy) −4.80%, indicating softer top‑line momentum.

- Profitability: Profit margin 23.10% and operating margin 38.26%; diluted EPS (ttm) 159.43.

- Returns: ROE 5.94% and ROA 0.31%; quarterly earnings growth (yoy) −1.80%.

- Balance sheet and liquidity: Total cash (mrq) 151.08T versus total debt 105.84T.

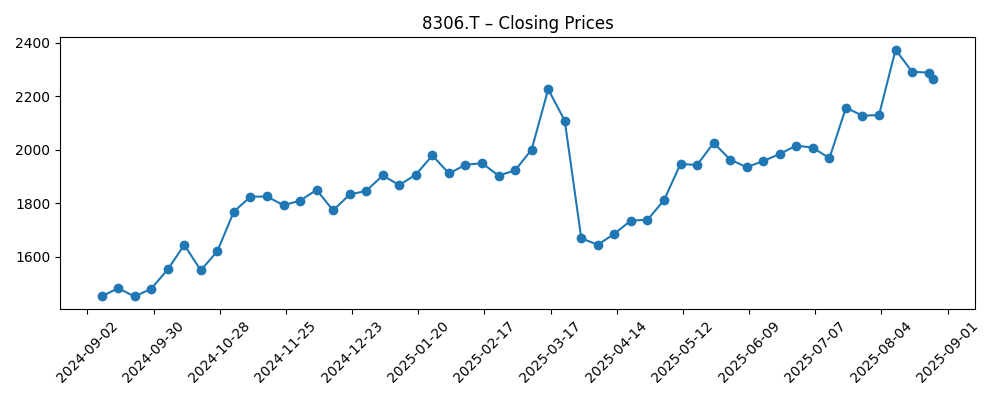

- Share price and technicals: 52‑week change +59.80%, 52‑week high 2,376.50; recent close 2,369.0 (Sep 22, 2025). 50‑DMA 2,185.08; 200‑DMA 1,971.10; beta (5Y) 0.22.

- Dividend profile: Forward annual rate 70 and yield 2.95%; trailing rate 64 and yield 2.73%; payout ratio 40.12%; ex‑dividend 9/29/2025.

- Ownership and liquidity: Shares outstanding 11.38B; float 11.27B; insiders 4.92%; institutions 37.30%; average 3‑month volume 40.75M.

- Pipeline and fee initiatives: MUFG is reported to eye money‑manager expansion and to launch a $680 million Japan real estate fund, potential supports for fee income amid softer revenue growth.

Share price evolution – last 12 months

Notable headlines

- Mitsubishi UFJ Financial Group Inc. (MUFG) Eyes Money Managers For International Expansion [Yahoo Entertainment]

- Exclusive - MUFG to launch $680 million Japan real estate fund [CNA]

- Northwestern Mutual Wealth Management Co. grows holdings in MUFG [ETF Daily News]

- Walleye Capital LLC invests $442,000 in MUFG [ETF Daily News]

- Contrasting MUFG & China Merchants Bank [ETF Daily News]

Opinion

MUFG’s reported push into money management and the planned $680 million real‑estate fund suggest a deliberate tilt toward fee and fiduciary income. For a megabank, diversifying away from purely interest‑driven earnings can smooth cycles and help offset slower revenue growth shown in recent quarterly figures.

The share price has rerated meaningfully, up 59.8% year‑on‑year and hovering near a 52‑week high of 2,376.50. Technically, the stock trades above its 50‑ and 200‑day moving averages, with a low beta profile that may appeal to investors seeking stability. It also trades above book value per share of 1,752.92, implying improved sentiment toward future returns.

That optimism faces checks: quarterly revenue and earnings growth are mildly negative (−4.80% and −1.80% yoy), and any macro slowdown or policy shifts could pressure net interest income and credit costs. Execution risk around new fund launches and cross‑border asset‑management deals also deserves attention.

Near term, the 9/29/2025 ex‑dividend date may influence trading flows, while medium term the strategy mix—fee income expansion, capital discipline, and balance‑sheet strength—underpins a base case of steady dividends and measured growth. Upside likely hinges on successful international scaling of asset‑management capabilities.

What could happen in three years? (horizon September 2025+3)

| Scenario | Key drivers | Implications for MUFG and the stock |

|---|---|---|

| Best | Fee‑income expansion from asset management and real estate mandates; stable credit costs; healthy capital markets activity. | Higher earnings mix resilience; sustained dividend growth within payout discipline; valuation supported by durable margins and strong liquidity. |

| Base | Moderate domestic loan growth; flat‑to‑slightly better fee income; benign credit environment. | Incremental earnings improvement; dividends maintained; shares track broader Japanese financials with lower volatility. |

| Worse | Macro slowdown, weaker markets activity, or execution setbacks in new initiatives. | Margin pressure and slower fee traction; cautious dividend stance; shares de‑rate toward long‑term averages pending clearer growth signals. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Domestic and global interest‑rate paths and yen volatility, with knock‑on effects for net interest income and foreign asset valuations.

- Asset quality and credit costs across corporate and retail portfolios, particularly in Japan and key overseas markets.

- Execution of asset‑management expansion and the $680 million real‑estate fund, including fundraising pace and fee generation.

- Capital return actions and dividend decisions, including timing effects around the 9/29/2025 ex‑dividend date.

- Capital‑markets activity influencing underwriting, trading, and advisory fees in securities and investment banking.

Conclusion

MUFG enters the next three years with a combination of strong liquidity, robust operating margins, and visible efforts to broaden fee‑based income through asset‑management and real‑estate initiatives. The stock’s outperformance and position near 52‑week highs reflect improving confidence, aided by trading above both the 50‑ and 200‑day averages and a forward dividend yield near 3% on a moderate 40.12% payout ratio. Still, near‑term revenue and earnings trends are slightly negative, and macro or policy shifts could test the interest‑income engine. Against that backdrop, a base‑case outlook features steady dividends and gradual earnings normalization, with upside if fee initiatives scale internationally and capital markets remain supportive. Conversely, a growth wobble or execution misstep could compress the premium over book and curb momentum. For diversified investors, MUFG offers an income‑supported, lower‑beta exposure to Japan’s banking recovery, with identifiable catalysts and balanced risks.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.