Itaú Unibanco (ITUB) enters August 2025 near its 52‑week high after a strong recovery from late‑2024 lows. The ADR last closed around $6.86, sitting above its 50‑ and 200‑day moving averages, with a 52‑week change of roughly 20% and a low 5‑year beta. Fundamentals remain solid: trailing‑twelve‑month revenue of 134.78B and net income of 42.84B support a 31.79% profit margin and 20.81% ROE, even as quarterly revenue growth is -8.90% while quarterly earnings growth is 10.60%. Liquidity is ample for a large bank, with 415.27B in cash versus 1.01T in total debt. The forward dividend yield stands at 0.54%, with an ex‑dividend date on August 20, 2025. Recent coverage calls Itaú a “premium compounder,” while fund flows look mixed, with some managers adding and others trimming. This note outlines a three‑year outlook focused on earnings resilience, asset quality, and valuation discipline.

Key Points as of August 2025

- Revenue: 134.78B (ttm); quarterly revenue growth (yoy) is -8.90%.

- Profit/Margins: Profit margin 31.79%; operating margin 26.95%; ROE 20.81%; ROA 1.57%.

- Earnings: Diluted EPS (ttm) 0.73; quarterly earnings growth (yoy) 10.60%.

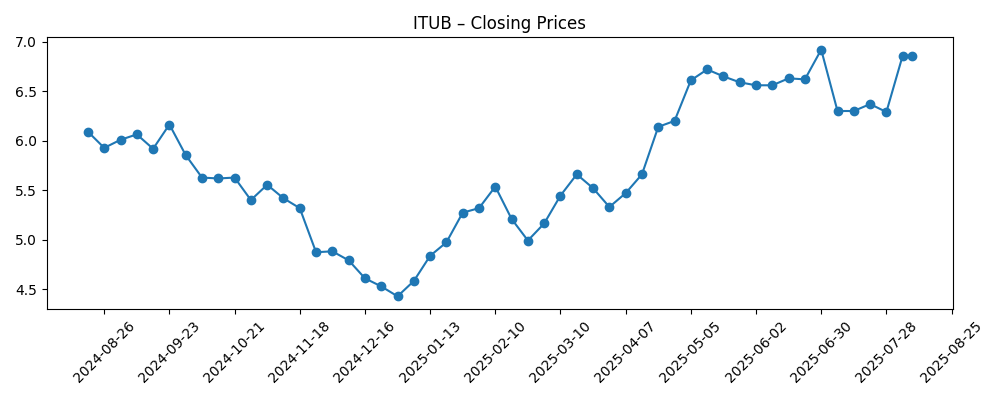

- Share price: $6.86 (week of Aug 8, 2025); 52‑week range 4.42–6.95; above 50‑day (6.54) and 200‑day (5.70) averages; 52‑week change 19.97%; beta 0.28.

- Cash & leverage: Total cash 415.27B; total debt 1.01T; operating cash flow (ttm) -40.66B.

- Dividend & actions: Forward dividend rate 0.04 (0.54% yield); trailing 2.39 (34.99% yield); payout ratio 70.89%; ex‑dividend 8/20/2025; last split 11:10 on 3/19/2025.

- Ownership & short interest: Institutions hold 22.77%; shares short 85.85M (0.80% of shares outstanding), down from 99.53M; short ratio 3.18.

- Analyst/investor view: Seeking Alpha highlights Itaú as a “premium compounder”; recent fund flows show additions by some managers and trims by others.

- Market cap (approx.): About $74B using $6.86 and 10.8B implied shares outstanding.

Share price evolution – last 12 months

Notable headlines

- Itaú Unibanco: The Premium Compounder Still Steering Brazil's Banking Scene [Seeking Alpha]

- Itau Unibanco Holding S.A. (NYSE:ITUB) Holdings Boosted by Envestnet Asset Management Inc. [ETF Daily News]

- Victory Capital Management Inc. Sells 2,901,013 Shares of Itau Unibanco Holding S.A. (NYSE:ITUB) [ETF Daily News]

Opinion

ITUB’s price action has healed decisively from the December 2024 trough near $4.43, with the ADR now hovering around $6.86 and close to its 52‑week high of $6.95. The set‑up into late Q3 looks constructive: a low 5‑year beta of 0.28 dampens downside volatility, while momentum is supported by the stock trading above both its 50‑ and 200‑day moving averages. On valuation, investors are effectively paying about 9–10x trailing EPS (0.73) and roughly sub‑0.4x book value per share (19.34), which is conservative for a bank delivering a 20.81% ROE. The upcoming August 20 ex‑dividend date could add near‑term trading interest, although the forward yield of 0.54% suggests total‑return investors remain more focused on earnings compounding than income. Overall, the technical and fundamental backdrop supports a cautious but positive stance into the next three years.

Under the surface, reported trends are mixed but manageable. Trailing‑twelve‑month revenue of 134.78B sits against a -8.90% quarterly revenue growth rate, yet quarterly earnings growth of 10.60% implies expense control, improved mix (fees vs. credit), and/or normalized credit costs. Margins remain firm (profit margin 31.79%; operating margin 26.95%), and ROE of 20.81% indicates the franchise continues to monetize scale and risk management. The negative operating cash flow (‑40.66B ttm) should be interpreted in the context of banking cash dynamics rather than industrial cash burn; nonetheless, it is a reminder to monitor funding conditions. Balance‑sheet size is substantial (415.27B cash; 1.01T debt), consistent with a universal bank model. In this context, the “premium compounder” framing looks credible provided asset quality stays benign and fee income remains resilient as lending cycles ebb and flow.

Flows and ownership data point to a market in price‑discovery rather than consensus. Institutional ownership stands at 22.77%, with short interest of 85.85M shares (0.80% of outstanding) and a short ratio of 3.18, declining from 99.53M a month earlier. That setup suggests limited bearish conviction near current levels. The contrasting headlines—Envestnet boosting holdings while Victory Capital trims—underscore a familiar debate: whether ITUB’s ROE durability merits a valuation re‑rating or whether macro sensitivity should keep the multiple capped. With the stock already near its 52‑week high, further upside likely requires confirmation that earnings growth can outpace the recent revenue softness, aided by discipline on costs and provisioning. Corporate actions also matter at the margin: a March share split (11:10) and the August 20 ex‑div date can influence liquidity and near‑term flows but do not change the long‑term thesis.

Looking ahead three years, the base case features steady profitability with ROE holding near current levels, modest operating leverage from digital scale, and disciplined capital returns anchored by the stated payout posture (70.89%). The forward dividend yield of 0.54% leaves room for total return to be driven primarily by earnings and any multiple normalization from current sub‑book levels. In a favorable scenario, stable credit, fee growth, and cost control could sustain mid‑cycle compounding, attracting broader institutional demand and reducing short interest further. Conversely, a harsher credit cycle or slower fees could pressure revenue and capital deployment, capping the multiple. With beta at 0.28 and the stock above key moving averages, the risk‑reward skews toward patient accumulation on pullbacks rather than chasing breakouts, pending clearer evidence that earnings momentum can endure.

What could happen in three years? (horizon August 2025+3)

| Case | Narrative | Implications for investors |

|---|---|---|

| Best | Asset quality remains resilient; fee income and core banking revenue stabilize; operating discipline sustains high returns on equity close to present levels; digital scale improves efficiency. | Valuation gradually re‑rates from sub‑book toward a premium to tangible value; dividends remain supported; total return led by earnings compounding and modest multiple expansion. |

| Base | Macro remains mixed; revenue growth is modest but positive; credit costs normalized; profitability metrics hold near current run‑rate. | Shares track earnings growth; capital returns steady around current payout posture; volatility remains below market due to low beta profile. |

| Worse | Credit cycle turns; revenue softens further; funding costs tighten and fee income slows; management prioritizes capital buffers over distributions. | Multiple compresses; price drifts toward the lower end of historical trading ranges; dividend flexibility reduced until trends stabilize. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Brazilian macro conditions and interest‑rate trajectory affecting credit demand, funding costs, and asset quality.

- Credit performance and provisioning trends across retail and corporate portfolios.

- Fee income momentum versus lending spreads as revenue mix shifts through the cycle.

- Capital allocation and dividend policy relative to the 70.89% payout ratio and regulatory requirements.

- Competitive dynamics from incumbents and fintechs, including digital adoption and cost efficiency.

- FX translation of BRL to USD for the ADR, which can magnify or mute reported results.

Conclusion

ITUB’s three‑year setup blends resilient profitability with a valuation that still appears conservative versus its return profile. The shares sit near a 52‑week high and above key moving averages, but low beta and improving earnings momentum provide some cushion against macro chop. Reported trends are mixed—revenue growth is negative while earnings growth is positive—yet margins and ROE remain robust, supporting the “premium compounder” narrative cited in recent coverage. Capital returns look sustainable under a steady backdrop, with the 8/20/2025 ex‑div date providing a near‑term marker. The base case favors steady compounding with disciplined risk management; upside depends on stable credit and fee growth that could justify a modest re‑rating from sub‑book levels. Downside risks center on a credit turn or funding stress that would pressure revenue and constrain distributions. For long‑term investors, staggered accumulation on weakness appears more prudent than momentum‑chasing at highs.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.