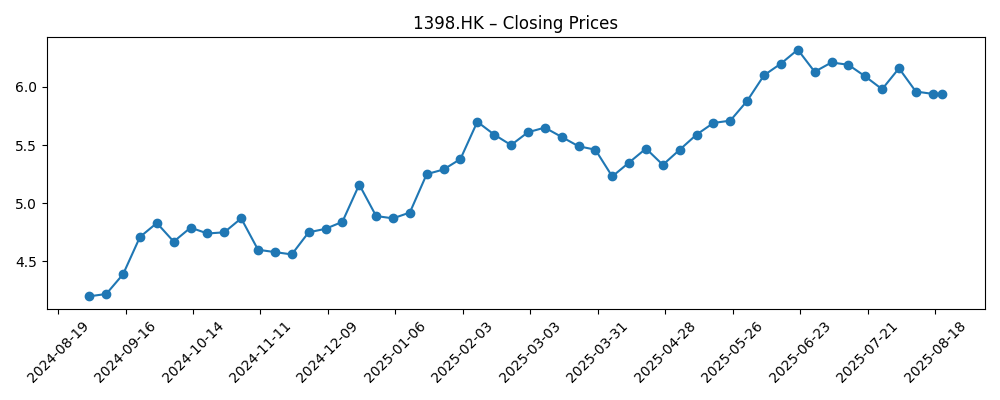

Industrial and Commercial Bank of China (ICBC, 1398.HK) enters August 2025 with a strong income profile and a volatile, policy‑sensitive share price. Over the last six months the stock climbed from the mid‑HK$4s to a June peak above HK$6 before settling near HK$5.94 as of August 21. Fundamentals remain solid on headline profitability – revenue (ttm) of 657.86B and net income (ttm) of 347.4B translate to robust margins – while quarterly revenue and earnings contracted modestly year over year. A forward dividend yield of 11.30% with a 47.18% payout ratio is a key support for investor demand. The central questions for the next three years: how net interest income holds up against policy rate moves, whether asset quality remains contained amid a slow property recovery, and if dividend discipline can persist through credit cycles.

Key Points as of August 2025

- Revenue (ttm): 657.86B; Net income (ttm): 347.4B; Diluted EPS (ttm): 1.050.

- Profitability: Profit margin 55.08%; operating margin 66.49%; ROE 9.16%; ROA 0.73%.

- Sales/Backlog: Not disclosed in provided data; performance hinges on net interest income and fee trends.

- Share price: 5.94 (Aug 21, 2025); 52‑week change 26.71%; range 4.060–6.480; 50D/200D MAs 6.141/5.481.

- Dividend: Forward 0.67 (11.30% yield); trailing 0.31 (5.19%); payout ratio 47.18%; ex‑div 7/3/2025.

- Balance sheet/cash flow: Total cash 5.55T; total debt 4.62T; operating cash flow (ttm) −824.06B.

- Ownership/liquidity: Shares outstanding 86.79B; float 210.69B; institutions 48.48%; avg vol (3m) 248.04M; beta 0.31.

- Market cap/analyst view: Market cap not provided; no analyst consensus in dataset.

Share price evolution – last 12 months

Notable headlines

Opinion

The share price arc since late 2024 offers a useful baseline for a three‑year view. ICBC rose from about HK$4.20 last September to a local high near HK$6.32 in late June 2025, then eased to roughly HK$5.94 by August 21. This pattern fits a “yield plus policy” trade: investors bid up the stock as dividend visibility improved and broader China risk sentiment stabilized, then trimmed exposure as growth data and rate expectations wobbled. With a 52‑week change of 26.71%, the name has outpaced major indices, but its 50‑day average (6.141) now sits just above spot and the 200‑day (5.481), signaling a consolidation phase. From here, price direction likely depends on whether earnings slippage (revenue −1.70% YoY; earnings −4.00% YoY) stabilizes while dividend capacity remains credible.

Profit and operating margins at 55.08% and 66.49% respectively, alongside a 9.16% ROE, underline ICBC’s scale economics and cost discipline. However, the bank’s operating cash flow (ttm) at −824.06B reminds investors that reported profits and cash generation can diverge in banking due to balance‑sheet flows and timing effects. Over a three‑year horizon, the key swing factor is the net interest margin path amid policy rate adjustments and competition for deposits. A lower‑for‑longer rate setting can compress asset yields faster than funding costs reset, pressuring earnings; conversely, targeted credit support to priority sectors can sustain fee income. ICBC’s low beta (0.31) suggests dampened volatility relative to the market, but macro shocks or regulatory changes can still produce step‑shifts.

Dividend policy anchors the equity story. The forward payout implies an 11.30% yield with a 47.18% payout ratio, which gives headroom if profits soften modestly but leaves limited flexibility under a sharp credit downturn. Historically, large Chinese banks have balanced shareholder returns with prudential buffers; over the next three years, maintaining a payout near current levels likely requires stabilizing top‑line trends and contained credit costs. The absence of sales/backlog data in this set is typical for banks; investors should instead focus on revenue per share (1.85), fee income resilience, and asset quality markers. If quarterly declines in revenue and earnings moderate, the dividend could remain the primary driver of total return, with price gains tracking improvements in macro sentiment.

Positioning into 2028, a base case is a range‑bound share price that oscillates around moving averages as fundamentals evolve, while dividends contribute the bulk of returns. Upside stems from evidence that margins can hold and that system‑wide credit risk continues to normalize; in that scenario, investor confidence could re‑rate the stock toward the upper end of its 52‑week range. On the downside, renewed pressure in property‑related exposures or aggressive rate cuts could compress profitability and test payout sustainability. Liquidity remains ample (avg 3‑month volume ~248.04M), so shifts in global risk appetite and China flows can move the name quickly. Given these cross‑currents, disciplined reinvestment of dividends and attention to policy signals may be the most pragmatic approach.

What could happen in three years? (horizon August 2025+3)

| Scenario | Outlook (to August 2028) |

|---|---|

| Best | Macro stabilization lifts confidence; net interest and fee income steady; ROE holds near high‑single digits; dividend maintained with potential incremental growth; shares gravitate toward the top end of recent ranges with lower volatility given beta 0.31. |

| Base | Growth remains subdued but stable; revenue/earnings drift around flat to slightly negative; dividend sustained broadly in line with current payout ratio; stock trades range‑bound around long‑term averages, with total return dominated by yield. |

| Worse | Renewed asset‑quality stress and margin compression; earnings under pressure; payout trimmed to preserve capital; shares re‑rate toward the lower end of historical ranges as investors prioritize balance‑sheet strength. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Policy rates and credit directives affecting net interest margins and loan growth.

- Asset‑quality trends, especially exposures tied to property and local‑government financing.

- Dividend policy and payout sustainability relative to earnings trajectory.

- Capital and regulatory requirements that influence lending capacity and profitability.

- Market sentiment toward China financials, flows into Hong Kong equities, and FX conditions.

Conclusion

ICBC’s investment case over the next three years balances dependable income against policy and credit‑cycle uncertainty. The bank posts strong headline profitability – including a 55.08% profit margin and 66.49% operating margin – yet shows modest year‑over‑year contraction in revenue and earnings. The forward dividend yield of 11.30% with a 47.18% payout ratio provides a meaningful cushion for total returns, but its durability hinges on stable net interest income and manageable credit costs. Technically, the stock’s advance from the HK$4s to a June peak above HK$6, followed by consolidation near HK$5.94, suggests a range‑bound bias unless macro sentiment or policy shifts provide a catalyst. With low beta, high liquidity, and no market‑cap or analyst data provided here, investors should focus on the observable metrics: margins, ROE, dividend timing (ex‑div 7/3/2025), and the trajectory of quarterly growth. Income‑oriented holders may find the risk‑reward acceptable; others may prefer confirmation of stabilization.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.