As of

Key Points as of September 2025

- Revenue: 665.27B (ttm); quarterly revenue growth (yoy) 4.80%.

- Profit/Margins: Net income 348.53B; profit margin 54.64%; operating margin 63.76%; ROE 9.11%; ROA 0.73%.

- Sales/Backlog: Not applicable for banks; industry reports highlight weak loan demand—watch loan growth and net interest margin.

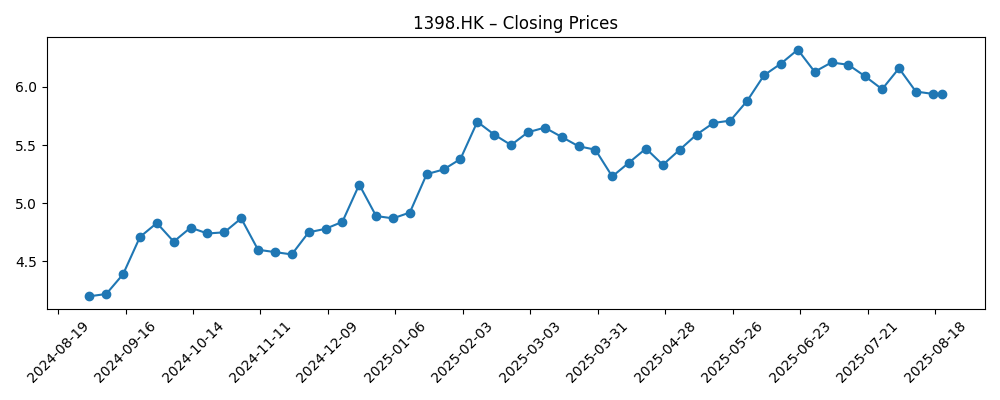

- Share price: ~HK$5.74 (2025‑09‑22); 52‑week range 4.39–6.48; 52‑week change +32.43%; 50‑day MA 5.995 vs 200‑day 5.612; beta 0.32.

- Dividend: Forward annual rate 0.67 (yield 11.42%); trailing rate 0.31 (5.20%); payout ratio 64.18%; last ex‑div 7/3/2025.

- Analyst view: Mixed—focus on dividend sustainability, NIM compression, and property‑linked credit costs.

- Market cap: Not provided in this snapshot; ICBC remains a mega‑cap by assets; shares outstanding 86.79B; institutions hold 48.48%.

- Liquidity/Leverage: Total cash 3.81T; total debt 5.22T; operating cash flow (ttm) −1.09T.

- Trading liquidity: Avg volume (3‑mo) 223.67M; price remains near the 50‑day trendline.

Share price evolution – last 12 months

Notable headlines

- HSBC, ICBC eye Hong Kong stablecoin licenses under new regime: Report

- Profitability pressure grows for China's state banks amid low rates, poor loan demand

- Top China bank ICBC posts 1.4% H1 profit fall

- HSBC, ICBC enter Hong Kong’s stablecoin race amid new rules

- Chinese firms may face limits on stablecoin activity in Hong Kong: Report

- Hong Kong stocks rise ahead of earnings reports from heavyweights Alibaba, ICBC

Opinion

ICBC’s three‑year story begins with income. A forward yield of 11.42% supported by a 64.18% payout ratio is compelling in a low‑beta (0.32) stock, particularly for investors seeking stability. Yet the dividend’s durability hinges on two levers outside pure operating control: domestic policy rates and credit costs in property‑adjacent portfolios. With revenue up 4.80% year over year but earnings growth modest and operating cash flow negative (common in bank flow accounting), the bank must balance shareholder returns with capital buffers. In this context, even slight improvements in loan demand or fee income can make the difference between maintaining or trimming distributions. For the next leg higher, the market will likely want clearer evidence of sustainable profit accretion rather than one‑off tailwinds.

On growth optionality, ICBC’s interest in Hong Kong stablecoin licensing points to a prudent, infrastructure‑first approach to digital assets. The prize is not speculative trading, but potential payments, custody, and tokenization rails that deepen client relationships and fee pools. However, headlines suggesting possible limits on Mainland‑affiliated firms’ stablecoin activity highlight execution risk. A viable path would emphasize compliance, institutional use‑cases, and integration with existing transaction banking. If regulations crystallize in favor of tightly supervised pilots, ICBC could convert its scale and trust into low‑volatility fee income. If rules constrain participation, the bank still benefits from the learning curve and can deploy capabilities into adjacent digital finance products where the policy stance is clearer.

Technically, the stock trades above its 200‑day moving average (5.612) and near the 50‑day (5.995). That setup often signals consolidation after a strong 52‑week advance of 32.43%. The 52‑week range of 4.39–6.48 frames the debate: a decisive break higher would likely need either a turn in loan demand or a policy backdrop that eases net interest margin pressure without eroding deposit franchises. Conversely, dips may be supported by yield‑seeking demand given the double‑digit forward yield. For long‑horizon investors, the priority may be accumulating on weakness rather than chasing strength, provided asset‑quality indicators remain contained and the dividend policy stays intact.

Over three years, we see a triptych of outcomes. In an improving macro, management can hold payout discipline while re‑mixing toward fees (including compliant digital adjacencies), allowing the stock to compound income and potentially narrow its valuation gap to global peers. In a middling environment, earnings stability and policy support could anchor the share price within a broad range while delivering substantial cash returns. In a stressed case, prolonged property repair and margin compression would force capital preservation—reducing growth initiatives and possibly recalibrating dividends. Monitoring rate policy, Stage‑3 loan trends, and regulatory developments around Hong Kong’s stablecoin regime will be decisive in steering expectations.

What could happen in three years? (horizon September 2025+3)

| Scenario | Narrative to September 2028 | Signals to watch |

|---|---|---|

| Best | Policy easing and stabilizing property markets revive loan demand; ICBC scales compliant digital payment/custody services in Hong Kong, lifting fee income while costs stay contained. Dividend remains a central pillar, and valuation benefits from reduced risk premia. | Improving credit trends; resilient net interest margin; approvals and client adoption for stablecoin‑related infrastructure; steady payout policy. |

| Base | Macro remains mixed; modest revenue growth offsets pressure on margins. Fee initiatives progress slowly but steadily. Dividend policy is maintained prudently, and shares oscillate around long‑term averages with total return dominated by income. | Flat‑to‑slightly better credit costs; stable deposits; incremental regulatory clarity in Hong Kong; limited operating leverage. |

| Worse | Extended property weakness and lower‑for‑longer rates compress profitability; tighter rules curb digital expansion. Capital preservation takes precedence, and management prioritizes balance‑sheet strength over distribution growth. | Rising non‑performing indicators; weaker loan demand; more restrictive digital‑asset rules; cautious guidance on dividends. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Domestic rate path and net interest margin dynamics across deposits and loans.

- Asset quality in property‑linked and SME exposures, including any uptick in impairments.

- Regulatory outcomes for Hong Kong stablecoin licensing and broader digital finance participation.

- Dividend policy sustainability relative to earnings trajectory and capital requirements.

- Investor risk appetite toward China financials and any shifts in institutional ownership.

Conclusion

ICBC’s investment case into 2028 balances a high, policy‑supported dividend against structural margin pressure and a still‑healing credit cycle. The bank’s scale and profitability metrics (profit margin 54.64%, ROE 9.11%) provide a cushion, but recent earnings growth is modest and operating cash flow has been negative on a ttm basis, underscoring the need for disciplined balance‑sheet management. Share performance has improved—up 32.43% over 52 weeks—yet the next phase likely hinges on incremental improvements in loan demand, fee diversification, and regulatory clarity around digital initiatives in Hong Kong. For income‑oriented holders, the forward yield (11.42%) and low beta may justify patience, provided asset quality remains stable and payout discipline is maintained. For total‑return seekers, catalysts include a turn in the macro, evidence of fee growth, and constructive policy signals. Position sizing should reflect macro sensitivities and regulatory timelines.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.