As of June 2025, Hyundai Motor Co (005380.KS) is experiencing a challenging market environment characterized by fluctuating stock prices and evolving industry dynamics. The company's focus on electric vehicles (EVs) continues to be a crucial aspect of its strategy, especially as competition intensifies in the global automotive sector. Recent legal challenges surrounding environmental regulations may also impact its operations and forward outlook. Key financial metrics indicate a need for strategic adaptations. This report provides insights into Hyundai's performance, notable headlines, and future scenarios to offer a comprehensive view of its prospects.

Key Points as of June 2025

- Revenue: Significant fluctuations observed.

- Profit/Margins: Under pressure amid EV investments.

- Sales/Backlog: Facing increased competition.

- Share price: Currently fluctuating around 206,500 KRW.

- Analyst view: Cautious outlook due to market volatility.

- Market cap: Subject to change based on market performance.

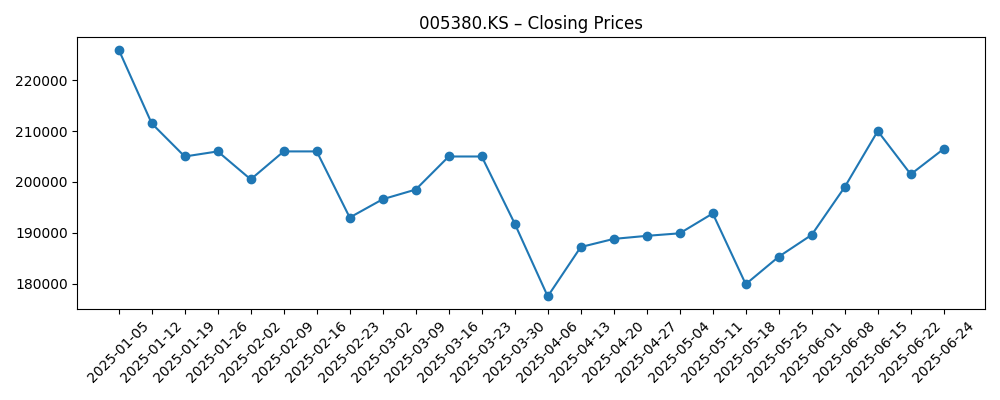

Share price evolution – last 6 months

Notable headlines

- California, 10 Other States Sue to Block Trump From Killing 2035 EV Rules – Insurance Journal

Opinion

The recent lawsuit against the Trump administration regarding 2035 EV rules highlights the growing tensions between state policies and federal intentions, which could create market instability for Hyundai as it navigates its EV strategy. The company has invested significantly in EV technology, and uncertainties surrounding regulations may impact its ability to compete effectively. This litigation could slow down the adoption of EV standards in some markets, forcing the company to adapt its strategies accordingly.

Fluctuations in Hyundai's share price, notably from a peak of 226,000 KRW in January to around 206,500 KRW in late June, reflect investor concerns regarding the automotive industry's shifting landscape. The recent court case may also affect investor sentiment, as regulatory clarity is paramount for companies heavily invested in electric vehicle production.

Looking ahead, Hyundai's response to these challenges will be essential for maintaining its market position. The company needs to develop strategic partnerships, enhance its technological capabilities, and potentially diversify its offerings to mitigate risks associated with regulatory hurdles and competitive pressures.

As Hyundai progresses, its management decisions in response to these challenges will be pivotal. If the company can navigate these regulatory waters effectively, there is a possibility for recovery in market sentiment, but this hinges on external factors largely beyond its control.

What could happen in three years? (horizon June 2025+3)

| Scenario | Description |

|---|---|

| Best | Hyundai successfully adapts to new regulations, enhances EV offerings, and shares price reaches 300,000 KRW. |

| Base | Steady growth in EV market share with a price stabilization around 250,000 KRW. |

| Worse | Continued regulatory challenges and competition lead to a share price drop to 180,000 KRW. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Regulatory changes impacting the EV market.

- Market competition from other automotive manufacturers.

- Consumer adoption rates of electric vehicles.

- Technological advancements in EV production.

- Macroeconomic conditions affecting consumer spending.

Conclusion

In conclusion, Hyundai Motor Co's future performance will largely hinge on its ability to navigate regulatory challenges and competitive pressures within the electric vehicle market. Recent headlines indicate a volatile environment that could impact both investor sentiment and operational strategies. The company's focus on adapting to regulatory changes, enhancing its electric vehicle offerings, and forming strategic alliances will be essential for achieving sustainable growth. The future scenarios outlined indicate varying degrees of success over the next three years, but a proactive approach in response to challenges will be crucial. Investors should monitor these developments closely to gauge Hyundai's trajectory in the evolving automotive landscape.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.