Over the past six months, GMBXF has rebounded from late‑March softness to trade near its 52‑week high. The company’s latest figures show revenue (ttm) of 16.41B with a 23.70% profit margin and 46.77% operating margin. Liquidity appears robust with 7.28B in cash against 10.14B of total debt and a current ratio of 6.49. The dividend profile tilts shareholder‑friendly: a forward annual rate of 0.25 (3.74% yield) and a 47.99% payout ratio. While quarterly revenue growth is negative (‑3.70% yoy), quarterly earnings growth of 10.00% yoy highlights cost discipline. The stock is up 19.14% over 52 weeks, last closing at 6.66 on Aug 8, 2025, above its 50‑day (5.98) and 200‑day (5.33) moving averages. With 7.78B shares outstanding and high insider ownership (63.77%), float is more limited (3.13B) and OTC volume modest. This note outlines a neutral, risk‑aware three‑year outlook.

Key Points as of August 2025

- Revenue: ttm 16.41B; revenue per share 2.13; quarterly revenue growth yoy at -3.70%.

- Profit/Margins: profit margin 23.70%; operating margin 46.77%; EBITDA 8.33B; net income 3.89B; ROE 19.05%; ROA 11.86%.

- Cash flow & balance sheet: operating cash flow 5.62B; levered free cash flow 1.66B; cash 7.28B; total debt 10.14B; debt/equity 40.92%; current ratio 6.49.

- Sales/Backlog: no backlog disclosed in provided data; quarterly earnings growth 10.00% yoy despite a revenue decline.

- Share price & technicals: last close 6.66 (Aug 8, 2025); 52‑week change 19.14%; 52‑week high/low 6.71/4.39; above 50‑day (5.98) and 200‑day (5.33) averages.

- Dividend: forward rate 0.25 (3.74% yield); trailing 0.10 (1.52% yield); payout ratio 47.99%; last ex‑dividend 5/27/2025.

- Ownership & float: shares outstanding 7.78B; float 3.13B; insiders hold 63.77%; institutions 18.06%.

- Analyst view & sentiment: OTC coverage appears limited; 5‑year beta 1.17 suggests moderate cyclicality; performance broadly tracks the S&P 500’s 52‑week change.

- Market cap: implied large capitalization given shares outstanding and recent price near the 52‑week high.

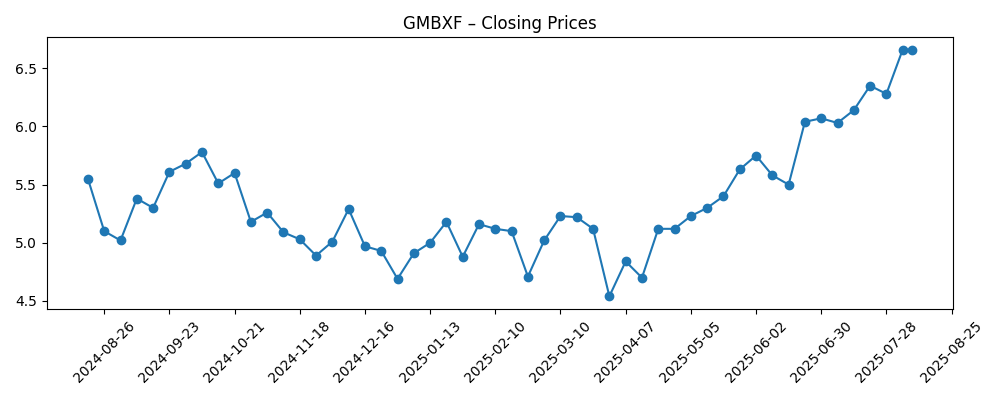

Share price evolution – last 12 months

Notable headlines

Opinion

The past half‑year price action suggests sentiment has turned constructive, with GMBXF lifting from sub‑5 levels in late March to 6.66 by Aug 8, 2025, close to its 6.71 high. That move has occurred alongside resilient profitability: a 46.77% operating margin and 23.70% profit margin support the case that the company can defend earnings even when top‑line growth is soft (‑3.70% yoy). In our view, this combination of tighter cost control and stronger discipline has been the key driver of the re‑rating, as investors reward durable margin structures in cyclical businesses. The trend also aligns with the improved earnings growth metric (10.00% yoy), which can reassure shareholders that cash conversion remains a priority.

Looking forward three years, the investment case will likely hinge on commodity exposure, execution on operating efficiency, and capital allocation. With 7.28B in cash versus 10.14B in total debt and a 6.49 current ratio, the balance sheet appears flexible enough to sustain dividends (forward rate 0.25; 3.74% yield) and selective investment. We think the forward yield, reinforced by a 47.99% payout ratio, positions the shares as a hybrid of income and cyclical growth. That said, maintaining free cash flow at 1.66B while navigating potential price volatility will be crucial to protecting the dividend and funding new projects without undue leverage.

Technically, the stock has broken above medium‑term trend lines and is trading above its 50‑ and 200‑day moving averages (5.98 and 5.33). Momentum can persist if earnings quality stays firm; however, proximity to the 52‑week high (6.71) means sensitivity to macro headlines may be elevated in the near term. Liquidity considerations also apply: an OTC listing with modest average volume (around 14.34k for three months; 21.67k for 10 days) and a relatively concentrated insider base (63.77%) can amplify day‑to‑day volatility. For longer‑term investors, this configuration argues for staggered entry points rather than chasing strength.

Our base view is neutral to cautiously constructive. The company has demonstrated the ability to grow earnings despite top‑line softness, suggesting levers in mix and cost remain available. If management prioritizes sustaining operating cash flow (5.62B ttm) and steady capital returns while avoiding aggressive balance‑sheet expansion, the stock can compound through cycles. Conversely, macro or regulatory setbacks, weaker commodity pricing, or execution missteps could compress multiples from current levels. In that context, we would anchor expectations on cash generation and dividend durability as the core pillars of the three‑year outlook.

What could happen in three years? (horizon August 2025+3)

| Scenario | Outcome by August 2028 |

|---|---|

| Best case | Stable to stronger commodity backdrop, disciplined costs, and sustained cash conversion. Earnings quality remains high, dividend grows from the current run‑rate, and valuation holds near the top of its recent range. Balance sheet stays conservative with comfortable liquidity. |

| Base case | Mixed commodity cycle with periods of volatility. Revenue trends are uneven but margins remain resilient. Dividend is maintained with modest adjustments, and the company funds selective projects from operating cash flow without materially increasing leverage. |

| Worse case | Prolonged commodity weakness and operational or regulatory disruptions. Pricing pressure narrows margins and free cash flow, forcing a more defensive stance on dividends and capex. Valuation reverts toward the lower end of its recent trading range until conditions improve. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Underlying commodity price trends and demand cyclicality affecting realized sales and margins.

- Cost discipline and operating efficiency, including the ability to sustain current margin levels.

- Capital allocation choices: dividend continuity, buybacks (if any), and the scale/timing of new projects.

- Balance‑sheet strategy and access to funding given total debt of 10.14B and available cash of 7.28B.

- Regulatory and permitting environment in core operating regions, plus ESG‑related developments.

- Liquidity and ownership structure dynamics: insider concentration (63.77%) and OTC trading volumes.

Conclusion

GMBXF enters the next three years with supportive fundamentals and improved market sentiment. The shares have advanced toward a 52‑week high as profitability and cash generation underpin confidence despite a soft revenue print. With 5.62B in operating cash flow and a forward dividend yield of 3.74%, the equity case rests on steady returns and disciplined reinvestment, while a strong current ratio and substantial cash balance provide optionality. We maintain a neutral but constructive stance: if management sustains margins and free cash flow through the cycle, the stock can continue to compound via dividends and selective growth. Investors should, however, respect cyclicality and headline risk. Given modest OTC liquidity and concentrated insider ownership, we favor gradual accumulation on weakness rather than momentum purchases, anchoring decisions on cash‑flow resilience and dividend durability.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.