As of June 2025, Berkshire Hathaway continues to showcase resilience amidst fluctuating market conditions. Despite a recent decline in quarterly earnings, the company maintains strong fundamentals with a robust profit margin and significant cash reserves. Investor sentiment remains cautiously optimistic, driven by recent stock performance and leadership insights. The company's diversified portfolio, combined with its strategic positioning in a volatile market, places it in an intriguing spot for the coming years. This report delves into key metrics, potential scenarios, and factors affecting share price for Berkshire Hathaway.

Key Points as of June 2025

- Revenue: $371.29B

- Profit Margin: 21.79%

- Sales Growth: -0.20% (yoy)

- Share Price: $487.54

- Analyst View: Cautiously optimistic

- Market Cap: Approx. $651.7B

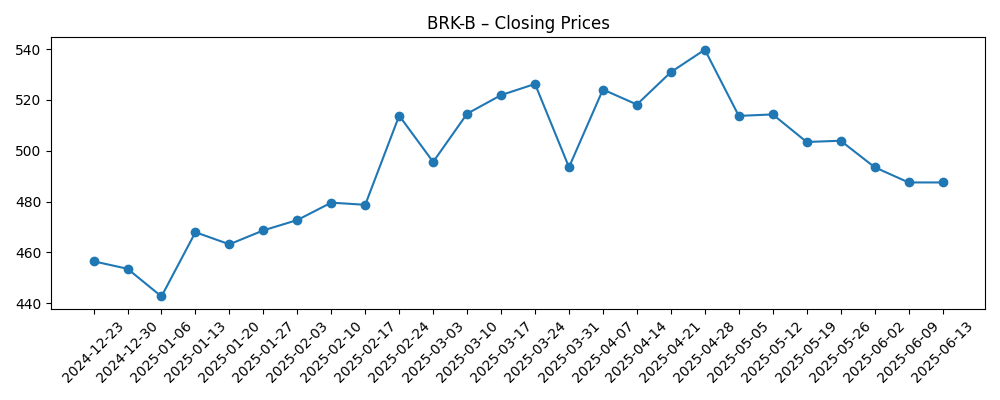

Share price evolution – last 6 months

Notable headlines

- Jim Cramer on Berkshire Hathaway Inc. (BRK-B): “I Like That” – Yahoo Entertainment

- Berkshire Hathaway (BRK-B): Low Beta Stock in a Volatile Market – Yahoo Entertainment

- Market Digest: HON, NVDA, BRK/B, FOXA – Yahoo Entertainment

Opinion

The recent headlines suggest a mixed sentiment surrounding Berkshire Hathaway as it navigates a challenging financial landscape. The insights from market analysts, including Jim Cramer, highlight a positive outlook towards the company's long-term strategies, particularly its low beta status which makes it attractive in times of uncertainty. Investors seem to have reacted positively to these insights, as evidenced by the stock's resilience despite prior earnings setbacks. However, the negative quarterly revenue growth may cast a shadow on future performance expectations. Maintaining a focus on operational efficiency and strategic investments will be crucial for sustaining momentum.

With a solid profit margin of 21.79% and a considerable cash reserve of $347.68 billion, Berkshire Hathaway appears well-equipped to weather economic challenges. This financial strength is likely to support its ongoing investments across diverse sectors, which remain a cornerstone of its operational strategy. As the company adapts to market trends, its ability to leverage these investments could enhance shareholder value in the coming years. However, the recent volatility in share price may indicate underlying concerns that need to be addressed.

Looking forward, the effectiveness of management strategies, coupled with macroeconomic factors, will play a significant role in determining Berkshire Hathaway's trajectory. Investors will be keenly watching the upcoming earnings reports for signs of recovery in the company's revenue streams. Successful navigation of these waters can potentially translate into an upward revision of share price targets by analysts, reinforcing the positive sentiment surrounding the stock.

In conclusion, while the outlook for Berkshire Hathaway remains cautiously optimistic, it will require a strategic blend of operational management and market responsiveness to achieve sustained growth. The overall sentiment seems to favor a long-term investment perspective, aligning with the company's historical performance and resilience in facing market volatility.

What could happen in three years? (horizon June 2025+3)

| Scenario | Expected Revenue ($B) | Projected Share Price ($) |

|---|---|---|

| Best | 450 | 600 |

| Base | 400 | 550 |

| Worst | 350 | 480 |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Overall market conditions and economic indicators

- Company's operational efficiency and profitability

- Investor sentiment and market perception

- Strategic acquisitions and investments

- Regulatory environment and tax implications

Conclusion

In summary, Berkshire Hathaway's future performance will depend on its ability to adapt to ongoing market challenges while leveraging its strong financial position. The company's diversified portfolio provides a buffer against market volatility, but its short-term revenue growth concerns cannot be overlooked. Investors should remain alert to both the positive indicators seen in analyst sentiments and the potential uncertainties arising from economic fluctuations. Overall, a measured approach to investing in BRK-B may yield favorable results in the long run, particularly if the company successfully navigates the evolving landscape.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.