Alibaba (BABA) enters the next three years with a steadier share price and improving profitability, but a measured growth profile. As of August 2025, the stock closed at $135.00, up 64.09% over 52 weeks and trading above its 50-day and 200-day moving averages. The business prints sizable scale (Revenue ttm: 1T; Gross Profit: 412.15B) with a 14.63% profit margin and 14.13% operating margin, supported by 416.41B in cash against 253.27B in debt and a 1.45 current ratio. Yet quarterly revenue growth is modest at 1.8% year over year, and levered free cash flow sits at -33.09B despite strong operating cash flow. Recent headlines point to AI product launches and portfolio pruning, while broker commentary remains constructive but selective. This outlook weighs those signals alongside valuation, balance sheet, and near-term execution risks.

Key Points as of August 2025

- Revenue: Revenue (ttm) 1T; Revenue per share 430.41; Quarterly revenue growth (YoY) 1.80%.

- Profit/Margins: Profit margin 14.63%; Operating margin (ttm) 14.13%; Gross profit 412.15B; EBITDA 185.17B; ROE 13.45%.

- Earnings momentum: Quarterly earnings growth (YoY) 66.70%; Diluted EPS (ttm) 7.49.

- Cash & balance sheet: Total cash 416.41B; Total debt 253.27B; Debt/Equity 23.17%; Current ratio 1.45.

- Cash flows & dividend: Operating cash flow 150.55B; Levered FCF -33.09B; Forward annual dividend rate 1.05 (0.78% yield); Payout ratio 13.56%; Dividend date 7/10/2025; Ex-dividend 6/12/2025.

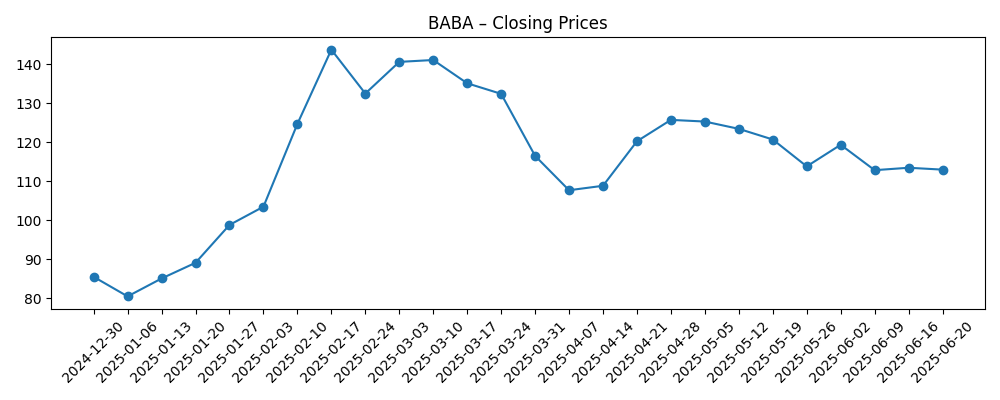

- Share price & trading: Last close (8/29/2025) 135.00; 52-week range 80.06–148.43; 52-week change +64.09%; 50DMA 117.58; 200DMA 111.92; Beta (5Y) 0.16; Avg vol (3m) 13.93M.

- Market cap & ownership: Shares outstanding 2.38B; Institutions hold 12.34%; Short interest 35.53M (1.49% of outstanding; short ratio 2.59). Market cap implied by shares and price is substantial.

- Sales/Backlog: No backlog disclosed; sales trend modest with 1.80% YoY quarterly revenue growth while AI-linked products and divestments reshape the mix.

Share price evolution – last 12 months

Notable headlines

- Here’s What Justified Alibaba’s (BABA) Appreciation Over Time

- Can Alibaba Group Holding Ltd. (BABA) Benefit from Investments in Generative AI?

- Mizuho Reduces PT on Alibaba Group Holding Limited (BABA) Stock

- Alibaba Group Announces Its Pair of Smart Glasses Powered by Its AI Model

- Mizuho Securities Maintains a Buy on Alibaba Group Holding (BABA)

- Alibaba to Exit Indian Food Delivery Company Eternal with $613M Stake Sale

Opinion

Alibaba’s recent AI push, including smart glasses powered by its in‑house model, signals a pragmatic strategy: use the company’s ecosystem scale to seed practical, everyday AI experiences. This approach could support engagement across marketplaces, logistics, and payments without betting the farm on a single breakthrough. From an investor lens, the key is monetization speed versus cost discipline. The company’s operating margin (ttm) at 14.13% and profit margin at 14.63% provide a cushion, but the negative levered free cash flow warns against unchecked capex or incentives. Over the next three years, successfully embedding AI into commerce and cloud workflows—while avoiding margin erosion—would likely matter more than headline‑grabbing hardware wins.

Brokerage signals look mixed but broadly constructive, with a maintained Buy rating offset by a reduced price target. That combination often implies analysts see fundamental progress but are resetting near‑term expectations to reflect execution risks and a still‑cautious macro. The stock’s rise—52‑week change of 64.09%—and position above the 50‑ and 200‑day moving averages suggest improving sentiment, yet the 50‑day average still trails the 52‑week high, implying room for digestion. For a three‑year horizon, this dynamic argues for measured optimism: a path of steady improvement rather than a straight‑line rerating, particularly as Alibaba balances investment needs with shareholder returns through a modest dividend payout.

Portfolio cleanup—exiting non‑core holdings such as the Indian food delivery stake—fits a narrative of focus and capital recycling. For Alibaba, concentrating on core commerce, cloud, and AI‑adjacent services could simplify the story and reduce cash burn variability, helping address the current gap between strong operating cash flow and negative levered free cash flow. If divestment proceeds are redeployed into high‑return projects or used to fortify the balance sheet, investors may reward the shift with multiple stability. Conversely, if disposals reduce optionality or signal limited organic growth avenues, the market could interpret them as defensive moves.

Looking ahead, the risk‑reward hinges on converting scale into consistent growth. Quarterly revenue growth at 1.80% YoY is a reminder that large platforms face saturation in core markets and regulatory friction. However, a low beta (0.16) and significant cash reserves offer resilience if macro conditions wobble. Over three years, watch for signs of sustained commerce take‑rate stability, cloud workload wins tied to generative AI, and disciplined cost management. Should these elements align, Alibaba could sustain margins while nudging top‑line growth higher; if they do not, shares may remain range‑bound, sensitive to sentiment shifts and external policy developments.

What could happen in three years? (horizon August 2025+3)

| Scenario | Narrative | What investors might see |

|---|---|---|

| Best | AI features deepen engagement across commerce and cloud; portfolio streamlining frees capital for high‑return projects; regulatory backdrop remains stable. | Improved operating leverage, steadier free cash flow, and premium valuation versus recent history. |

| Base | Core commerce grows modestly; cloud benefits selectively from AI workloads; continued discipline on costs with occasional reinvestment spikes. | Margins roughly stable, free cash flow normalization, and a valuation anchored near long‑term averages. |

| Worse | Competitive pressure and policy headwinds slow growth; AI monetization lags; higher incentives weigh on profitability. | Margin compression, choppier cash generation, and a de‑rating toward cautious multiples. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Execution in AI‑enabled commerce and cloud following recent product launches, including smart glasses and model integration.

- Margin discipline versus growth, given a 14.13% operating margin and negative levered free cash flow alongside strong operating cash flow.

- Capital allocation: pace and effectiveness of divestments, potential buybacks or dividends (payout ratio 13.56%).

- Regulatory and competitive developments in core markets that affect take rates, logistics costs, or cloud pricing.

- Shareholder base dynamics, including short interest (1.49% of outstanding) and institutional ownership (12.34%).

Conclusion

Alibaba’s investment case into 2028 rests on turning strategic focus and AI deployment into durable, cash‑generative growth. The company’s scale—Revenue (ttm) 1T—and healthy profitability (profit margin 14.63%; operating margin 14.13%) provide a platform for reinvestment, while 416.41B in cash and a 1.45 current ratio support resilience. Yet the contrast between solid operating cash flow and negative levered free cash flow underscores the importance of disciplined spending and portfolio prioritization. Recent headlines suggest traction in AI and a willingness to prune non‑core stakes, and analyst commentary remains supportive even as price targets adjust. After a 64.09% 52‑week advance and with the stock above key moving averages, performance may hinge on execution rather than multiple expansion alone. For long‑term investors, the next three years likely favor steady, fundamentals‑driven progress over rapid re‑rating.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.