Airbus SE (AIR.PA) enters late 2025 with demand for single‑aisle jets still robust and its share price hovering close to 52‑week highs. Investors are weighing solid top‑line scale (revenue ttm 70.02B) and improving profitability against the friction of supply‑chain bottlenecks and negative levered free cash flow. Recent headlines point to potential step‑ups in output — including chatter that Airbus could eclipse Boeing’s long‑held 737 delivery record — and to incremental capacity moves such as outsourcing H125 helicopter fuselages to Mahindra. With a 1.12% forward dividend yield and a “Moderate Buy” sell‑side stance, sentiment remains constructive, but the bar has risen after a 28.67% 12‑month gain. This three‑year outlook considers how delivery cadence, margins, and cash conversion could shape AIR.PA through August 2028.

Key Points as of August 2025

- Revenue: ttm 70.02B; revenue per share 88.65; quarterly revenue growth (yoy) 0.50%.

- Profit/Margins: profit margin 7.04%; operating margin 6.23%; diluted EPS (ttm) 6.23; net income 4.93B; quarterly earnings growth (yoy) 218.30%.

- Sales/Backlog: Commercial demand remains robust; reports suggest Airbus could eclipse Boeing’s decades‑long 737 delivery record; outsourcing H125 fuselages to Mahindra points to capacity de‑risking.

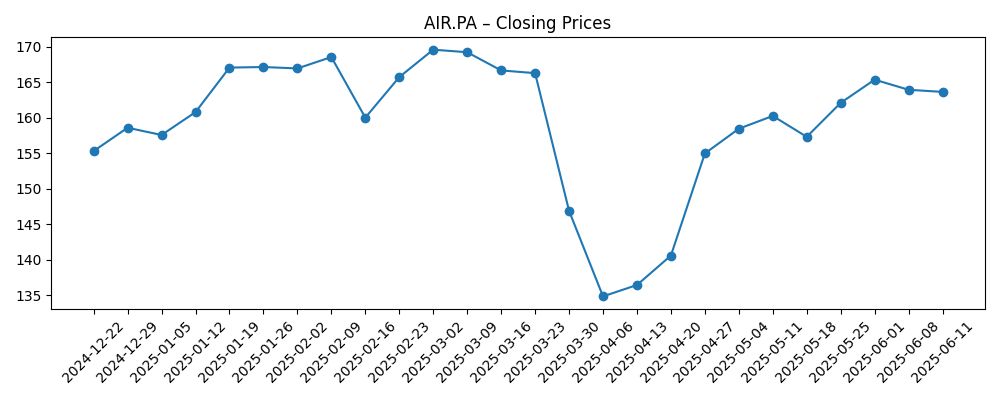

- Share price: €179.06 (2025‑08‑29); 52‑week range €124.72–€187.00; 50‑day MA €178.70; 200‑day MA €163.46; 52‑week change 28.67%; beta 1.25.

- Cash & debt: total cash 12.01B; total debt 13.35B; current ratio 1.16; operating cash flow 6.17B; levered free cash flow −3.73B.

- Dividend: forward annual dividend rate 2; forward yield 1.12%; payout ratio 32.05%; ex‑dividend date 2025‑04‑22.

- Ownership: shares outstanding 787.33M; float 588.18M; insiders hold 25.70%; institutions hold 31.34%.

- Analyst view: average recommendation cited as “Moderate Buy” in August 2025 reporting.

- Market cap: large‑cap European aerospace; implied by share count and price, Airbus sits in mega‑cap territory.

Share price evolution – last 12 months

Notable headlines

- Airbus Is About to Eclipse a Record That Boeing Held for Decades

- Mahindra Group Wins Airbus Contract To Make H125 Helicopter's Fuselage

- Airbus Group (OTCMKTS:EADSY) Given Average Recommendation of “Moderate Buy” by Analysts

Opinion

Airbus’s near‑term narrative is dominated by deliveries. The suggestion that it may eclipse Boeing’s decades‑long 737 delivery record underscores persistent demand for A320‑family jets and the competitive advantage Airbus has built through its order book and production footprint. The Mahindra H125 contract, though smaller in scale than single‑aisle programs, points to a broader theme: diversifying suppliers and adding buffer capacity to reduce bottlenecks. For equity holders, the critical variable is not orders but conversions — turning orders into certified aircraft at predictable rates. If parts availability and labor constraints continue to ease, 2026–2028 could be defined by steadier monthly output, a more stable working‑capital profile, and a step‑up in cash conversion. The stock’s outperformance over the past year suggests investors are already discounting incremental progress, putting a premium on operational follow‑through.

Margins and cash flow are the pivot. On fundamentals, Airbus shows a profit margin of 7.04% and operating margin of 6.23% on 70.02B of ttm revenue — respectable for a complex manufacturer, and consistent with an ongoing recovery in post‑pandemic operations. Yet levered free cash flow is −3.73B despite 6.17B in operating cash flow, highlighting heavy investment needs and working‑capital friction as build rates rise. The investment case over the next three years rests on whether working capital normalizes as deliveries accelerate, enabling free cash flow to turn decisively positive. A sustainably funded dividend (forward yield 1.12%, payout ratio 32.05%) supports total return, but the durability of cash generation will likely drive re‑rating more than income. Execution that narrows the gap between operating profit and free cash flow could be a powerful catalyst.

Price action is constructive but leaves less room for error. AIR.PA trades near the top of its 52‑week range (€124.72–€187.00) and around the 50‑day moving average of €178.70, with a 200‑day trend at €163.46. A 28.67% 12‑month gain, rising averages, and moderate volume imply buyers have controlled the tape for much of 2025. Still, a beta of 1.25 telegraphs sensitivity to broader risk‑off moves and cyclical shocks. The “Moderate Buy” stance cited in August aligns with this setup: earnings momentum is improving, but consensus likely reflects both supply‑chain optimism and caution on cash. Near term, watch for higher‑highs confirmation above €187 on strong delivery updates; failure to hold the €163–€179 zone could signal a consolidation back toward longer‑term support if macro headwinds intensify.

Strategically, Airbus’s incremental capacity actions — such as the H125 fuselage outsourcing — are small but directionally important. They reinforce a playbook of spreading load, lifting resilience, and protecting schedules across Commercial Aircraft and Helicopters. Over a three‑year horizon, that approach could also support Defense and Space delivery credibility, an area where on‑time execution matters for margins and reputation. Competitive intensity remains elevated, but the potential to set new delivery records would bolster Airbus’s bargaining power with the supply base and customers. For investors, the mix of scale (ttm revenue 70.02B), improving profitability, and still‑to‑be‑proven free‑cash‑flow strength argues for a measured stance: constructive on execution, alert to supply and regulatory risks, and focused on whether capital discipline translates to a consistently self‑funded growth cycle.

What could happen in three years? (horizon August 2025+3)

| Scenario | Assumptions | Potential share‑price behavior |

|---|---|---|

| Best | Supply chain normalizes; Airbus sustains higher delivery cadence and operational efficiency; free cash flow turns durably positive; dividend grows within payout discipline. | Breakout and sustained trade above the €187.00 52‑week high, supported by improving cash conversion and margin expansion. |

| Base | Gradual production improvements; mixed macro; steady margins near current levels; free cash flow improves but remains sensitive to working capital. | Range‑bound around trend lines, with buyers defending the €163.46–€178.70 moving‑average zone absent negative surprises. |

| Worse | New supply disruptions or regulatory delays; cost inflation; weaker airline capex; cash conversion lags. | Drawdown toward prior supports, with risk of a retest of the €124.72 52‑week low if execution stumbles. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Delivery cadence and supply‑chain stability across engines, structures, and avionics.

- Cash conversion and working‑capital swings relative to operating profit and investment needs.

- Certification, quality, and regulatory timelines affecting key programs and deliveries.

- Airline demand resilience, financing costs, and macro conditions impacting order activity.

- Competitive dynamics on pricing and production rates versus peers, and supplier negotiations.

- Capital allocation — dividend sustainability, potential buybacks, and capex discipline.

Conclusion

Airbus heads into 2026–2028 with a favorable demand backdrop, improving margins, and a share price that reflects growing confidence in execution. The balance sheet and operating profile (cash 12.01B; debt 13.35B; profit margin 7.04%) are consistent with continued recovery, while the dividend (1.12% forward yield; 32.05% payout) supports total return. The central debate is cash: turning negative levered free cash flow into a stable surplus as deliveries scale. Headlines about potential delivery records and incremental capacity moves suggest management is pressing its advantage, but investors will want to see working‑capital normalization and predictable output. If Airbus converts its production ambitions into free cash flow, the stock could merit a premium and hold gains above recent highs; if bottlenecks or macro shocks persist, consolidation toward longer‑term supports is plausible. The three‑year setup rewards patient, execution‑focused monitoring.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.