Ahold Delhaize (AD.AS) enters late‑2025 with steady top‑line progress and disciplined cash generation, but margins and leverage remain the swing factors for the next three years. The grocer delivered trailing‑twelve‑month revenue of 91.65B, with quarterly sales up 3.30% year on year, while net and operating margins sit at 2.02% and 3.98%, respectively. Operating cash flow reached 6.54B and levered free cash flow 3.09B, supporting a 3.45% forward dividend yield with a 57.92% payout ratio (ex‑dividend 8/8/2025). Shares closed the latest week at 34.41, versus a 52‑week range of 29.78–38.76, a 50‑day average of 35.03 and a 200‑day average of 34.49. With beta at 0.28 and return on equity of 12.69%, Ahold offers a defensive profile, yet a 138.61% debt‑to‑equity and 0.72 current ratio keep execution and balance‑sheet discipline in sharp focus.

Key Points as of August 2025

- Revenue: trailing‑twelve‑month sales of 91.65B; quarterly revenue growth up 3.30% year over year.

- Profit/Margins: net margin 2.02%; operating margin 3.98%; ROE 12.69%; ROA 4.46%.

- Cash generation and dividend: operating cash flow 6.54B; levered free cash flow 3.09B; forward dividend yield 3.45% with 57.92% payout (ex‑dividend 8/8/2025).

- Balance sheet: total debt 19.56B; debt‑to‑equity 138.61%; current ratio 0.72; total cash 3.95B.

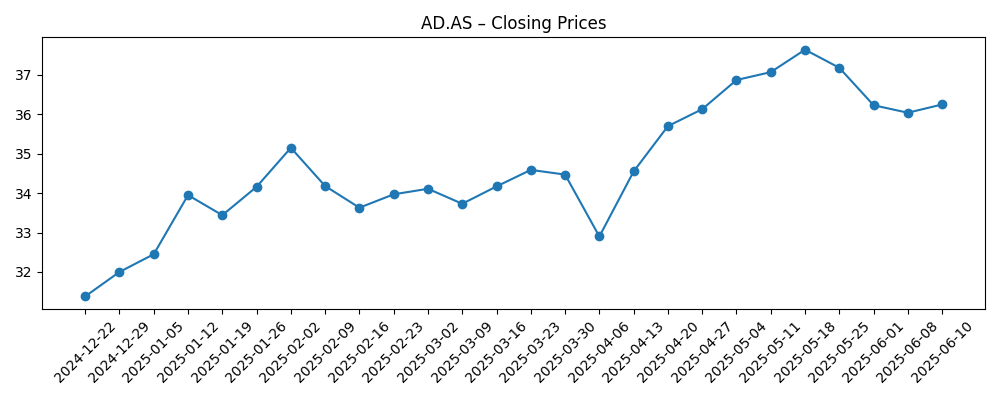

- Share price: latest weekly close 34.41; 52‑week high/low 38.76/29.78; 50‑day/200‑day averages 35.03/34.49; 52‑week change 10.27% vs S&P 500 at 15.11%.

- Risk profile: five‑year beta 0.28 underscores defensive characteristics through cycles.

- Market cap: approximately 31.2B (based on ~907.83M shares outstanding and the latest close).

- Ownership/liquidity: float 892.71M; institutions hold 52.08%; insiders 0.09%; average 3‑month volume 1.79M (10‑day 1.64M).

Share price evolution – last 12 months

Notable headlines

- Short Interest in Koninklijke Ahold Delhaize (OTCMKTS:AHODF) Expands By 157.4% — ETF Daily News

- Ahold NV (OTCMKTS:ADRNY) Sees Significant Growth in Short Interest — ETF Daily News

- Ahold NV (OTCMKTS:ADRNY) Sees Large Decrease in Short Interest — ETF Daily News

- Critical Contrast: Ahold (OTCMKTS:ADRNY) and Bolt Projects (NASDAQ:BSLK) — ETF Daily News

Opinion

Short‑interest headlines dominated August and help explain some of the share price’s choppiness around the mid‑30s. A spike in reported short positions on OTC tickers (ADRNY/AHODF) can amplify volatility in the Amsterdam‑listed stock as sentiment bleeds across listings. While such prints are backward‑looking and methodology varies, they often track narratives rather than fundamentals. For Ahold Delhaize, a defensive beta (0.28), healthy cash generation and a 3.45% forward yield argue against a deeply bearish structural case. Still, the rapid reversal from a “significant increase” to a “large decrease” in short interest within weeks underscores a market searching for a clear earnings inflection rather than positioning with conviction.

The core fundamental debate remains margin durability. With net margin at 2.02% and operating margin at 3.98%, even modest cost surprises or competitive pricing moves can swing earnings power. Recent 3.30% year‑on‑year revenue growth suggests demand resilience, but food retail relies on scale‑driven efficiencies and disciplined promotions to protect profitability. Investors will likely reward tangible proof points such as improved mix, private‑label penetration and supply‑chain savings translating into higher EBITDA conversion to cash. Conversely, wage inflation, energy costs and shrink can erode the thin margin stack quickly, particularly if price investments are required to defend traffic.

Balance‑sheet optics are another swing factor. Debt‑to‑equity of 138.61% and a 0.72 current ratio argue for cautious capital allocation until visibility improves. The offset is cash generation: 6.54B in operating cash flow and 3.09B in levered free cash flow provide flexibility to sustain the dividend (57.92% payout) while funding operations and targeted investments. Execution that steadily nudges leverage lower without sacrificing growth initiatives could earn a re‑rating. However, any deterioration in working capital or a setback in margin would quickly shift the narrative back to balance‑sheet risk.

Price‑wise, shares are hovering near the 200‑day average (34.49) and below the 50‑day (35.03), with a 52‑week change of 10.27% lagging the S&P 500’s 15.11%. That setup often keeps the stock range‑bound until a catalyst breaks the stalemate. Near‑term, dividend support and defensive characteristics can limit downside in risk‑off tapes, but sustained upside likely requires either a margin beat, stronger‑than‑expected sales momentum, or credible signals of deleveraging. The whipsawing short‑interest prints may continue to color day‑to‑day moves, but over a three‑year horizon, consistent cash conversion and balance‑sheet discipline remain the most reliable drivers.

What could happen in three years? (horizon August 2028)

| Scenario | Narrative | Potential drivers | What to watch |

|---|---|---|---|

| Best | Steady sales growth compounds, margin improves, and leverage trends lower, unlocking a valuation re‑rating. | Private‑label mix gains, supply‑chain efficiencies, disciplined promotions, resilient consumer spend. | Operating margin cadence, cash conversion, debt trajectory, traffic and basket indicators. |

| Base | Low growth with stable margins; dividend maintained and funded by cash flow; shares track defensively. | Balanced pricing, cost control offsetting inflation, continued focus on everyday value and loyalty engagement. | Like‑for‑like sales, cost inflation vs. productivity, inventory and working‑capital stability. |

| Worse | Cost pressures and competitive pricing compress margins; deleveraging stalls; sentiment weakens. | Persistent wage/energy inflation, elevated shrink, intensified competition, execution setbacks. | Margin slippage, negative cash‑flow trends, covenant headroom, any guidance resets. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Margin trajectory versus input‑cost inflation and pricing intensity in core markets.

- Cash‑flow consistency relative to dividend commitments and investment needs.

- Balance‑sheet signals: leverage trend, liquidity (current ratio), and refinancing conditions.

- Operational execution in omnichannel grocery and supply‑chain productivity.

- Investor positioning and sentiment, including swings in reported short interest.

Conclusion

Ahold Delhaize’s three‑year setup balances defensiveness with execution risk. The company’s scale, 0.28 beta, and 3.45% forward yield provide a stable footing, reinforced by 6.54B in operating cash flow and 3.09B in levered free cash flow. Yet thin margins (2.02% net; 3.98% operating), a 138.61% debt‑to‑equity ratio, and a 0.72 current ratio keep the focus on operating discipline and balance‑sheet management. Shares have drifted around long‑term averages and underperformed the S&P 500 over the past year, reflecting investor hesitation in the absence of a clear earnings inflection. If management converts incremental sales growth (3.30% YoY last quarter) into durable margin gains and gradual deleveraging, the stock could earn a higher quality premium over time. Until then, income support and defensiveness suggest a hold‑and‑monitor stance, with catalysts tied to margin beats, cash conversion, and visible progress on leverage.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.