Ahold Delhaize has shown resilience in its recent performance, with revenue growth driven by an increase in consumer demand. The company's latest quarterly results reflect a solid revenue stream and improving profit margins despite challenging market conditions. Analysts remain optimistic about the company's continuing evolution in digital grocery and its ability to adapt to changing consumer preferences. As of June 2025, the outlook remains cautiously optimistic, with numerous factors influencing future growth.

Key Points as of June 2025

- Revenue: €90.9 billion

- Profit Margin: 1.99%

- Sales Growth: 7.10% YoY

- Share Price: €36.25

- Analyst View: Strong-Buy rating

- Market Cap: €33.1 billion

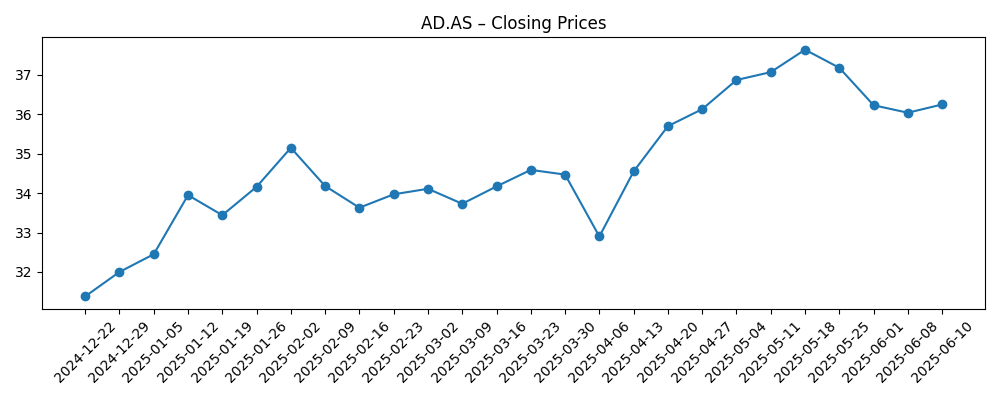

Share price evolution – last 6 months

Notable headlines

- Koninklijke Ahold Delhaize (OTCMKTS:AHODF) Short Interest Down 57.1% in May – ETF Daily News

- Koninklijke Ahold Delhaize (OTCMKTS:ADRNY) Rating Increased to Strong-Buy at Wall Street Zen – ETF Daily News

- Short Interest in Koninklijke Ahold Delhaize (OTCMKTS:ADRNY) Rises By 42.9% – ETF Daily News

Opinion

The reduction in short interest for Ahold Delhaize provides a positive indication of investor sentiment towards the company. This shift could be driven by recent performance improvements and a favorable rating upgrade, suggesting that investors are increasingly confident in Ahold Delhaize's growth trajectory. A key factor that could influence the share price is whether the company can maintain its revenue growth in an evolving retail market.

With dividend yields remaining attractive, many investors may find Ahold Delhaize appealing as a stable income-producing asset. However, potential risks exist, notably from inflationary pressures and supply chain disruptions. How the management navigates these challenges will be critical in determining future performance.

Furthermore, the company's focus on expanding its online grocery presence helps align with shifting consumer trends toward convenience. Continuous investment in technology and infrastructure will be essential to sustain competitive advantages in this arena.

Overall, Ahold Delhaize appears well-positioned to capitalize on emerging opportunities while facing ongoing market challenges. The management's strategic decisions in the coming quarters will be instrumental in shaping the company's valuation and shareholder returns.

What could happen in three years? (horizon June 2025+3)

| Scenario | Projected Share Price (€) | Summary |

|---|---|---|

| Best | 45.00 | Strong growth driven by digital initiatives and market expansion. |

| Base | 40.00 | Stable growth with moderate improvements in margins and revenue. |

| Worse | 30.00 | Market pressures and high competition impact profitability. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Changes in consumer behavior towards online shopping.

- Inflation and supply chain stability.

- Results from strategic acquisitions and partnerships.

- Management's adaptability to market trends.

- Overall economic conditions affecting retail sales.

Conclusion

In conclusion, Ahold Delhaize is navigating a complex retail environment with a focus on growth and market adaptation. The positive investor sentiment, reflected in the reduced short interest and analyst rating upgrades, suggests that there is a belief in the company’s potential for continued success. However, challenges remain, particularly regarding inflation and competition. The company’s strategy to strengthen its online presence and improve operational efficiency will be crucial in the coming years. Ahold Delhaize is positioned to leverage its strengths and respond to challenges effectively, making it an entity worth monitoring closely moving forward.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.