Unilever (UNA.AS) enters the next three years from a position of scale but with mixed momentum. As of

Key Points as of September 2025

- Revenue: 59.77B (ttm); quarterly revenue growth (yoy) -3.20%; revenue per share 24.16.

- Profit/Margins: Profit margin 9.29%; operating margin 18.85%; ROE 28.70%; ROA 8.66%.

- Sales/Backlog: Consumer-staples model; no formal backlog disclosure. Gross profit 26.38B.

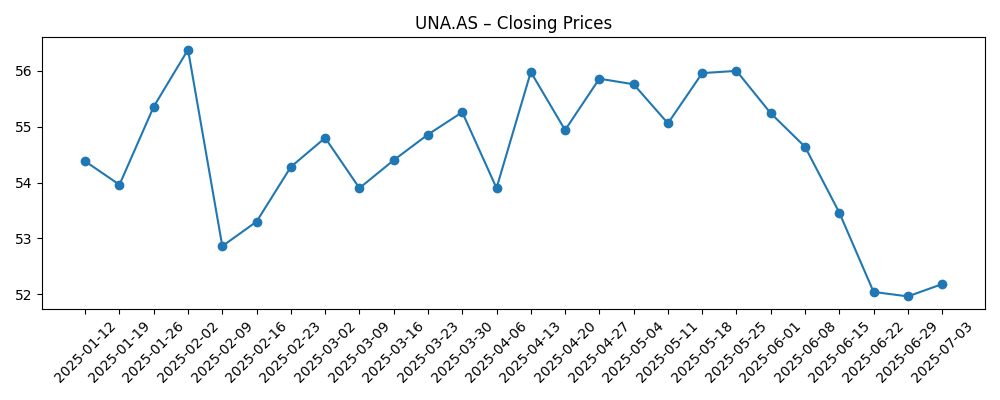

- Share price: ~55.4 (Sep 4, 2025); 52‑week range 50.88–59.66; 50‑day MA 52.39; 200‑day MA 54.30; 52‑week change -7.30%; beta 0.23.

- Valuation: Trailing P/E 24.47; forward P/E 16.58; PEG 1.82; Price/Sales 2.28; Price/Book 7.55; EV/Revenue 2.63; EV/EBITDA 13.96.

- Market cap: 134.31B; Enterprise value 157.34B; shares outstanding 2.45B; float 2.43B.

- Cash & debt: Total cash 5.37B; total debt 32.02B; debt/equity 160.68%; current ratio 0.76; operating cash flow 8.44B.

- Income: Net income attributable to common 5.55B; diluted EPS (ttm) 2.24; quarterly earnings growth (yoy) -5.10%.

- Dividends: Forward annual rate 1.8; forward yield 3.28%; trailing rate 1.83; payout ratio 79.68%; ex-dividend date 8/14/2025.

Share price evolution – last 12 months

Notable headlines

Opinion

Marketing execution is likely to be the fulcrum for Unilever over the next three years. Recent coverage of the company’s marketing transformation underscores a shift toward tighter effectiveness, which matters because top-line trends are currently soft (quarterly revenue growth -3.20%) and earnings momentum is negative (quarterly earnings growth -5.10%). In staples, small share gains compound when paired with pricing discipline and cost control. Unilever’s operating margin at 18.85% indicates a strong base; the task now is to protect it while stabilizing volumes. Expect emphasis on proven brands, disciplined media allocation, and retail-media partnerships that can sharpen in‑store and online conversion. If the company can show consistent volume recovery without sacrificing price/mix, investors may gain confidence that current valuation multiples are sustainable, setting the stage for gradual multiple support through a steadier growth narrative rather than a dramatic rerating.

Valuation and income provide a cushion but not a free pass. A forward P/E of 16.58 sits in a reasonable zone for a global consumer-staples leader, and the forward dividend yield of 3.28% offers carry during execution. The payout ratio of 79.68% implies limited room to stretch dividends without earnings growth; that raises the bar on cash generation and capital allocation. Leverage is elevated (total debt 32.02B; debt/equity 160.68%) and liquidity modest (current ratio 0.76), so investors will watch deleveraging and working‑capital efficiency alongside operating cash flow. In our view, balanced priorities—fund brand building, preserve margins, and steadily lower leverage—would support a more resilient equity story. Conversely, any stumble that pressures margins could force trade‑offs between investment and distributions, which would weigh on sentiment.

Price action over the last six months suggests a defensive base forming. The stock slid toward the low 51s in July, then retraced to ~55.4 by early September, with the 50‑day moving average (52.39) recently rising toward the 200‑day (54.30). With a low beta of 0.23 and a 52‑week range of 50.88–59.66, the share has behaved like a classic staple: limited downside volatility, but also a ceiling until fundamentals re‑accelerate. For a rerating, investors likely need a sequence of quarters showing stable price/mix, improving volumes, and disciplined overhead. Absent that, the stock may continue to oscillate around long‑term averages as income investors clip the dividend and total‑return holders await clearer catalysts. Put differently, execution—not macro—may be the decisive driver from here.

Over a three‑year horizon, the central debate is whether brand investment can reignite growth without meaningfully diluting margins. The marketing transformation highlighted in recent reporting could be a credible path if it raises return on media and speeds innovation rollouts. Cost productivity and portfolio focus will matter as well, given leverage and cash payout commitments. If the company can pair modest top‑line acceleration with consistent free cash flow and selective reinvestment, dividend sustainability should remain intact and optionality for future portfolio moves would increase. If progress stalls, management may need to prioritize balance‑sheet strength over growth investments, which could cap upside. The spread between these outcomes may not be dramatic quarter to quarter, but compounding effects over three years can be significant for total shareholder return.

What could happen in three years? (horizon September 2025+3)

| Scenario | Discussion |

|---|---|

| Best | Brand investments lift volume, mix skews premium, and cost discipline sustains margins. Cash generation supports steady deleveraging and a reliable, growing dividend. Valuation benefits from improved confidence in durable growth and execution. |

| Base | Growth normalizes with stable price/mix and modest volume improvement. Margins hold broadly steady as savings fund media and innovation. Dividend remains well covered by earnings and cash flow, and valuation tracks sector averages. |

| Worse | Competitive pressure and input costs squeeze margins while volume recovery lags. Cash priorities shift toward balance‑sheet protection, limiting dividend growth and brand investment. Valuation compresses until a clearer improvement plan emerges. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Effectiveness of marketing transformation in driving volume while preserving price/mix and margins.

- Cost inflation/deflation across commodities and logistics, and resulting impact on gross and operating margins.

- Capital allocation discipline: balance between dividend, deleveraging, and brand/innovation investment.

- Competitive dynamics, including private‑label share gains and promotional intensity.

- Foreign‑exchange movements given global revenue mix and translation effects on reported results.

- Regulatory, ESG and reputational developments that affect brand strength and investor appetite.

Conclusion

Unilever’s near‑term setup is balanced: resilient margins, dependable cash generation, and an income profile offset softer top‑line and earnings trends. With a forward P/E of 16.58 and a 3.28% forward dividend yield, investors are paid to wait for execution. The strategic focus should remain clear—invest behind priority brands, sharpen marketing returns, and protect margins while gradually reducing leverage. If the marketing transformation flagged in recent coverage translates into steadier volumes and stronger mix, the shares can defend their multiple and rebuild momentum. Absent that proof, the stock may trade around long‑term averages, with dividend income driving a larger share of total return. Over three years, small operational wins can compound meaningfully in staples; conversely, missteps could constrain flexibility. On balance, disciplined brand investment and cash prudence are the levers most likely to tilt outcomes favorably.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.