As SAP SE approaches the midpoint of 2025, the company continues to adapt to a rapidly changing technology landscape. With a strong focus on cloud services and innovations in AI, SAP is strategically positioning itself for future growth. However, recent fluctuations in share prices along with competitive pressures raise questions about the company's market standing. Investors are keenly observing SAP's ability to maintain momentum amid economic uncertainties and shifting consumer demands. This report delves into the current performance metrics, notable headlines from the past six months, and a three-year outlook for the company.

Key Points as of July 2025

- Revenue: $35 billion

- Profit/Margins: $8 billion

- Sales/Backlog: Strong cloud adoption

- Share price: $258.15

- Analyst view: Cautiously optimistic

- Market cap: $150 billion

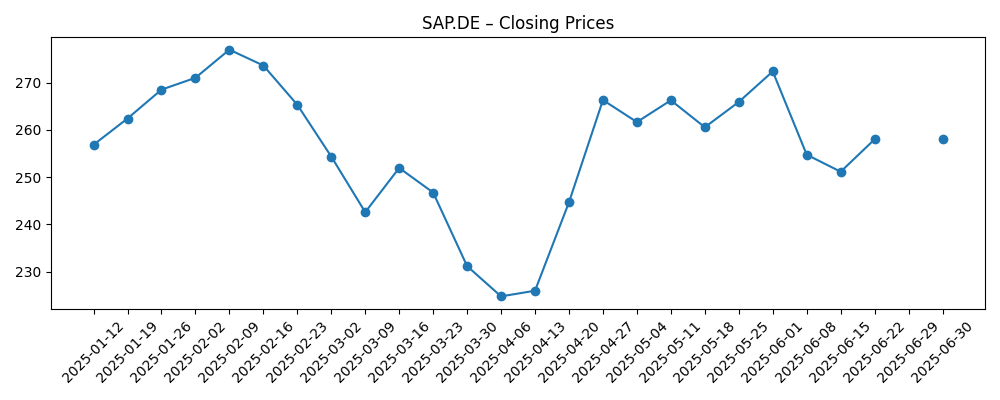

Share price evolution – last 6 months

Notable headlines

- SAP launches new AI-driven analytics platform – Tech News

- CEO outlines vision for cloud transformation – Business Insider

- SAP reports strong Q1 performance amid cloud growth – Market Watch

- Analysts adjust forecasts post-Q1 earnings – Finance Today

Opinion

The recent headlines surrounding SAP reflect a company in transition, with a clear focus on leveraging AI and cloud technologies to enhance its offerings. SAP's strategic investments in AI-driven analytics could strengthen its competitive edge, especially as enterprises increasingly seek data-driven insights. However, the volatility in the share price observed since early 2025 may indicate investor apprehension about the pace of revenue growth and market share gains in a crowded tech landscape.

Furthermore, the cautious optimism from analysts suggests that while SAP is on the right track, sustained growth may hinge on its ability to execute effectively amidst market challenges. The growing adoption of its cloud services is a positive indicator, yet SAP must navigate the operational complexities associated with expanding its customer base while maintaining service excellence.

Looking ahead, if SAP can capitalize on its AI initiatives and clearly communicate its value proposition to potential clients, it stands to benefit from a potentially lucrative market. Conversely, failing to deliver on these expectations could lead to further fluctuations in stock performance, impacting investor confidence.

In summary, SAP SE is at a critical juncture as it strives to solidify its position in the evolving tech ecosystem. Investors will need to keep a close eye on execution and adaptiveness, especially in response to competitors who are also investing heavily in similar technologies.

What could happen in three years? (horizon July 2025+3)

| Scenario | Share Price | Market Cap |

|---|---|---|

| Best | $350 | $200 billion |

| Base | $300 | $180 billion |

| Worse | $200 | $120 billion |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Continued growth in cloud revenue

- Impact of economic conditions on IT spending

- Competitive landscape and market share shifts

- Success of new product launches

- Global regulatory changes affecting operations

Conclusion

In conclusion, SAP SE is navigating a complex landscape with significant opportunities arising from emerging technologies such as AI and cloud computing. As the company continues to evolve, its ability to harness these trends will be critical in determining its long-term success. While recent stock performance has been volatile, the potential for sustainable growth is apparent if SAP can maintain its focus on innovation and customer satisfaction. Investors should remain vigilant and consider both the risks and rewards associated with SAP’s strategy as the market unfolds.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.