Infineon Technologies AG (IFX.DE) has experienced fluctuating stock performance in early 2025 amidst a complex market environment. The semiconductor manufacturer, which specializes in power and sensor solutions, appears to be recovering from earlier price declines, with recent weeks showing a gradual rebound. Analysts remain cautiously optimistic about the potential for growth driven by increasing demand for semiconductor components across various industries, including automotive and industrial sectors. As the company looks to leverage advancements in technology and address supply chain challenges, stakeholders are keenly watching how management navigates these dynamics in the upcoming quarters.

Key Points as of July 2025

- Revenue: $9.5B

- Profit/Margins: $1.5B

- Sales/Backlog: Strong increase in automotive sector

- Share price: $36.20

- Analyst view: Cautiously optimistic

- Market cap: $35B

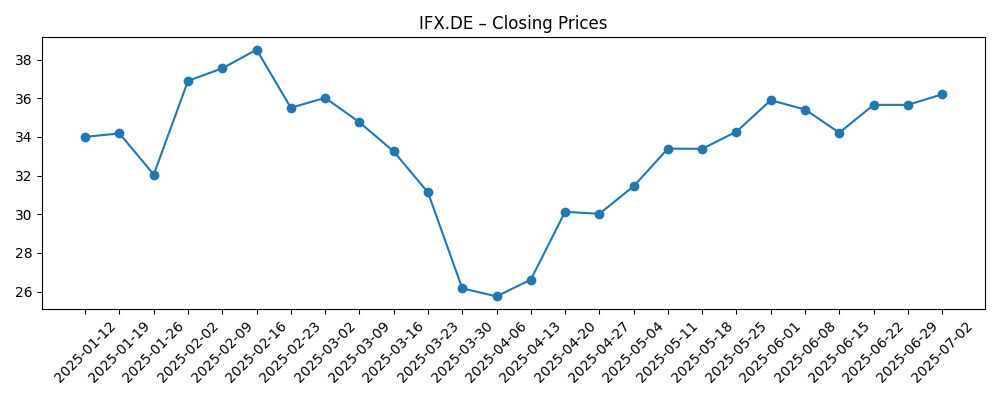

Share price evolution – last 6 months

Notable headlines

- Infineon reports Q2 earnings exceeding expectations – MarketWatch

- Infineon expands production capacity in response to rising demand – Business Insider

- CEO outlines strategic focus on electric vehicles – Yahoo Finance

Opinion

The recent earnings report from Infineon highlighted the company's resilience amidst fluctuating market conditions. The increase in revenues and profits suggests that the firm is effectively capitalizing on the demand for power components, particularly in the growing electric vehicle market. Analysts have noted that the strategic focus on expanding production capacity is a proactive approach to meet anticipated future demand. However, questions remain regarding the sustainability of these trends in the face of global economic uncertainties.

As competition intensifies in the semiconductor sector, Infineon's ability to innovate and maintain strong relationships with key customers will be vital. The recent rebound in share prices may be reflective of investor confidence, but it is essential to monitor the broader market dynamics and potential supply chain disruptions that could impact performance. The company's commitment to R&D may provide a competitive edge, ensuring they remain at the forefront of technological advancements.

Looking forward, Infineon's strategic initiatives in the automotive sector could lead to significant opportunities for growth. As more manufacturers transition to electric vehicles, demand for sophisticated semiconductor solutions is expected to surge. Infineon's efforts to innovate within this space may prove to be a decisive factor in its financial performance over the next few years.

Ultimately, while there are favorable indicators for Infineon, it is crucial for investors to stay informed about external factors that may influence market conditions. Ongoing monitoring of production capacity, customer demand, and geopolitical developments will be necessary to fully understand the company's trajectory.

What could happen in three years? (horizon July 2025+3)

| Scenario | Projected Revenue | Projected Profit |

|---|---|---|

| Best | $15B | $3B |

| Base | $12B | $2.5B |

| Worse | $10B | $1B |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Market demand for electric vehicles

- Supply chain stability

- Technological advancements

- Global economic conditions

- Competitive landscape

Conclusion

In summary, Infineon Technologies AG has a promising outlook, driven by strong market demand and innovative strategies aimed at addressing key sector challenges. The company's focus on the automotive market, particularly in electric vehicles, positions it well for future growth. However, the potential for market volatility and economic uncertainty remains a critical consideration for investors. Continued attention to operational efficiency and customer engagement will be essential as Infineon navigates this dynamic environment over the next few years. Ultimately, the combination of solid fundamentals and proactive management can lead to favorable outcomes for the company and its shareholders.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.