ASML Holding is navigating a transformative phase in the semiconductor industry as it faces both opportunities and challenges. With its cutting-edge technology for extreme ultraviolet (EUV) lithography, ASML is positioned to play a pivotal role in the future of chip manufacturing. The company has recently experienced fluctuations in share price, reflecting broader market concerns and investor sentiment. This report delves into ASML's current financial health, recent headlines affecting its outlook, and what to expect in the coming three years as it adapts to a rapidly evolving tech landscape.

Key Points as of June 2025

- Revenue: $22.6B

- Profit/Margins: $7.5B (33% margin)

- Sales/Backlog: Healthy backlog due to strong demand

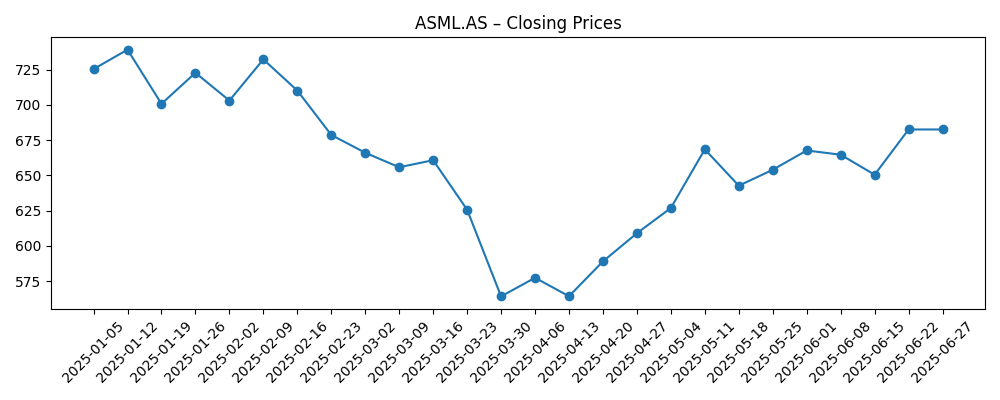

- Share price: $682.5

- Analyst view: Mixed opinions amid EUV capex concerns

- Market cap: $400B

Share price evolution – last 6 months

Notable headlines

- 4 Reasons to Buy ASML Holding Stock Like There's No Tomorrow – Yahoo Entertainment

- Bernstein Initiates ASML at ‘Market Perform’ Amid EUV Capex Concerns – Yahoo Entertainment

- ASML's next act: High-NA, Hyper-NA and the edge of what's possible – Digitimes

- ASML reports transactions under its current share buyback program – GlobeNewswire

- Miracle Mile Advisors LLC Boosts Holdings in ASML Holding (NASDAQ:ASML) – ETF Daily News

Opinion

ASML Holding's recent stock performance has been marked by considerable volatility, largely influenced by investor sentiment towards increased capital expenditures in extreme ultraviolet lithography. Analysts' mixed views highlight ongoing concerns regarding the company's ability to sustain its rapid growth in a competitive landscape. While some analysts point to the strong demand for chips, reflecting a robust backlog, others caution that the pressure of rising EUV investments could dampen margins in the short term.

The company's strategic pivot towards high-NA and Hyper-NA technologies represents a significant opportunity to capture a larger market share in the semiconductor sector, catering to advanced chipmakers. ASML's innovation could position it favorably in an industry increasingly driven by the need for superior performance and efficiency in chip manufacturing.

Investors may still be wary as they assess the potential impacts of economic conditions on ASML's market dynamics. However, positive developments in global tech demand and advancements in EUV technology could bolster ASML's financial outlook, enhancing investor confidence in the long run.

Given these factors, ASML's positioning illustrates both the risks and rewards inherent in investing in cutting-edge technology stocks. As the market stabilizes and tech demand rebounds, ASML could see a resurgence in share price, benefitting from its strong technological edge.

What could happen in three years? (horizon June 2025+3)

| Scenario | Potential Share Price |

|---|---|

| Best | $900 |

| Base | $750 |

| Worse | $500 |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Demand for semiconductor technology

- Capital expenditure trends in the tech sector

- Advancements in lithography technologies

- Global economic conditions and trade policies

- Competitive landscape and new market entrants

Conclusion

In conclusion, ASML Holding stands at a critical juncture as it continues to lead in the semiconductor lithography space. The company's innovative capabilities, particularly in EUV technology, have positioned it well for future growth despite current market fluctuations. However, investors should remain cognizant of the challenges posed by capital expenditure demands and economic uncertainties. As the industry adapts to new technological advancements and market dynamics, ASML's ability to navigate these factors will be vital in determining its long-term success. Investors will need to weigh potential risks against the promising growth trajectories in the semiconductor market.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.