ASML Holding (ASML.AS) enters Q4 2025 near record levels, underpinned by accelerating AI-driven chip demand and a solid financial base. Over the last twelve months, the company produced revenue of 32.16B with a 29.27% profit margin and 34.64% operating margin, translating to 9.42B in net income and 24.03 in diluted EPS. Cash of 7.25B versus 3.7B of debt, plus 11.18B in operating cash flow, provide flexibility for R&D, capacity and shareholder returns. After a spring drawdown, shares have rebounded toward the 52‑week high of 897.20, with the latest close at 888.40. Analysts have turned more constructive, citing strong bookings and a robust backlog, while ASML’s strategic bet on European AI startup Mistral signals deeper alignment with long-term compute trends. This note outlines a three‑year outlook from today’s starting point.

Key Points as of October 2025

- Revenue: TTM revenue 32.16B; quarterly revenue growth 23.20% year over year; gross profit 16.89B; EBITDA 12.09B.

- Profit/Margins: Profit margin 29.27%; operating margin 34.64%; ROE 58.24%; ROA 16.35%.

- Sales/Backlog: Recent upgrades cite strong bookings and a robust backlog, improving visibility into future shipments (no figures disclosed).

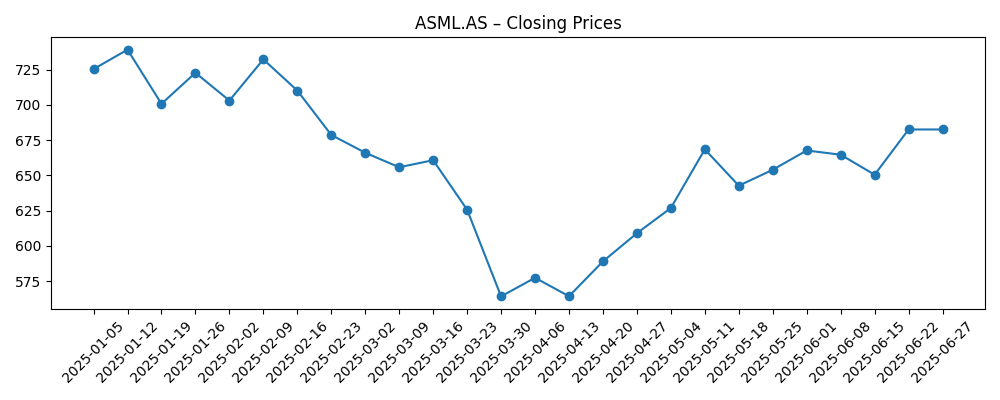

- Share price/technical: Latest close 888.40 (2025-10-06); 52‑week range 508.40–897.20; 50‑day MA 688.83; 200‑day MA 668.71; beta 1.28; recovery from March lows near 564.

- Analyst view: Multiple positive calls, including upgrades and higher targets citing AI capex momentum and order strength.

- Market cap/ownership: Large-cap European semiconductor equipment leader with 388.15M shares outstanding; float 387.23M; institutions hold 44.56%; insiders hold 0.02%.

- Balance sheet/liquidity: Total cash 7.25B vs total debt 3.7B; current ratio 1.43; levered free cash flow 8.56B.

- Dividend: Forward annual dividend rate 6.48 (0.74% yield); payout ratio 26.60%; last ex-dividend date 7/28/2025.

Share price evolution – last 12 months

Notable headlines

- ASML Stock: An Overlooked AI Play? (Forbes)

- ASML invests $1.5 billion in Mistral AI (TechRadar)

- ASML Holding N.V. bets €1.3B on Mistral AI (Yahoo)

- Deutsche Bank and Mizuho raise price targets on ASML (Yahoo)

- ASML stock rises as semi equipment group rallies (IBD)

- ASML upgraded; Morgan Stanley sees upside (Yahoo)

- Arete upgrades ASML to Buy, cites strong bookings (Yahoo)

- Commentary on Morgan Stanley’s ASML coverage (Yahoo)

Opinion

ASML’s recent fundamentals suggest that the AI compute buildout is still in early innings. The firm’s 23.20% year-over-year revenue growth and 45.10% quarterly earnings growth reflect both volume recovery and mix shift toward higher-value lithography and services. Margins remain robust, supported by scale, pricing discipline, and an expanding installed base. The spring drawdown tested sentiment, but the quick rebound toward the 52‑week high signals investors are willing to underwrite multi-year demand for leading-edge nodes. In our view, the most durable pillar for the next three years is the combination of secular AI demand and a tight supplier set. If bookings continue to convert at a healthy pace and service revenue compounds on the installed base, ASML can defend margins while funding innovation—keeping execution risk manageable even if industry growth normalizes from recent peaks.

The strategic investment in Mistral AI, reported at roughly $1.5 billion/€1.3B, adds an unconventional layer to the thesis. While it will not move financials in the short run, it can deepen ASML’s access to frontier workloads, data pipelines, and co-optimization opportunities with chip designers. Insights into model architectures, memory bandwidth constraints, and interconnect bottlenecks can inform tool roadmaps and software that maximizes scanner utilization and yield. There are risks—venture outcomes are uncertain, and returns are indirect—but the optionality is notable for a company whose value often hinges on being first with production-grade lithography. In Europe’s growing AI ecosystem, proximity to model developers could help ASML anticipate patterning requirements earlier, potentially translating into better product timing and tighter customer engagement over a multi-year horizon.

At the stock level, price action reflects rising expectations. The latest close at 888.40 sits just below the 52‑week high of 897.20, well above the 50‑day and 200‑day moving averages of 688.83 and 668.71. After a trough near 564 in late March, the trend has turned decisively higher, helped by analyst upgrades and a sector rally. With a forward dividend yield of 0.74% and a payout ratio of 26.60%, total return is driven primarily by earnings growth rather than income. The bar is high: any wobble in AI data center capex or delays in customers’ node transitions could invite multiple compression. Still, a strong balance sheet (7.25B cash vs 3.7B debt) and substantial free cash flow provide buffers. We expect phases of consolidation, but dips may attract longer-horizon buyers if order momentum remains intact.

Execution remains the swing factor. ASML must continue scaling production, services, and software support to ensure customers can ramp complex nodes without yield setbacks. Supply chain reliability and field service capacity are critical as the installed base grows. Geopolitical constraints, particularly export controls, can reshuffle regional mix and timing, but the company has shown an ability to navigate within regulatory frameworks. Over the next three years, we expect the narrative to center on delivery cadence, service attach, and the breadth of AI-related demand across logic and memory. If management maintains discipline on cost and prioritizes bottleneck reductions, the margin structure seen in recent periods could prove resilient. Conversely, schedule slips or elongated customer qualification cycles would pressure growth optics, even if long-term demand drivers remain in place.

What could happen in three years? (horizon October 2028)

| Case | Narrative | Key drivers |

|---|---|---|

| Best | AI-led wafer starts expand broadly across leading logic and advanced memory. Order conversion and service attach stay strong, sustaining healthy margins and cash generation. Strategic ecosystem ties (e.g., with AI developers) sharpen product timing and software capability. | Persistent AI capex, smooth customer ramps, supply chain reliability, stable regulations, effective installed-base monetization. |

| Base | Industry growth normalizes from peak levels but remains solid. Shipments track plan with occasional timing shifts; margins hold near recent levels. Backlog supports utilization; services grow in line with the installed base. | Balanced AI/data center spending, steady logic/memory mix, disciplined costs, manageable regulatory headwinds. |

| Worse | AI capex pause and export constraints cause order delays; customers stretch tool utilization and slow node transitions. Operating leverage turns unfavorable, leading to volatile earnings and more cautious guidance. | Macro slowdown, tighter controls in key markets, supply bottlenecks, competitive pricing pressure, elongated qualifications. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- AI data center capex cycle intensity and timing of leading-edge node transitions.

- Export controls and regulatory developments affecting shipment mix and timing.

- Manufacturing and field-service execution, including installed-base support and software.

- Supply chain availability for critical components and logistics reliability.

- Competitive dynamics and pricing power across tool generations and services.

Conclusion

ASML’s setup into the next three years is defined by strong starting fundamentals, a constructive demand backdrop tied to AI, and a share price near record highs that embeds a premium for flawless execution. With 32.16B in trailing revenue, double-digit growth, and robust profitability, the company has the financial capacity to invest through the cycle while supporting returns. Analyst sentiment has strengthened on evidence of healthy bookings and backlog, and the Mistral AI stake adds strategic optionality, even if near-term financial impact is limited. The risk balance centers on the durability of AI-driven capex, regulatory constraints, and execution on production and service scaling. Our base case anticipates steady growth and resilient margins, with intermittent volatility as expectations reset. For long-term investors, the debate is less about direction and more about cadence—how fast the multi-year AI patterning opportunity translates into delivered tools and cash flow.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.