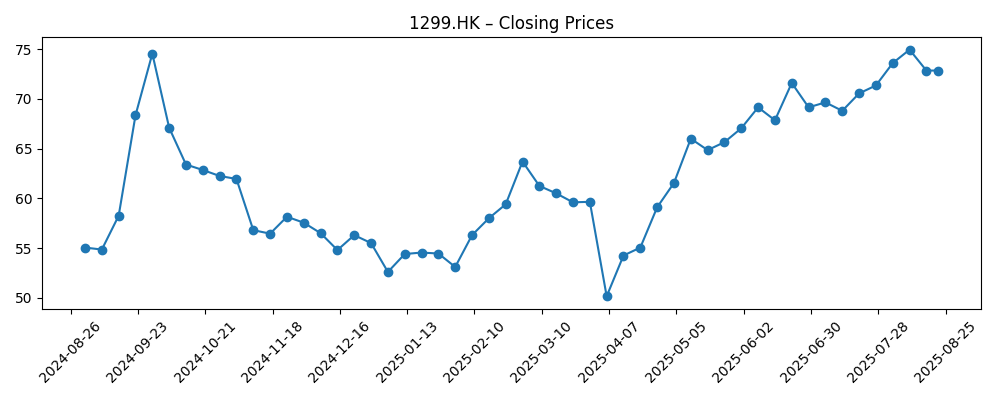

AIA Group Limited (1299.HK) enters August 2025 with improving top-line momentum and a steadier share price after a volatile year. The insurer reports revenue of 25.49B (ttm) with a profit margin of 23.76% and return on equity of 15.10%. Despite robust quarterly revenue growth of 29.40% year over year, quarterly earnings growth is negative, underscoring mix and timing effects common in life insurance. Shares are up 32.09% over 12 months, trading between 48.6–77.5 and recently near the low-70s, supported by a 50-day moving average above the 200-day. Valuation signals an earnings rebuild ahead (forward P/E 14.03 vs trailing 28.51). Liquidity and capital remain sound, with a 3.48 current ratio and a forward dividend yield of 2.47% ahead of the 9/5/2025 ex-date. Our three-year view weighs China exposure, cash generation, and execution on growth.

Key Points as of August 2025

- Revenue – TTM revenue of 25.49B; quarterly revenue growth (YoY) of 29.40% suggests healthy policy demand.

- Profit/Margins – Profit margin 23.76% and operating margin 42.71%; ROE at 15.10% highlights solid efficiency.

- Sales/Backlog – No formal backlog in life insurance; growth depends on new business momentum and product mix.

- Share price – 52-week change of 32.09%, range 48.6–77.5; recent weekly close near 72.85; 50-day at 71.256 above 200-day at 61.564; beta 0.86.

- Analyst view – Forward P/E 14.03 vs trailing 28.51; Price/Sales 4.65 and Price/Book 2.41 frame valuation.

- Market cap – 762.43B; EV/Revenue 4.71; debt 19.45B vs cash 9.52B; Total Debt/Equity 47.59% and current ratio 3.48.

- Cash flow – Operating cash flow 6.63B; levered free cash flow 5.12B supports dividends and potential buybacks.

- Earnings trend – Quarterly earnings growth (YoY) of -23.50% highlights near-term pressure despite revenue strength.

- Income & dividend – Net income (ttm) 6.06B; forward dividend yield 2.47% with payout ratio 68.57%; ex-dividend 9/5/2025.

Share price evolution – last 12 months

Notable headlines

- AIA Group Limited (AAGIY) Q2 2025 Earnings Call Transcript [Seeking Alpha]

- AIA (OTCMKTS:AAGIY) Short Interest Up 144.4% in July [ETF Daily News]

Opinion

AIA’s Q2 2025 commentary underscores a familiar split for life insurers: strong top-line activity but uneven translation to bottom-line results in the near term. The numbers point to revenue acceleration alongside weaker quarterly earnings growth, which can reflect product mix, reserving, and investment market effects. The valuation gap between trailing and forward P/E suggests investors expect an earnings rebuild as new business gains scale and expense ratios normalize. Over the next three years, the fulcrum is disciplined execution in high-value segments, particularly protection and health, where margins and persistency tend to be stronger. If management sustains cash generation and maintains capital flexibility, dividend growth and buybacks could complement earnings to support total returns.

The spike in reported short interest on the U.S. ADR in July signals pockets of skepticism, likely tied to macro sensitivity in Greater China and the durability of demand. With beta at 0.86, AIA is not the market’s most volatile name, but sentiment shifts can still drive swings—especially around results, capital actions, and regulatory updates. If operational delivery closes the gap implied by the forward multiple and revenue growth persists, shorts may face a tougher backdrop. Conversely, any stumble in earnings quality, mortality/morbidity experience, or investment results could validate caution and cap the re-rating.

Technically, the stock has repaired damage from its early-2025 trough, with the 50-day moving average now above the 200-day and price consolidating in the low-to-mid 70s. The 52-week range of 48.6–77.5 shows ample room for both upside and retracement. Upcoming catalysts include the ex-dividend date on 9/5/2025 and subsequent updates on new business momentum. Valuation at Price/Book 2.41 and Price/Sales 4.65 implies investors are paying for durability and growth; sustaining ROE near current levels while converting top-line gains into earnings is key to justify that premium.

Strategically, AIA’s edge remains its multi-market footprint and agency/bancassurance distribution. Over the next three years, the bull case leans on cross-border travel normalization, affluent demand for protection and savings, and product innovation in health. Execution risks revolve around regulatory capital frameworks, currency movements, and investment portfolio quality. Given free cash flow capacity and a forward yield of 2.47%, capital returns can cushion volatility. But meaningful, durable upside likely depends on steady improvements in earnings quality and visibility, not just revenue growth.

What could happen in three years? (horizon August 2028)

| Scenario | Narrative and markers to watch |

|---|---|

| Best | New business growth remains robust across Mainland China and key ASEAN markets; product mix tilts to protection and health, lifting margins and persistency. Earnings quality improves as expense ratios normalize and investment results stabilize. Capital returns grow while solvency stays strong, supporting a valuation re-rate. Watch for sustained revenue growth, stable claims experience, and consistent dividend progression. |

| Base | Moderate growth continues with periodic macro bumps. Earnings catch up to top-line trends but remain sensitive to markets and rates. Dividends rise gradually with occasional buybacks. Valuation tracks sector averages, with total return driven by steady cash generation. Watch for balanced product mix, controlled acquisition costs, and stable fee/investment contributions. |

| Worse | Prolonged weakness in Greater China demand, adverse claims or lapse experience, and market volatility pressure earnings. Regulatory shifts or currency swings weigh on capital ratios and investor sentiment. Capital returns stall, and valuation compresses. Watch for deteriorating earnings visibility, negative reserve movements, and tighter distribution productivity. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Macro conditions and consumer sentiment in Mainland China and Hong Kong affecting new business sales and persistency.

- Interest rates, equity markets, and currency movements impacting investment results and capital ratios.

- Regulatory and accounting changes influencing reserve requirements, capital buffers, and reported earnings.

- Claims, mortality/morbidity trends, and lapse rates affecting margins and earnings quality.

- Capital allocation policies, including dividend growth and buybacks, relative to free cash flow and solvency.

- Distribution productivity and partnerships, including agency and bancassurance performance across key markets.

Conclusion

AIA’s setup into the next three years pairs encouraging revenue momentum with the task of improving earnings quality and visibility. The stock has rebuilt confidence, with price action supported by better technicals and a forward multiple that implies an earnings catch-up is feasible. Fundamentals show healthy margins, solid ROE, and meaningful cash generation, while the balance sheet provides flexibility for dividends and potential buybacks. Key swing factors include the trajectory of demand in Greater China, investment market behavior, and regulatory clarity. A steady cadence of delivery on top-line growth, controlled acquisition and operating costs, and resilient claims experience would support a gradual re-rating. Conversely, renewed macro stress or unfavorable experience variances could cap multiples. For investors, the case rests on confidence in execution and the durability of protection and health demand, balanced by awareness of cyclical and regulatory risks.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.