AB InBev (ABI.BR) enters late 2025 with resilient profitability, large‑scale cash generation, and a mixed top‑line backdrop. Over the past six months, the share price recovered from early‑2025 lows yet remains below its 52‑week high, reflecting cautious sentiment on beer demand and currency swings. The company’s trailing‑twelve‑month revenue is 58.52B with a 26.38% operating margin and 12.16% profit margin, and levered free cash flow of 10.16B supports deleveraging and dividends (forward yield 1.96%). Near term, Morgan Stanley trimmed its price target by EUR 1, while AB InBev announced a $15 million U.S. brewery investment and continued adjustments around its Russia JV. This three‑year outlook weighs margin durability, balance‑sheet progress, and brand momentum against input‑cost volatility and volume uncertainty.

Key Points as of September 2025

- Revenue (ttm): 58.52B; quarterly revenue growth (yoy) −2.10%.

- Profit/Margins: profit margin 12.16%, operating margin 26.38%, EBITDA 18.24B; diluted EPS (ttm) 3.00.

- Cash generation: operating cash flow 15.19B; levered free cash flow 10.16B; payout ratio 32.54% with forward dividend yield 1.96% (rate 1).

- Balance sheet: total debt 75.84B; total debt/equity 82.96%; current ratio 0.64; cash 7.37B.

- Share price: recent weekly close 51.32 (2025‑09‑05); 52‑week range 44.89–63.04; 50‑day/200‑day moving averages 55.45/54.77; beta 0.86.

- Analyst view: Morgan Stanley lowered its AB InBev price target by EUR 1; stock underperformed over 12 months (−9.90% vs S&P 500 +20.22%).

- Market cap: approximately 88.8B based on ~1.73B shares outstanding and a ~51.32 recent close.

- Ownership: insiders 43.98%, institutions 20.35%; float 930.34M.

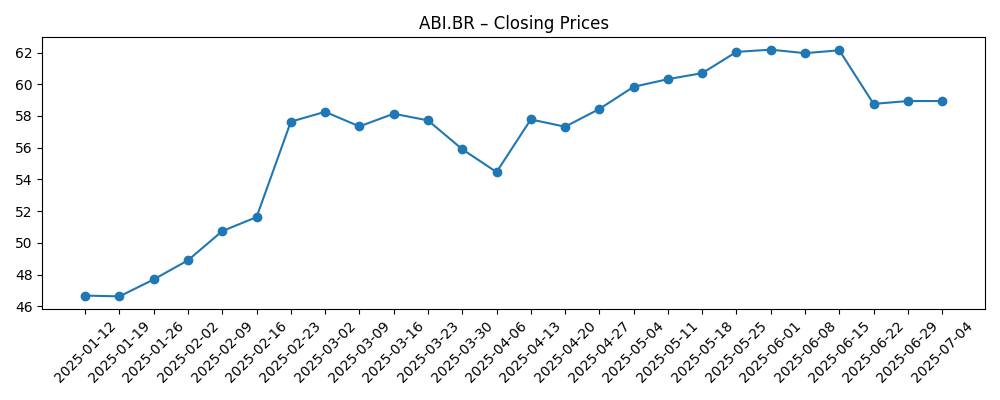

Share price evolution – last 12 months

Notable headlines

- Budweiser maker Anheuser-Busch to invest $15 million in US brewery

- AB InBev price target lowered by EUR 1 at Morgan Stanley

- Anadolu Efes slumps after Russia JV with AB InBev rebranded

Opinion

The share price trajectory over the past year underscores sentiment sensitivity rather than a collapse in fundamentals. Weekly closes show a slide from the high‑50s/low‑60s in October 2024 to 45.65 by early January 2025, followed by a strong rebound through June (peaking near 62.18) before a sharp late‑July setback to 49.94 and a recent stabilization around 51.32. That pattern aligns with shifting risk appetite and industry demand concerns more than with AB InBev’s margin profile, which remains solid. With a 26.38% operating margin and 12.16% profit margin, the company is positioned to absorb short‑term volume volatility. The 50‑day moving average sits below the 200‑day (55.45 vs 54.77), flagging a fragile near‑term trend. Over three years, a steady rerating likely requires visible volume stabilization in core markets and continued evidence that cost control converts to sustainable free cash flow.

The $15 million U.S. brewery investment is small relative to AB InBev’s 10.16B levered free cash flow, but it carries signaling value. Targeted capex that improves efficiency, logistics, or product flexibility can help protect margins if volumes are flat to slightly down. It also reinforces local manufacturing credentials in a key market, a soft catalyst for retailer and regulatory relationships. Importantly, the payout remains conservative (payout ratio 32.54%) and the forward yield of 1.96% leaves balance‑sheet flexibility for incremental investments or debt reduction. In a three‑year lens, a cadence of disciplined, high‑ROI projects—combined with brand support—can underpin mid‑20s operating margins even if top‑line growth is muted. While this singular announcement won’t move the needle financially, it supports the narrative of operational fine‑tuning rather than transformational change.

Morgan Stanley’s EUR 1 price‑target trim is a reminder that the market remains watchful on volumes and pricing. Yet earnings resilience is notable: quarterly earnings growth (yoy) sits at 13.80% even as quarterly revenue growth is −2.10%, implying mix, pricing, and cost discipline are offsetting soft spots in demand. If the company sustains this spread, the equity story could pivot from “volume recovery needed” to “cash compounding with stable share.” However, the 52‑week underperformance (−9.90% vs S&P 500 +20.22%) suggests investors require more than cost control—they want durable brand momentum and cleaner macro. Over the next three years, consistent mid‑teens cash returns on capital are plausible if margins hold and capex stays disciplined; a rerating would likely follow only after several quarters of stable volumes.

The Russia JV backdrop adds another layer. Reports of rebranding around the AB InBev–Anadolu Efes venture highlight ongoing complexity. While operational and financial exposure has been managed conservatively, changes to JV branding can reduce reputational noise but rarely resolve strategic overhangs immediately. The balance sheet remains the key swing factor: total debt is 75.84B against 7.37B cash, with debt/equity at 82.96%. The counterbalance is strong free cash flow (10.16B ttm) and 15.19B operating cash flow, giving headroom to continue deleveraging without sacrificing brand investment or the dividend. Over three years, steady debt paydown could lower risk perception and volatility (beta 0.86 already sub‑1), supporting a more defensive profile should macro conditions soften.

What could happen in three years? (horizon September 2025+3)

| Scenario | Outlook by September 2028 |

|---|---|

| Best case | Volumes stabilize and edge higher in key markets; pricing and mix sustain mid‑20s operating margins. Free cash flow remains robust, enabling visible deleveraging and incremental dividend growth while funding targeted capex. Brand momentum in premium and core segments improves, with disciplined marketing effectiveness. Valuation rerates toward a quality consumer‑staples peer range as execution risk fades. |

| Base case | Flat to slightly negative volumes offset by pricing/mix; operating margins remain resilient near current levels. Cash generation continues to prioritize debt reduction and a stable dividend policy. Select efficiency projects and portfolio tweaks keep profitability steady. The stock tracks fundamentals, with modest multiple expansion contingent on lower leverage and clearer demand signals. |

| Worse case | Persistent volume pressure in major markets and input‑cost/FX headwinds compress margins. Free cash flow declines, slowing deleveraging and limiting shareholder returns. Competitive pricing intensifies, diluting mix benefits. Macro or regulatory shocks (taxes, trade, or category restrictions) weigh on sentiment, and the valuation de‑rates toward a deep‑value consumer profile. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Volume trajectory and pricing power in core markets; evidence of stabilization versus ongoing category softness.

- Input costs (e.g., packaging and agricultural commodities) and foreign‑exchange movements impacting margins.

- Balance‑sheet progress: pace of deleveraging given 75.84B total debt and ongoing free cash flow generation.

- Regulatory/tax dynamics in key geographies and any developments around the Russia JV structure or branding.

- Brand execution and mix shifts between premium, core, and low/no‑alcohol segments, including competitive responses.

- Sell‑side sentiment shifts (e.g., target changes) and broader risk‑on/risk‑off market conditions.

Conclusion

AB InBev’s investment profile into 2028 hinges on protecting mid‑20s operating margins while rebuilding confidence in volumes. The company is producing strong cash flow (15.19B operating, 10.16B levered FCF) against a heavy but manageable debt load, supporting a measured dividend (forward yield 1.96%) and room to reinvest. Recent share‑price volatility reflects macro and category concerns more than a deterioration in profitability. Small but targeted capex—like the $15 million U.S. brewery commitment—signals incremental efficiency gains, while the modest price‑target cut underscores a cautious but intact investment case. Provided AB InBev continues to convert earnings into cash and chips away at leverage, a gradual rerating is plausible over three years. Execution on brand health and disciplined capital allocation remain the decisive catalysts for sustained value creation.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.