Recent housing market data reveals a complex landscape of challenges and opportunities, as builders and buyers navigate high mortgage rates while showing cautious optimism about future improvements. Housing starts have declined, yet builder confidence indicators suggest potential positive shifts ahead, particularly as expectations for future sales reach a six-month high despite ongoing affordability concerns.

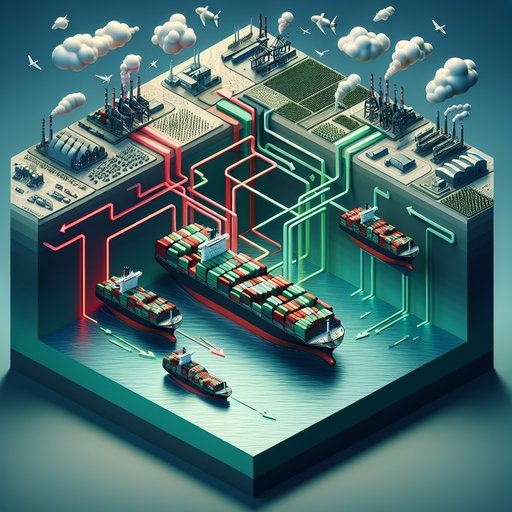

A wave of recent US tariff decisions has sparked international concern and retaliation, affecting industries from automobiles to textiles across multiple continents. Japan's export figures have declined for the fourth consecutive month [1], while India's textile sector struggles with new 50% tariffs [2]. These developments mark a significant escalation in global trade tensions, with several key US trading partners seeking diplomatic solutions.

The insurance sector is experiencing a significant technological transformation as artificial intelligence reshapes traditional business models and creates new opportunities for growth. According to recent industry analysis, insurance companies are emerging as unexpected leaders in AI adoption and innovation [1], while simultaneously grappling with challenges in healthcare coverage and regional disparities in insurance access.

Recent developments in global energy markets highlight growing tensions and regional supply challenges. The United States has imposed new sanctions on an international financial network facilitating Iranian oil sales, specifically targeting entities in Hong Kong and the UAE [1]. Meanwhile, domestic fuel markets show significant regional disparities, with the Pacific Northwest experiencing particularly steep price increases.

The cryptocurrency market faced significant turbulence as Nakamoto, a prominent bitcoin treasury company, experienced a devastating 50% share price crash [1]. Meanwhile, the SEC reached a "resolution in principle" with Gemini's Earn program after a two-year investigation [2], marking a significant development in crypto regulation.

Recent developments in the banking sector have raised concerns about stability as the Bank for International Settlements (BIS) warns of a growing disconnect between debt and equity markets. While U.S. banks show minor funding pressures, financial institutions continue to adapt to changing market conditions and regulatory landscapes, with both traditional banks and fintech companies facing unique challenges.

The US dollar has experienced a significant decline, reaching a four-year low against the euro as markets anticipate crucial Federal Reserve decisions. This shift occurs amid a remarkable surge in euro-denominated bond issuance by major US corporations, with sales hitting a record $100 billion this year [1]. The currency movements reflect broader changes in global financial markets and corporate financing strategies.

Significant changes are reshaping the global agricultural landscape as Russia explores alternative trading methods and U.S. farmers face economic pressures. The U.S. Department of Agriculture is considering economic assistance for farmers amid market uncertainties [1], while Russia has begun using barter trade to circumvent international sanctions, exchanging wheat for Chinese automobiles [2].

A series of high-stakes trade negotiations between the United States and several major economic partners has created a complex web of international tensions. As bilateral talks with China enter their second day [1], simultaneous disputes with India, South Korea, and other nations highlight the increasingly fragmented nature of global trade relations.

Financial markets are bracing for a pivotal week as fifteen central banks, including the U.S. Federal Reserve, Bank of England, and Bank of Japan, prepare to announce their monetary policy decisions [1]. This coordinated series of announcements marks one of the most significant periods for global monetary policy this year, with markets particularly focused on potential signals of the Fed's first rate cut of 2025.