In a strategic shift away from the traditional path to public markets, healthcare artificial intelligence company Innovaccer is choosing to expand through acquisitions and secondary funding rounds. The unicorn recently secured $275 million in funding and is deploying this capital to pursue strategic purchases rather than rushing toward an initial public offering [1].

The company's decision reflects a broader trend in the tech sector where private companies are increasingly opting to remain private longer, using alternative methods to provide liquidity to early investors and employees. By raising secondary rounds, Innovaccer can offer these stakeholders a chance to cash out without the pressures and scrutiny that come with being a public company.

Meanwhile, in the Asian markets, a significant restructuring is taking place as Shanghai-based self-driving technology company Banma is preparing to separate from Alibaba through a Hong Kong IPO. The move will reduce Alibaba's stake from 44.72% to 30%, marking a significant shift in the autonomous driving sector [2].

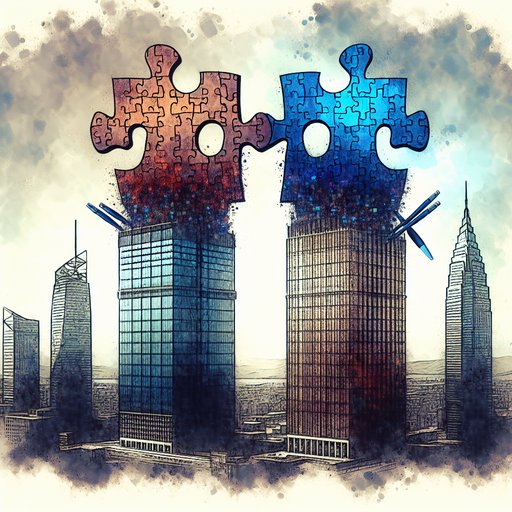

The contrast between these two approaches – Innovaccer's private market focus versus Banma's public offering strategy – highlights the different paths available to technology companies seeking growth. While Innovaccer is using its funds to acquire complementary businesses and consolidate its market position, Banma is pursuing independence and public market capital.

In the broader market context, these developments come at a time when companies are carefully weighing their options for growth and capital raising. The healthcare AI sector, in particular, has seen increased activity in mergers and acquisitions as companies seek to build comprehensive platforms and expand their technological capabilities.

- Why health AI unicorn Innovaccer is making acquisitions and raising secondary rounds instead of chasing an IPO

- Filing: Shanghai-based self-driving company Banma aims to spin off from Alibaba via a Hong Kong IPO, reducing Alibaba's stake from the current 44.72% to 30% (Aileen Chuang/South China Morning Post)