Unilever (ULVR.L) enters the next three years with a defensive profile but elevated execution demands. The shares have lagged over 12 months, while valuation signals the market is already pricing an earnings recovery: trailing P/E is 24.02 versus a forward P/E of 17.21 and a 3.28% forward dividend yield. Revenue over the last twelve months is 59.77B with profit margin of 9.29% and operating margin of 18.85%, yet quarterly revenue and earnings contracted year over year. Balance-sheet leverage is high (total debt 32.02B; debt/equity 160.68%) and liquidity tight (current ratio 0.76), making cash generation crucial. With a 0.20 beta and sizeable free cash flow (5.47B), the stock should remain relatively stable, but sustained volume improvement, disciplined pricing, and brand investment will dictate whether a rerating toward peers is achievable.

Key Points as of September 2025

- Revenue: trailing twelve months at 59.77B; revenue per share 24.16; enterprise value to revenue 2.59 and price to sales 2.24.

- Profit and margins: profit margin 9.29% and operating margin 18.85%; EBITDA 11.83B; return on equity 28.70% indicates capital efficiency.

- Sales trend: quarterly revenue growth year over year at -3.20% and quarterly earnings growth at -5.10%, highlighting near term volume or mix softness.

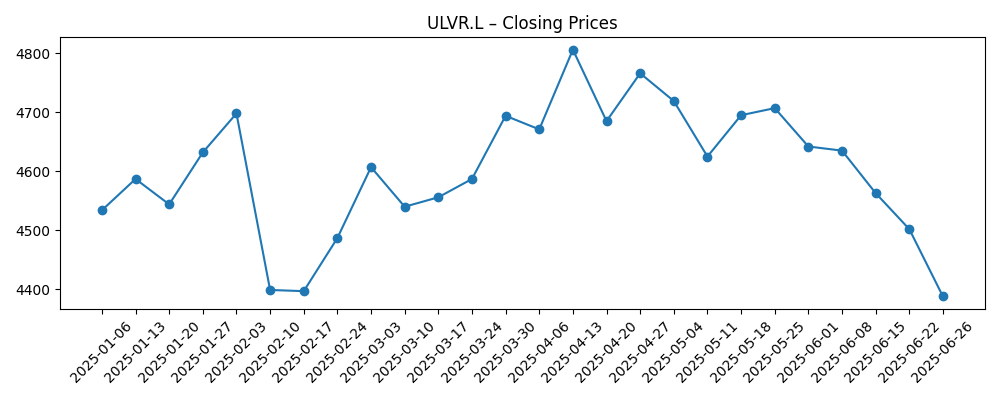

- Share price: last print 4,664p on 2025-09-01; roughly flat over six months, down 5.37% over 52 weeks; trading around the 50 day 4,510 and 200 day 4,589 averages; beta 0.20.

- Analyst view proxy: valuation implies improvement with forward P/E 17.21 vs trailing 24.02; PEG 1.89 suggests moderate growth expectations embedded.

- Market cap and enterprise value: market cap 114.06B and EV 133.97B; EV to EBITDA at 13.75.

- Balance sheet and liquidity: total debt 32.02B; debt to equity 160.68%; current ratio 0.76 underscores tight liquidity management needs.

- Cash generation and dividends: operating cash flow 8.44B; levered free cash flow 5.47B; forward dividend yield 3.28% with payout ratio 80.12%.

- Ownership: approximately 3.37% insider and 47.19% institutional ownership; float 2.43B shares vs 2.45B outstanding.

Share price evolution – last 12 months

Notable headlines

Opinion

Unilever’s valuation gap between trailing and forward earnings multiples suggests investors are anticipating a turn in fundamentals through better volumes, steadier pricing, or both. The 52 week underperformance and low beta profile frame the stock as a defensive compounder rather than a momentum trade. To unlock a rerating, management needs to convert brand investment into measurable volume gains while defending gross margin as promotional intensity normalizes. The company’s price to sales and EV to revenue metrics sit in a range consistent with global staples peers, but the earnings growth negative prints underline that delivery, not narrative, will drive the next leg. If price mix normalizes and input costs remain benign, incremental operating leverage could support a more durable earnings trajectory into 2026–2028.

Cash discipline is central over the next three years. With a current ratio of 0.76 and debt to equity at 160.68%, balance sheet flexibility is not unlimited. That elevates the importance of operating cash flow at 8.44B and levered free cash flow of 5.47B to fund the dividend and selective reinvestment. The payout ratio of about 80% leaves limited room for disappointment, but it also underlines a commitment to income investors. A credible path to working capital efficiency, targeted brand building with clear returns, and measured capital allocation could bring the forward P/E closer to realization while preserving the dividend. Conversely, any stumble that compresses cash flow would quickly constrain optionality for buybacks or portfolio moves.

Growth will likely hinge on volume recovery in core categories and on premiumization that sticks without harming share. The negative quarterly revenue and earnings growth figures point to the need for better innovation cadence, sharper execution in channels, and continued optimization of underperforming SKUs. Private label competition remains an ever present risk in a slower growth consumer backdrop. However, the franchise breadth, strong operating margin at 18.85%, and low beta give Unilever a base from which to compound if it can refine the mix and sustain brand equity. Digital and e commerce execution should matter more, given changing shopper habits, and could offer margin friendly growth if scaled efficiently.

For the share price, the path of least resistance is likely to follow earnings delivery. In the next 12–18 months, evidence of stabilizing volumes and resilient margins would support the forward P/E case and reduce the valuation discount to higher growth peers. Without major corporate events flagged recently, catalysts are likely to be organic: category share trends, input cost direction, and guidance updates. Macro variables such as currency and rates can either amplify or dampen progress. If Unilever couples steady cash conversion with visible top line stabilization, the stock could grind higher from a base near the 200 day average. If not, the combination of a high payout and leverage may cap the multiple and keep returns closer to dividend carry.

What could happen in three years? (horizon September 2025+3)

| Scenario | Narrative | Implications |

|---|---|---|

| Best | Volumes recover across key categories with sustained premiumization and disciplined promotions. Cost inflation remains manageable and productivity initiatives protect gross margin. | Earnings compound steadily, cash flow supports dividend and selective reinvestment, leverage trends down, and valuation edges toward a quality staples premium versus the current forward multiple. |

| Base | Top line grows at a modest pace with mixed volume and pricing, while margins hold broadly stable. Execution is consistent but not spectacular. | Total returns skew to dividend plus modest multiple stability. Balance sheet remains serviceable, with incremental deleveraging and ongoing brand investment within cash flow. |

| Worse | Consumer trading down intensifies, private label gains share, and input costs or FX turn adverse. Promotional spend rises to defend volumes, pressuring profitability. | Cash flow tightens, dividend flexibility diminishes given the high payout, and valuation de rates below current forward levels until growth and margins reset. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Volume and mix trajectory versus private label and local competitors in core categories.

- Input cost and currency moves driving gross margin and pricing power, including promotion intensity.

- Portfolio pruning or bolt ons and the return on brand and innovation spend.

- Balance sheet discipline given debt to equity at 160.68% and a current ratio of 0.76.

- Regulatory and reputational developments in key markets that affect demand or costs.

- Execution in digital and e commerce channels improving reach and margin structure.

Conclusion

Unilever’s next three years will be shaped by the balance between steady cash generation and the need to re accelerate growth. The starting point is defensively positioned: low beta at 0.20, strong operating margin at 18.85%, and substantial free cash flow at 5.47B support the dividend. Yet headwinds are visible in the recent year over year declines in revenue and earnings and in the elevated leverage and tight liquidity. The market’s message is clear in the valuation spread between trailing and forward P/E multiples: improvement is expected. Delivery likely requires consistent volume recovery, durable pricing with less promotion, and focused capital allocation to the highest return brands and channels. If management executes, the base case is a dividend supported compounding story. If not, the high payout and leverage may limit flexibility and keep the shares range bound.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.