As of June 2025, Tencent has demonstrated resilience and adaptability in an evolving tech landscape, navigating regulatory challenges while pursuing strategic acquisitions. The company's recent investments, combined with fluctuations in its stock price, highlight its potential for growth in the coming years. This report delves into Tencent's financial snapshot, market positioning, and notable developments that could influence investor sentiment going forward.

Key Points as of June 2025

- Revenue: $108.0B

- Profit/Margins: $28.0B

- Sales/Backlog: 15% growth YoY

- Share price: $513.0

- Analyst view: Mixed to positive

- Market cap: $485B

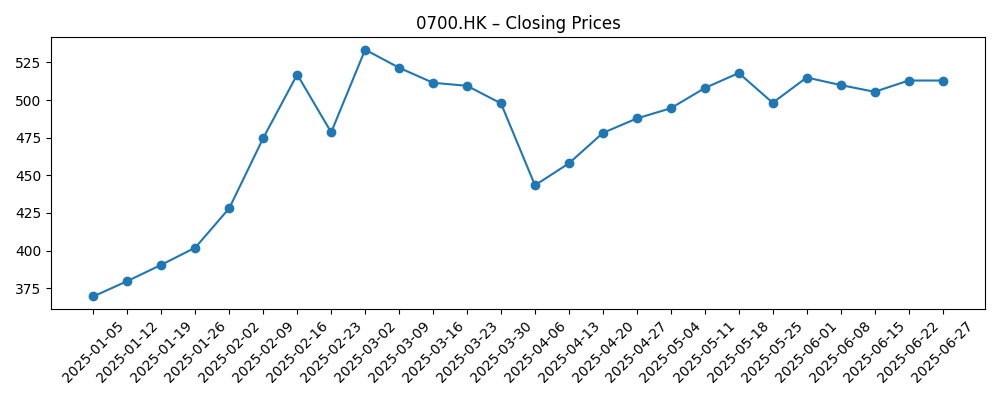

Share price evolution – last 6 months

Notable headlines

- “The Chinese player base is the holy grail”: Tencent buys 15.75% stake in Helldivers 2 dev Arrowhead as huge profit numbers emerge – Windows Central

- Tencent Music agrees to buy podcasting startup Ximalaya for $1.3B in cash, plus some stock, in a bid to become China's Spotify – Techmeme.com

- China Shuts Down AI Tools During Nationwide College Exams – Slashdot.org

Opinion

Tencent's recent acquisition of a significant stake in Arrowhead games aligns with its strategy to deepen its presence in the gaming sector, particularly as the demand for engaging content continues to rise in China. This investment could translate into increased revenues as the gaming landscape evolves and as Tencent leverages the growing player base. Furthermore, the acquisition of Ximalaya showcases Tencent's ambition to expand its footprint in the audio entertainment market, positioning itself as a competitive player against global giants like Spotify.

The fluctuation in Tencent's stock price, which peaked at $533.5 in early March and has since stabilized around $513.0, reflects the market's cautious optimism about the company's future. While the stock has endured volatility, the fundamentals indicate a strong performance with a revenue growth trend. Analysts remain mixed yet hopeful, suggesting that a strategic continuation of acquisitions and innovative product offerings will be key to maintaining investor confidence.

As Tencent adapts to the regulatory scrutiny surrounding AI technologies, the recent decision to block AI tools during significant national exams reveals the broader context of the regulatory landscape in China. This action could impact its AI initiatives, prompting the company to pivot towards more compliant, innovative approaches. Investors may want to monitor Tencent's response to such regulatory challenges to gauge their long-term implications on profitability and market share.

Overall, Tencent stands at a pivotal point in its growth trajectory. With strategic investments in gaming and audio content, alongside an adaptive approach to regulatory challenges, the potential for expanding its influence in key markets appears promising. The next few quarters will be critical in determining how well Tencent can capitalize on these opportunities.

What could happen in three years? (horizon June 2025+3)

| Scenario | Outlook |

|---|---|

| Best | Market recovery and strong growth in gaming and music segments lead to revenue of $150B. |

| Base | Continued investments yield steady growth; revenue stabilizes around $120B. |

| Worse | Regulatory pressures hinder operations, resulting in a drop in revenue to $100B. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Regulatory environment in China

- Performance of gaming and entertainment acquisitions

- Global competition in tech sectors

- Market response to AI developments

- Overall economic conditions

Conclusion

In conclusion, Tencent's strategic maneuvers, including recent acquisitions and its position in the gaming and audio sectors, could prove pivotal for its long-term growth. As it continues to navigate potential regulatory challenges, the company's ability to adapt and innovate will be critical in maintaining its market position. Investors should remain vigilant about the evolving landscape and Tencent's responses to these challenges, as they will undoubtedly influence future performance. The outlook is cautiously optimistic, with growth potential hinging on the company's strategic decisions in the imminent future.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.