As of June 2025, Samsung Electronics continues to display resilience in a competitive market, highlighted by recent strategic partnerships and product innovations. The tech giant's share performance showcases fluctuating investor sentiment, predominantly influenced by its advancements in semiconductor production and smartphone technology. With a focus on optimizing supply chains and enhancing product lines, Samsung is well-positioned to leverage growth opportunities in the coming years. Key developments over the past six months have also provided insight into consumer preferences and the company's strategic responses.

Key Points as of June 2025

- Revenue 2024: 219 billion

- Earnings: 27 billion

- Sales/Backlog: Strong backlog

- Share price: 59,200

- Analyst view: Positive outlook

- Market cap: 285 billion

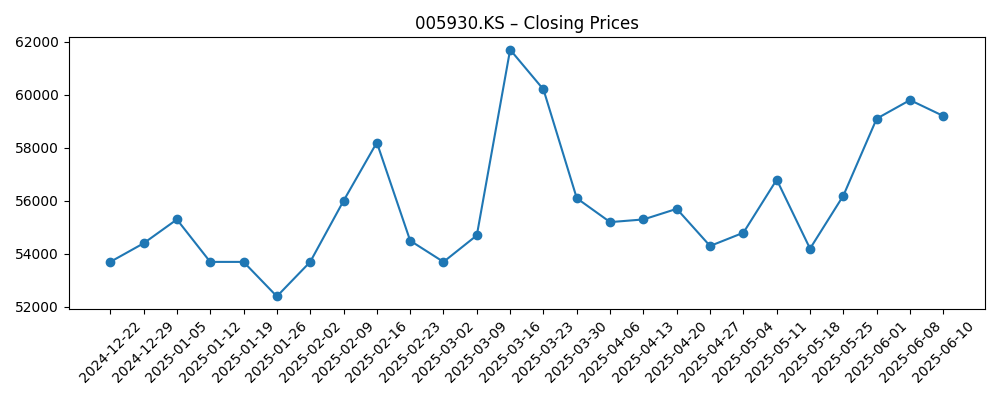

Share price evolution – last 6 months

Notable headlines

- Samsung's top Exec addresses Galaxy S25 Edge battery woes in a recent interview – Android Central

- Nintendo has partnered with Samsung to increase Switch 2 chip production, which could see the console selling 20 million units by March 2026 – TechRadar

- Samsung's ‘Goldilocks’ Galaxy phone may have set the standard for Apple’s iPhone 17 Air to chase – TechRadar

Opinion

The recent volatility in Samsung's share price reflects broader market dynamics and investor sentiment. The company's focus on enhancing its semiconductor production capabilities through the partnership with Nintendo suggests a strategic pivot to cater to the rising demand for gaming devices. This move is expected to bolster Samsung's revenue streams significantly. Furthermore, addressing battery issues in flagship models like the Galaxy S25 Edge is crucial for maintaining brand loyalty and customer satisfaction. Analysts are keeping a close eye on the outcomes of these initiatives, as they could determine the company's market share in the highly competitive smartphone arena.

Additionally, Samsung's innovative 'Goldilocks' Galaxy phone appears to set a new benchmark for competitors, including Apple. This could lead to a shift in consumer preferences towards Samsung devices, driving sales in subsequent quarters. If successful, this could reinforce Samsung's position as a leader in smartphone technology while mitigating competitive pressures. Let's not forget the implications of strong consumer demand for next-generation products, which may provide further upside to their financial outlook.

However, risks remain, especially concerning global supply chain disruptions and geopolitical factors that could impact production. The ongoing developments with the Galaxy Ring and other wearable devices will also play a role in diversifying revenue streams. Samsung's ability to navigate these challenges effectively will be paramount in sustaining growth and investor confidence over the next few years.

As we look ahead, the anticipated earnings for Samsung will heavily depend on how well it can execute its strategic initiatives and adapt to the rapidly evolving market landscape. The focus on innovation and partnerships is likely to drive investor interest, but it will be essential for management to maintain transparency regarding production capabilities and market expectations.

What could happen in three years? (horizon June 2025+3)

| Scenario | Market Cap (in billions) | Share Price (in KRW) |

|---|---|---|

| Best | 550 | 80,000 |

| Base | 463 | 70,000 |

| Worse | 350 | 50,000 |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Adoption and success of new products

- Geopolitical stability in production regions

- Market demand for semiconductors

- Competitive responses from Apple and other brands

- Consumer sentiment towards technology upgrades

Conclusion

In conclusion, Samsung Electronics is navigating a complex market landscape as it confronts both opportunities and challenges. The strategic partnerships, especially in semiconductor production, indicate a robust forward-looking vision that could drive revenue growth. Nonetheless, the company must remain vigilant about consumer demands and potential disruptions in supply chains. Investor sentiment appears cautiously optimistic, with a positive outlook expected as long as the company continues to innovate and address market challenges effectively. Ongoing monitoring of key performance indicators and market responses will be crucial to determine the trajectory of Samsung's share price and overall market position in the years ahead.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.