Petrobras (PBR), Brazil’s state-controlled oil major, enters the next three years balancing rich cash returns with policy and execution risk. The company generated 85.53B in trailing-12-month revenue with a 15.19% profit margin and 26.22% operating margin, supported by 33.42B EBITDA and 35B operating cash flow. Yet quarterly revenue contracted 10.10% year over year and liquidity remains tight (current ratio 0.76) against 68.06B total debt. Shares have lagged, down 14.55% over 52 weeks and recently trading near 12.63, with the 50-day/200-day moving averages at 12.47 and 12.88. The dividend is a focal point: a forward yield of 14.42% and a 90.08% payout ratio underscore income appeal but raise sustainability questions. Operationally, ramp-up at the Búzios pre-salt field is a key tailwind, while state influence on pricing and capital allocation will likely drive valuation.

Key Points as of September 2025

- Revenue: Trailing 12 months at 85.53B; revenue per share 13.27; quarterly revenue growth (yoy) at -10.10%.

- Profit/Margins: Profit margin 15.19%; operating margin 26.22%; EBITDA 33.42B; gross profit 41.65B; diluted EPS 2.14.

- Cash flow: Operating cash flow 35B; levered free cash flow 15.32B.

- Balance sheet: Total debt 68.06B vs. cash 9.5B; debt/equity 92.44%; current ratio 0.76; book value per share 5.68.

- Sales/Backlog proxy: Operational momentum at the Búzios pre-salt field, which recently surpassed 900K bpd production.

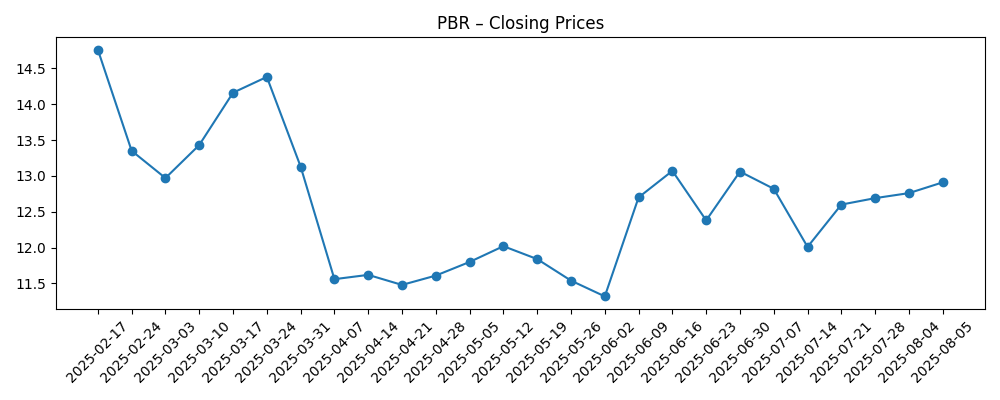

- Share price: 52-week change -14.55%; latest close 12.63 (week of 2025-09-12); 52-week range 11.03–15.34; beta 0.32.

- Dividends: Forward rate 1.82 (yield 14.42%); trailing rate 1.34 (yield 10.55%); payout ratio 90.08%; ex-div 8/25/2025; dividend date 12/30/2025; 5-year average dividend yield 21.69%.

- Analyst view: Not provided here; market tone appears cautious given negative yoy revenue and policy risk.

- Market cap: Not specified in the data; valuation remains sensitive to oil prices and Brazilian state policy.

Share price evolution – last 12 months

Notable headlines

Opinion

The production milestone at Búzios is strategically important because Petrobras’s near-term equity story hinges on reliable pre-salt growth funding sizable dividends. With 85.53B in trailing revenue, 33.42B of EBITDA, and 35B of operating cash flow, the company has the scale to sustain high distributions. However, a 90.08% payout ratio leaves little cushion if oil markets soften or if unplanned downtime hits large hubs like Búzios. In that context, management discipline on capex allocation and uptime becomes as crucial to equity value as headline oil prices. The low beta (0.32) points to contained volatility historically, but income-led investors should still watch the operational cadence closely.

Policy remains the twin risk and catalyst. As a state-controlled entity, Petrobras may face changing guidance on dividends, domestic fuel pricing, or investment priorities. Those levers can alter free cash flow available to equity even when operations perform. Liquidity indicators such as the 0.76 current ratio and the 68.06B debt load argue for prudence if policy asks for higher capex or price interventions. The share’s 52-week underperformance and a forward yield of 14.42% suggest the market discounts policy uncertainty alongside cyclical effects. Any move toward a clearer, rules-based payout and pricing framework would likely narrow that discount.

Operational execution could provide upside. Búzios ramp-up helps offset natural declines and supports utilization of existing infrastructure, potentially improving unit costs and sustaining margins (15.19% profit margin; 26.22% operating margin). If Petrobras converts operational strength into steadier free cash flow after capex, it can both service debt and maintain attractive dividends without stressing the balance sheet. The company’s large gross profit base (41.65B) and levered free cash flow (15.32B) indicate capacity, provided that growth spending does not overrun. Stable project delivery and predictable turnarounds would underpin confidence in keeping distributions resilient through the cycle.

Shares have oscillated this year, including a trough around April, and recently settled near 12.63, close to the 50-day and 200-day moving averages (12.47 and 12.88). With a short interest of 2.13% of float and average three-month volume of 21.94M, positioning does not appear stretched. Over the next three years, relative performance will likely track three variables: the durability of Búzios-led volumes, the evolution of dividend policy, and macro oil. If Petrobras navigates these with steady governance and transparent capital allocation, the equity could re-rate; if not, income may remain high but total returns could lag.

What could happen in three years? (horizon September 2028)

| Scenario | Assumptions | Potential outcomes for PBR |

|---|---|---|

| Best | Búzios and other pre-salt assets deliver reliable growth; clear, rules-based dividend framework; disciplined capex; gradual deleveraging. | Improved valuation multiple with steadier distributions; balance sheet strengthens; share performance outpaces emerging-market energy peers. |

| Base | Stable production with routine outages; payout calibrated to cash flow; moderate policy interventions; capex sufficient to sustain volumes. | Range-bound valuation anchored by income; dividends remain attractive though more variable; total returns track cash distributions. |

| Worse | Oil downcycle and/or stricter domestic pricing; project delays; higher spending needs; limited flexibility given liquidity metrics. | Dividend moderation to protect balance sheet; weaker profitability; equity underperforms regional and global oil benchmarks. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Brazilian government decisions on pricing, dividends, and capital allocation at the state-controlled company.

- Execution at pre-salt projects, especially uptime and growth at Búzios and associated hubs.

- Global oil and refined product price trends and OPEC+ supply dynamics.

- Balance sheet and liquidity evolution given 68.06B debt and a 0.76 current ratio.

- Legal, regulatory, or environmental events affecting operations or cash distributions.

- FX volatility (BRL/USD) impacting costs, revenues, and investor risk appetite.

Conclusion

Petrobras’s investment case over the next three years rests on converting pre-salt strength into consistent, policy-resilient cash flow. The company’s scale (85.53B revenue, 33.42B EBITDA) and robust operating cash generation (35B) support the current income profile, but a high payout ratio and tight liquidity argue for careful capital allocation. Delivering steady volumes from Búzios and maintaining cost discipline can sustain margins and stabilize free cash flow after capex. On the policy front, a transparent framework for dividends and domestic pricing would reduce uncertainty and could prompt a valuation re-rating. Conversely, heavier interventions or a cyclical downturn could force dividend adjustments and keep the stock range-bound. For now, the shares offer elevated income with execution and policy sensitivity. Monitoring production cadence, payout guidance, and leverage will be critical to gauging whether total returns can improve from a weak 52-week performance.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.