As Microsoft Corporation (MSFT) approaches the mid-2025 fiscal year, steady growth amidst AI advancements characterizes its outlook. Recent financial reports show a robust revenue stream of $270.01 billion, coupled with a profit margin of 35.79%. The company is capitalizing on its AI initiatives and strategic partnerships, as evidenced by headlines that illustrate its focus on innovation and collaboration. Analysts have raised price targets, reflecting confidence in the stock's potential for continued appreciation. However, challenges remain as Microsoft addresses regulatory scrutiny and competitive pressures. Investors should watch key performance indicators and market trends closely in this evolving landscape.

Key Points as of June 2025

- Revenue: $270.01B

- Profit Margin: 35.79%

- Quarterly Revenue Growth (YoY): 13.30%

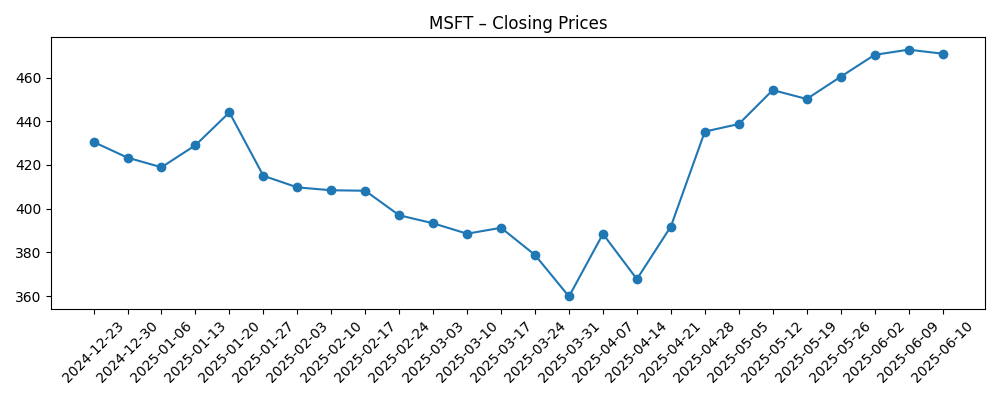

- Share Price: ~$470

- Analyst View: Positive with price targets raised

- Market Cap: $3.49 Trillion

Share price evolution – last 6 months

Notable headlines

- Microsoft Adds Elon Musk’s xAI to Azure AI Models – Yahoo Entertainment

- Citi Raises Microsoft (MSFT) Price Target to $540 on Strong Q3 and AI Momentum – Yahoo Entertainment

- BofA Names Microsoft (MSFT) a Winner in Small-to-Mid-Size Business Software – Yahoo Entertainment

- Microsoft stock just hit a record high as it cashes in on the AI boom – Quartz India

- Microsoft just took the next big step in the AI race, Deutsche Bank says – Quartz India

Opinion

The recent rise in Microsoft's stock price, which has approached new highs amid positive quarterly results, underscores the increasing investor confidence in its AI strategies. The partnership with xAI and the initiatives highlighted by experts position Microsoft at the forefront of AI integration in business solutions. Should these strategies yield substantial results, the stock could maintain its upward trajectory, especially if they drive further user engagement and revenue increases.

However, the competitive landscape is becoming increasingly fierce, with other tech giants also investing heavily in AI and cloud services. Microsoft's ability to differentiate its offerings will be crucial in sustaining its market position. Regulatory hurdles may also pose risks, should any legal challenges arise that could affect its business model or operational strategies.

Ultimately, Microsoft's success will largely depend on how effectively it navigates these challenges while expanding its market share in emerging technologies. Investors should remain cautious but optimistic as the company continues to leverage innovative technologies to drive growth.

In conclusion, as Microsoft heads toward a potentially transformative fiscal period, its stock fundamentals appear solid. The company’s adaptability to market changes, alongside its proactive engagements in AI, could set a strong foundation for capitalizing on future opportunities. Investors are encouraged to keep a close watch on performance indicators and strategic developments that could influence share price movements.

What could happen in three years? (horizon June 2028)

| Scenario | Projected Share Price |

|---|---|

| Best | $600 |

| Base | $500 |

| Worse | $400 |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Continued growth in AI and cloud services

- Regulatory environment and compliance issues

- Market competition and new entrants

- Investor sentiment and economic conditions

Conclusion

In conclusion, as Microsoft heads toward a potentially transformative fiscal period, its stock fundamentals appear solid. The company’s adaptability to market changes, alongside its proactive engagements in AI, could set a strong foundation for capitalizing on future opportunities. Investors are encouraged to keep a close watch on performance indicators and strategic developments that could influence share price movements.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.