MediaTek enters late‑2025 with improving top‑line momentum, a sturdier balance sheet, and a share price that has cooled after a mid‑year rebound. The key change is firmer demand in Android smartphones and edge devices just as OEMs add on‑device AI features, which lifted quarterly revenue growth to 18.10% year over year. That recovery, however, meets tougher pricing and mix dynamics in premium system‑on‑chip (SoC) tiers, meaning margin gains may be more gradual than revenue. Why it matters: as investors rotate within semiconductors toward AI beneficiaries, the debate for MediaTek is whether on‑device AI and diversification into connectivity, IoT and automotive can sustain earnings resilience through the next handset cycle. Cash generation supports a generous capital return framework, including a forward dividend yield of 4.04%, but payout levels limit room for aggressive buybacks if growth were to slow. Sector context: chipmakers tied to handsets trail the data‑center AI surge, so narrative and valuation will hinge on execution in AI‑ready mobile platforms and exposure to China‑led demand swings.

Key Points as of October 2025

- Revenue: trailing‑twelve‑months revenue is 573.54B, with quarterly revenue growth of 18.10% year over year.

- Profit/Margins: profit margin 18.54% and operating margin 19.54%; net income (ttm) 106.31B and diluted EPS (ttm) 66.75.

- Sales/Backlog: demand has improved alongside Android refresh and AI‑phone features; formal backlog disclosure not provided.

- Balance sheet: total cash 196.74B vs total debt 15.26B; current ratio 1.35 indicates adequate near‑term liquidity.

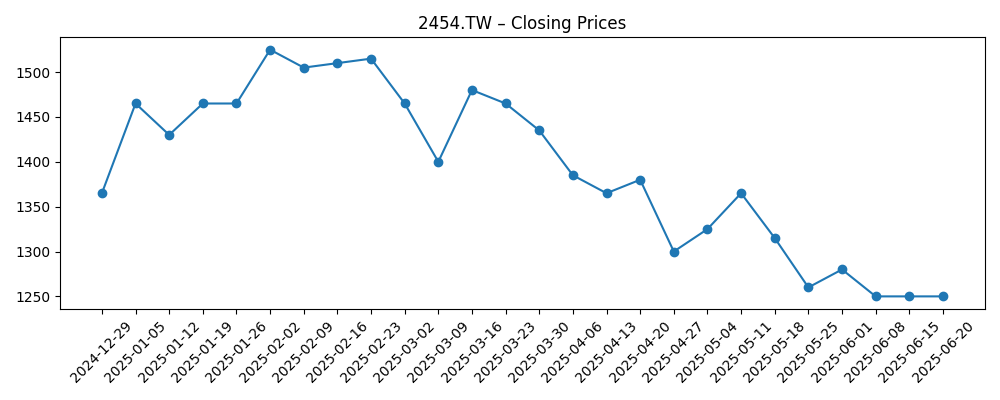

- Share price: latest weekly close around 1,335, below the 50‑day and 200‑day moving averages (1,386.20 and 1,389.12); 52‑week range 1,140–1,575; 52‑week change 6.43%.

- Dividend: forward annual dividend rate 54 with a 4.04% forward yield; payout ratio 80.96%; last ex‑dividend date 7/3/2025.

- Market cap: implied in the low TWD trillions based on recent price and 1.6B shares outstanding; day‑to‑day level varies with price.

- Analyst view: formal ratings/targets not provided in the data; debate centers on AI‑phone uplift versus pricing pressure and mix.

- Qualitative: competitive tension with premium Android incumbents, foundry node transitions, China demand/FX exposure, and regulatory headlines remain swing factors.

Share price evolution – last 12 months

Notable headlines

Opinion

MediaTek’s latest trend line shows a company exiting the inventory overhang with healthier sell‑in and a product stack aligned to the AI‑ready smartphone cycle. An 18.10% year‑over‑year quarterly revenue lift signals broad demand repair, while trailing profitability (18.54% profit margin; 19.54% operating margin) reflects decent pricing discipline in a competitive season. The quality of the recovery matters: gains appear volume‑led with some mix benefits in higher‑tier Dimensity platforms, but pricing remains contested in the upper Android categories. That sets expectations for steady, not explosive, operating leverage. Cash generation remains solid, and the balance of cash to debt supports operational flexibility. Put together, the earnings base looks sturdier than a year ago, yet still sensitive to OEM ordering patterns and regional handset swings.

Share performance tells a similar story: the stock rallied into early September before retracing toward the 50‑day and 200‑day moving averages, and its 52‑week change lags broad U.S. equities. Investors appear to be weighing cyclical normalization against the durability of margin expansion. The dividend framework (forward yield 4.04% with an 80.96% payout ratio) signals confidence in cash flows but caps room for aggressive buybacks in a downturn, placing more burden on execution to drive multiple expansion. With operating cash flow outpacing free cash flow, working capital and investment needs are evident, which is typical for this phase of a handset upcycle as builds resume and node migrations progress.

Within the industry, the narrative pivot is on‑device AI. If OEMs prioritize AI inference on handsets and edge devices, MediaTek’s integration of NPUs and connectivity into competitive SoCs can extend its reach beyond mid‑range phones into premium tiers, while also reinforcing attach in Wi‑Fi, IoT, and automotive telematics. Pricing power will hinge on tangible AI use‑cases that lift bill of materials without sparking substitution. Foundry dynamics—wafer pricing, yield learning on newer nodes, and allocation—could modulate gross margin more than unit volumes. Meanwhile, geographic exposure, particularly to China‑centric demand and supply chains, will continue to add volatility to orders and currency translation in TWD.

Valuation over the next three years will likely track three levers: sustained revenue growth from AI‑capable platforms, incremental margin from mix and node efficiency, and capital returns. A steadier cash balance supports R&D intensity to defend share against premium competitors, but it also must cover dividends near current levels. If MediaTek demonstrates consistent ASP uplift and operating discipline while broadening into auto/IoT sockets, narrative could migrate from cyclical handset proxy to diversified edge‑AI enabler, warranting a sturdier multiple. Conversely, if AI features fail to command price and competition tightens, the story reverts to a volume game with range‑bound margins and a yield‑supported, income‑oriented profile.

What could happen in three years? (horizon October 2025+3)

| Scenario | Narrative |

|---|---|

| Best | AI‑capable smartphone platforms achieve broad adoption across premium and upper‑mid tiers, lifting average selling prices and mix. Foundry node transitions are smooth, with cost improvements offsetting die‑size creep. Attach rates in Wi‑Fi, IoT and auto connectivity expand, reducing reliance on any single handset OEM or region. Margin structurally improves and cash flows comfortably fund R&D and stable dividends, supporting a sturdier valuation narrative. |

| Base | Android refresh continues, but pricing remains competitive. MediaTek holds or modestly grows share in key tiers while expanding selectively into edge devices. Gross margin is range‑bound as node costs and promotional intensity offset efficiency gains. Capital returns remain steady; valuation tracks earnings growth with periodic volatility tied to China demand and product launch timing. |

| Worse | AI features fail to drive durable handset ASP uplift and OEMs down‑spec to protect retail prices. Premium competitors defend share aggressively, squeezing pricing. Foundry cost inflation and supply tightness pressure margins. China‑related demand or regulatory shocks hit volumes, and elevated dividends constrain balance‑sheet optionality, leaving the multiple compressed. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Android and China handset demand trajectory, including uptake of on‑device AI features and OEM inventory behavior.

- Pricing and competitive dynamics in premium and upper‑mid smartphone SoCs versus incumbent rivals.

- Foundry supply, node transition costs, and wafer pricing/yield trends at key manufacturing partners.

- Regulatory and geopolitical developments affecting China exposure, export controls, and supply chain continuity.

- FX movements (USD/TWD) and their impact on reported results and cost structure.

- Execution in diversification areas (Wi‑Fi, IoT, automotive connectivity) that can dampen handset cyclicality.

Conclusion

MediaTek’s set‑up into the next three years is clearer than a year ago: demand has stabilized, AI‑centric features are redefining the Android roadmap, and the balance sheet provides flexibility. The remaining questions are about pace and quality—how much of the growth is mix‑led with sustainable pricing, and how effectively foundry cost curves and product efficiency can defend margins through competitive cycles. With dividends already generous, the story leans on execution in premium tiers, broader edge attach, and disciplined opex to support any re‑rating. The share price’s drift toward key moving averages suggests investors await proof points from holiday and spring refreshes. Watch next 1–2 quarters: AI‑phone uptake at key OEMs; gross‑margin trajectory during node transitions; channel inventory behavior; pricing versus rivals; and evidence of diversification wins in Wi‑Fi/IoT/auto. Clearer traction on those fronts would sharpen the narrative from cyclical recovery to a more durable edge‑AI platform play.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.