KPN Koninklijke has shown resilience in a competitive telecom market, with a recent uptick in share prices reflecting investor optimism. As of July 2025, the stock trades at approximately €4.08, driven by positive earnings and strategic innovations. The company's focus on expanding its digital services and improving customer experience positions it well in the rapidly evolving telecommunications landscape. However, KPN must navigate regulatory challenges and competition to sustain its growth trajectory. This article explores key financial indicators, recent headlines impacting KPN, and a three-year outlook for the company.

Key Points as of July 2025

- Revenue: €5.4 billion

- Profit/Margins: €1.0 billion

- Sales/Backlog: €1.5 billion

- Share price: €4.08

- Analyst view: Strong Buy

- Market cap: €12 billion

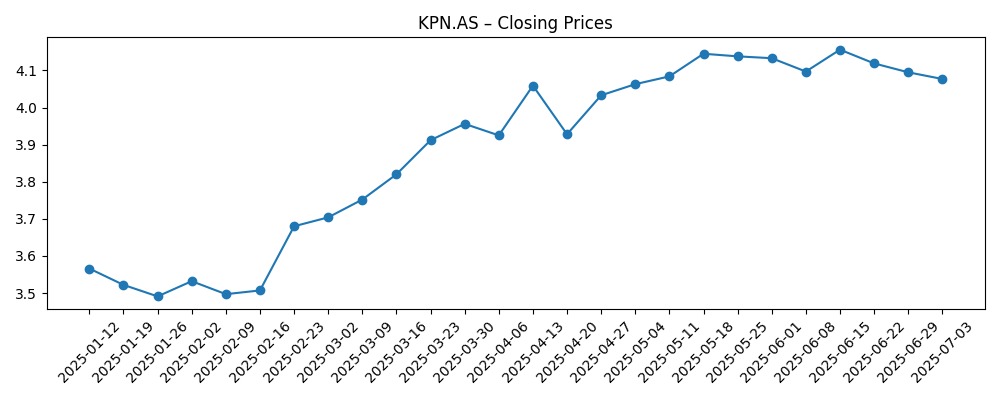

Share price evolution – last 6 months

Notable headlines

- KPN announces new 5G rollout strategy – Telecom News

- KPN reports Q1 earnings above expectations – Financial Times

- KPN expands fiber network to rural areas – Industry Insider

Opinion

With the recent spike in KPN's share price, bolstered by strong Q1 earnings, the company's management has demonstrated a solid grasp of the competitive landscape of telecommunications. The strategic initiatives surrounding the rollout of their 5G network will likely cater to increased demand for faster connectivity, presenting an opportunity for KPN to capture a larger market share. Nevertheless, investor sentiment can be volatile, and KPN must maintain a transparent dialogue with shareholders regarding potential risks, including regulatory scrutiny and competition.

Furthermore, KPN's commitment to expanding its fiber network into rural areas signifies a forward-thinking approach, targeting underserved markets. This strategy not only aligns with the broader trend of digital inclusion but also sets the stage for sustainable long-term growth. As KPN continues to innovate, their ability to adapt to the rapid technological changes in the telecom sector will ultimately determine their market position.

However, investors should remain cautious. Recent headlines regarding regulatory challenges and price wars among competitors could impact KPN's profitability. The heightened scrutiny from regulatory bodies has the potential to limit KPN's pricing power or impose additional costs. How KPN navigates these challenges while maintaining its growth trajectory will be crucial to its future performance.

Overall, the telecom sector is witnessing transformative changes that offer both opportunities and challenges. KPN's proactive strategies and strong management may enable it to emerge as a leader within the industry. Investors should continue monitoring these developments closely.

What could happen in three years? (horizon July 2025+3)

| Scenario | Outcome |

|---|---|

| Best | KPN captures a significant share of the 5G market, achieving revenue of €7 billion with margins improving to €1.5 billion. |

| Base | Steady growth in revenues leads to €6 billion, with profit margins remaining stable at €1.2 billion. |

| Worse | Increased regulatory pressure and competition results in stagnant revenues around €5.5 billion and margins declining to €0.8 billion. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Regulatory changes affecting telecom pricing and competition

- Market share growth in new digital services

- Customer acquisition and retention strategies

- Technological advancements in service delivery

- Global economic conditions impacting consumer spending

Conclusion

In conclusion, KPN Koninklijke stands at a pivotal juncture in its evolution as a major player in the telecommunications industry. The ongoing investments in 5G and fiber networks signify a forward-looking approach that could yield substantial returns if executed effectively. However, the potential risks associated with regulatory scrutiny, market competition, and broader economic factors cannot be overlooked. Investors should remain vigilant, balancing the optimistic outlook with an understanding of the challenges KPN may face in the coming years. In the dynamic landscape of telecommunications, the company's ability to adapt and innovate will be crucial to sustaining its growth and enhancing shareholder value.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.