Fomento Económico Mexicano (FEMSA, NYSE: FMX) enters late 2025 balancing recovery in its share price with strategic shifts. Over the past six months, the stock swung from a May high near 106.59 to an August trough around 85.25, before rebounding to about 92.31 in mid‑September. Fundamentals remain mixed: trailing‑twelve‑month revenue is 812.89B with 6.30% quarterly revenue growth year over year, but profit margin is a slim 2.43% and quarterly earnings growth shows a sharp −78.50%. Liquidity is solid with 163.44B in cash versus 265.48B debt, and a low 0.34 beta underscores defensiveness. Recent headlines center on CEO succession planning, a reiterated Buy from HSBC, a broker average target of $105.16, and the decision to take full control of OXXO Brazil. This note outlines a three‑year outlook from today’s starting point.

Key Points as of September 2025

- Revenue – TTM revenue 812.89B; quarterly revenue growth (yoy) 6.30%; revenue per share 2,342.98.

- Profit/Margins – Profit margin 2.43%; operating margin (ttm) 8.31%; gross profit 335.42B; EBITDA 82.36B; quarterly earnings growth (yoy) −78.50%.

- Cash, leverage, liquidity – Total cash 163.44B vs total debt 265.48B; debt/equity 81.67%; current ratio 1.34; operating cash flow 62.66B; levered free cash flow 117.06B.

- Returns – ROA 4.89% and ROE 9.10%; book value per share 70.47.

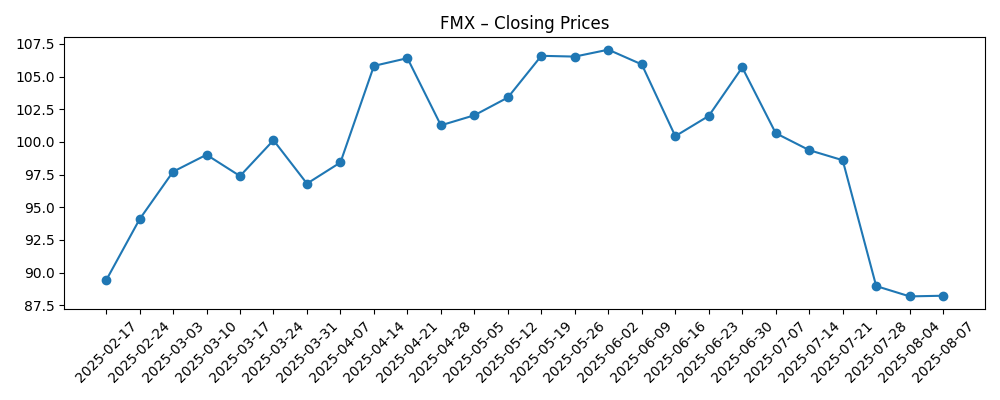

- Share price – 52‑week range 81.08–108.74; 50‑day MA 91.68 and 200‑day MA 94.56; beta 0.34; last six months: rebound to 92.31 after August weakness; 52‑week change −10.86% vs S&P 500 +16.89%.

- Dividend – Forward dividend rate 4.39 (yield 4.76%); trailing dividend 4.58 (yield 5.07%); payout ratio 161.11%; dividend date 7/28/2025; ex‑date 7/17/2025; 5‑year average yield 2.24.

- Analyst view – HSBC maintained Buy amid CEO succession planning; brokerages’ average target cited at $105.16.

- Market cap/ownership – Large‑cap Mexican consumer and retail group; shares outstanding 346.95M; institutions hold 36.59%; short interest 0.31% (601.66k; short ratio 0.96; 3‑month avg vol 874.18k).

Share price evolution – last 12 months

Notable headlines

- HSBC Maintains Buy Rating on FEMSA (FMX) Amid CEO Succession Plans

- FEMSA to control 100% of OXXO Brazil

- Brokerages Set Fomento Economico Mexicano S.A.B. de C.V. (NYSE:FMX) Price Target at $105.16

- Fomento Economico Mexicano (NYSE:FMX) Stock Unloaded Rep. Jonathan L. Jackson

Opinion

FEMSA’s move to take full control of OXXO Brazil could be the pivotal operational lever for the next three years. With control comes unified strategy, faster decision‑making, and cleaner capital allocation between formats and geographies. Brazil’s scale offers a long runway, but integration discipline matters: store economics, supply‑chain density, and category management must translate to consistent same‑store trends. Balance sheet metrics (163.44B cash against 265.48B debt; debt/equity 81.67%) suggest room to fund growth while preserving flexibility, provided free cash flow (117.06B) remains resilient. Execution in Brazil, more than any one macro variable, is likely to determine whether margins stabilize from current levels and whether investors rerate the shares closer to peer benchmarks.

The CEO succession narrative introduces short‑term uncertainty but can ultimately be constructive if strategy continuity is paired with sharper capital discipline. HSBC’s maintained Buy and the cited $105.16 average target indicate confidence that management changes will not derail core plans. In practice, the market will look for clean quarters: steady 6.30% revenue growth (yoy, quarterly) is a decent base, yet the −78.50% earnings contraction highlights cost pressures and one‑offs that must fade. Governance signals—clear guidance ranges, prioritized uses of cash, and transparent reporting on Brazil—can compress the perceived risk premium and help rebuild return on equity beyond the current 9.10%.

The dividend is both attraction and pressure point. A forward yield of 4.76% is supportive for a low‑beta (0.34) name, but a 161.11% payout ratio versus earnings is not sustainable indefinitely if profitability lags. The mitigating factor is cash generation: operating cash flow of 62.66B and levered free cash flow of 117.06B provide coverage today. Still, if earnings normalization proves slow, management may recalibrate the payout toward a healthier coverage ratio. Markets typically reward credible, internally funded growth over stretched distributions; a measured, well‑telegraphed policy could widen the investor base while reducing the risk of a forced cut during a downturn.

Technically and sentiment‑wise, FMX has repaired part of its drawdown—recovering from August lows near 85.25 to around 92.31—yet it remains below the 52‑week high (108.74) and the 200‑day moving average (94.56) acts as a reference. The 52‑week underperformance (−10.86% vs S&P 500 +16.89%) leaves room for mean reversion if fundamentals improve. Approaching the consensus target would likely require evidence of margin traction, early Brazil wins, and reassurance on the dividend. Conversely, a break back toward the low end of the 81.08–108.74 range could follow if integration drags or if macro headwinds in Mexico and Brazil pressure consumer demand. Near‑term catalysts include leadership updates, store growth disclosures, and cost efficiency milestones.

What could happen in three years? (horizon September 2025+3)

| Scenario | Operations | Profitability | Capital allocation | Share price/sentiment |

|---|---|---|---|---|

| Best | OXXO Brazil integration runs smoothly; footprint expands with healthy unit economics; supply chain efficiencies scale. | Margins rebuild toward pre‑slowdown levels; ROE trends upward as cost discipline sticks. | Dividend sustained with healthier coverage; selective reinvestment funded by robust free cash flow. | Rerating toward bullish targets as defensiveness plus growth attracts broader ownership. |

| Base | Execution steady; store growth paced to cash generation; mixed macro but manageable. | Margins stabilize; earnings volatility eases; gradual improvement year over year. | Dividend maintained with cautious increases; balance sheet metrics remain within current bands. | Range‑bound performance around long‑term averages; moderate multiple expansion if guidance is met. |

| Worse | Integration setbacks in Brazil; cost inflation and soft traffic pressure unit returns. | Prolonged margin compression; earnings recovery delayed. | Dividend reset to protect balance sheet; capex reprioritized. | De‑rating toward the lower end of the 52‑week range as investors demand proof of execution. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Execution quality and returns on OXXO Brazil following FEMSA’s move to full control.

- CEO succession outcomes and strategy continuity, including guidance credibility.

- Margin trajectory versus cost inflation and operating efficiency initiatives.

- Dividend policy sustainability relative to earnings and free cash flow.

- Macroeconomic and FX conditions in Mexico and Brazil affecting consumer demand.

- Competitive intensity in convenience retail and beverages across core geographies.

Conclusion

FMX offers a blend of defensiveness and self‑help. The balance sheet provides room to maneuver, cash generation is solid, and beta is low, yet profitability has lagged and earnings volatility has been elevated. Over the next three years, the decisive variables are Brazil execution, dividend policy credibility, and leadership stability. If FEMSA can translate full control of OXXO Brazil into consistent unit returns and operating leverage, margins should rebuild, ROE can improve from 9.10%, and the shares could close the gap to cited targets around $105.16. Conversely, integration slippage or an abrupt dividend reset would likely cap the multiple and anchor the stock toward the lower end of its recent 81.08–108.74 range. For now, the setup appears balanced: patient investors may find a reasonable risk‑reward if near‑term catalysts validate the operational plan.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.