Bank of America enters the next three years with solid earnings capacity and a stronger share price, supported by steady revenue and fee initiatives. On a trailing basis, revenue stands at $98.46B and net income at $26.59B, with profit margin of 28.51% and return on equity of 9.46%. Shares recently traded near the 52‑week high, with the last weekly close at $50.58 versus a 52‑week range of $33.07–$50.96 and a 52‑week change of 31.31%. The bank’s dividend policy remains measured, with a forward yield of 2.21% and a 30.50% payout ratio. Near term, performance hinges on the interest‑rate path, credit trends, and operating discipline after a volatile spring. Longer term, BAC’s scale in digital banking and wealth management—plus new partnerships—positions it to grow fee income while maintaining prudent capital returns.

Key Points as of September 2025

- Revenue: Trailing‑twelve‑month revenue of $98.46B with quarterly revenue growth of 4.20% year over year.

- Profit/Margins: Profit margin 28.51%; operating margin 30.91%; ROE 9.46%; ROA 0.84%.

- Sales/Backlog: Loan and fee pipelines remain a focus; Merrill wealth flows supported by an alternatives access push and digital engagement.

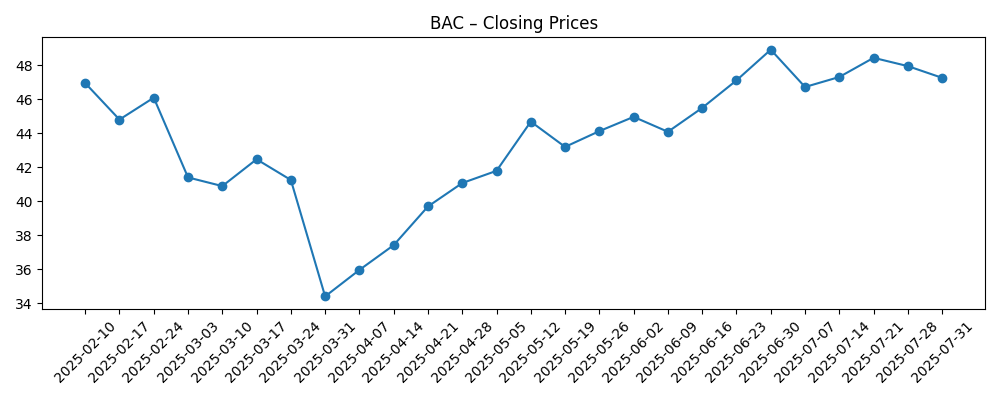

- Share price: Last weekly close $50.58; 52‑week range $33.07–$50.96; 52‑week change 31.31%; 50‑/200‑day moving averages $48.06/$44.84; beta 1.35.

- Analyst view: Select brokers have lifted price targets; short interest remains modest (1.32% of float; short ratio 2.84).

- Market cap: 7.41B shares outstanding; recent pricing places BAC firmly in large‑cap territory.

- Dividends: Forward rate $1.12 (2.21% yield); payout ratio 30.50%; ex‑dividend 9/5/2025; next dividend date 9/26/2025; trailing yield 2.05%.

- Balance sheet/liquidity: Total cash $838.14B vs total debt $819.27B; book value per share $37.13; operating cash flow (ttm) −$22.68B.

Share price evolution – last 12 months

Notable headlines

- Bank of America Corporation (BAC) Launches Alts Expanded Access Program With Merrill Wealth Management

- Bank of America’s (BAC) AI Assistant Erica Surpasses 3B Interactions

- Bank of America (BAC) Launches Premium Credit Card with Alaska Airlines

- Bank of America Stock: Is BAC Outperforming the Financial Sector?

- Freedom Broker Lifts Bank of America (BAC) Price Target on Industry Tailwinds

- 15,525 Shares in Bank of America Corporation $BAC Purchased by Quantbot Technologies LP

Opinion

Over the next three years, the most striking leverage point for BAC may be digital engagement. Erica surpassing 3B interactions is not just a marketing milestone; it signals durable customer behavior that lowers servicing costs and deepens cross‑sell. With a 28.51% profit margin and 9.46% ROE as the starting point, incremental digital adoption should support stable efficiency—even if net interest income softens with rate normalization. The dividend framework (30.50% payout, 2.21% forward yield) suggests room to continue increases aligned with earnings growth, while preserving capital flexibility. If management sustains a disciplined cost base and nudges fee income higher, steady mid‑single‑digit revenue momentum (4.20% recent yoy) could compound shareholder returns.

Wealth and card initiatives could become second engines of non‑interest revenue. The Merrill alternatives access program should lift advisory and custody fees by broadening product shelves and keeping assets in‑house through market cycles. Meanwhile, the new co‑branded premium credit card with Alaska Airlines can add resilient, fee‑rich balances and interchange, while generating prime customer acquisition. In combination, these vectors reduce reliance on the rate curve and provide more predictable revenue. Execution will matter: suitable distribution, advisor training, and risk controls must scale in step with demand to avoid compliance drag or elevated acquisition costs.

Shares sit near the 52‑week high ($50.58 last weekly close; $50.96 high), implying the market has already discounted part of the earnings normalization story following a volatile spring slide and recovery. From here, the path likely tracks macro rates, credit normalization, and management’s ability to defend margins. The 50‑/200‑day moving averages ($48.06/$44.84) show a constructive trend, but a higher beta (1.35) warns that swings could amplify through policy and growth headlines. Against a book value per share of $37.13, the stock trades at a premium to accounting capital, placing a burden of proof on sustainable ROE improvement and fee diversification.

Risks are not trivial. Credit costs can surprise on the downside if unemployment ticks up or consumer savings erode, pressuring net income and capital return plans. Regulatory shifts—either on capital buffers or fee practices—could cap returns or slow product rollout in wealth and cards. Still, BAC’s scale, abundant liquidity (cash $838.14B vs debt $819.27B), and modest short interest (1.32% of float; short ratio 2.84) provide resilience. If the economy achieves a soft landing, we see scope for incremental ROE gains and measured dividend growth. If growth falters, the bank’s diversified fee mix and digital cost advantages should help cushion the cycle relative to smaller peers.

What could happen in three years? (horizon September 2025+3)

| Scenario | Narrative |

|---|---|

| Best | Rates normalize without a hard landing; credit remains benign. Digital engagement lowers unit costs further as Erica‑led interactions expand, while Merrill’s alternatives platform and the Alaska Airlines premium card scale fee income. ROE trends higher from today’s base, enabling steady dividend growth while maintaining prudent capital. |

| Base | A mixed macro: modest loan growth, stable deposit costs, and contained credit. Fee initiatives offset softer net interest income. Operating discipline keeps margins broadly stable around recent levels, with dividends rising in line with earnings and payout kept close to current practice. |

| Worse | A shallow recession lifts charge‑offs and compresses spreads; regulatory changes raise capital needs and limit buybacks. Management prioritizes balance sheet strength; dividend growth pauses. Digital and wealth initiatives continue, but revenue growth slows and operating leverage narrows until the cycle turns. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Interest‑rate path and deposit pricing dynamics affecting net interest income and margins.

- Credit quality trends across consumer and commercial books, including charge‑offs and delinquencies.

- Regulatory and capital requirements that shape dividend and buyback capacity, plus fee‑practice rules.

- Execution in digital, wealth alternatives, and co‑branded cards, influencing fee growth and costs.

- Market risk and volatility (beta 1.35) impacting valuation multiples and sector flows.

- Competitive actions from peers in pricing, product, and technology adoption.

Conclusion

Bank of America’s three‑year outlook balances cyclical exposure with structural advantages. From a foundation of $98.46B in trailing revenue, 28.51% profit margin, and 9.46% ROE, the bank has multiple levers to defend returns: expanding digital usage (Erica at over 3B interactions), wealth management product breadth via the Merrill alternatives program, and a new premium co‑brand card to reinforce fee income and customer stickiness. Shares near the 52‑week high reflect improved sentiment, but also set a higher bar for execution as credit and regulation evolve. With a measured dividend framework (2.21% forward yield; 30.50% payout) and substantial liquidity, BAC appears positioned for steady compounding in a soft‑landing or muddle‑through economy. Downside scenarios hinge on credit normalization and policy shocks, where scale and cost control should still offer relative resilience versus smaller lenders.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.