America Movil, S.A.B. de C.V. (NYSE: AMX) continues to demonstrate robust financial performance, with quarterly revenue growth of 13.80% year-over-year. As of August 2025, the company's profit margins stand at 5.56%, reflecting its operational efficiency in a competitive telecommunications market. Recent trends indicate a recovery in share price, reaching around $17.98. Analysts are maintaining a cautiously optimistic outlook, acknowledging the challenges and opportunities that lie ahead for this telecommunications giant. As the company navigates through various market dynamics, its strategies will be critical in maintaining sustained growth.

Key Points as of August 2025

- Revenue: $926.22 billion

- Profit Margin: 5.56%

- Quarterly Revenue Growth: 13.80%

- Share Price: $17.98

- Analyst View: Price target set at $16.78

- Market Cap: Approx. $54.25 billion

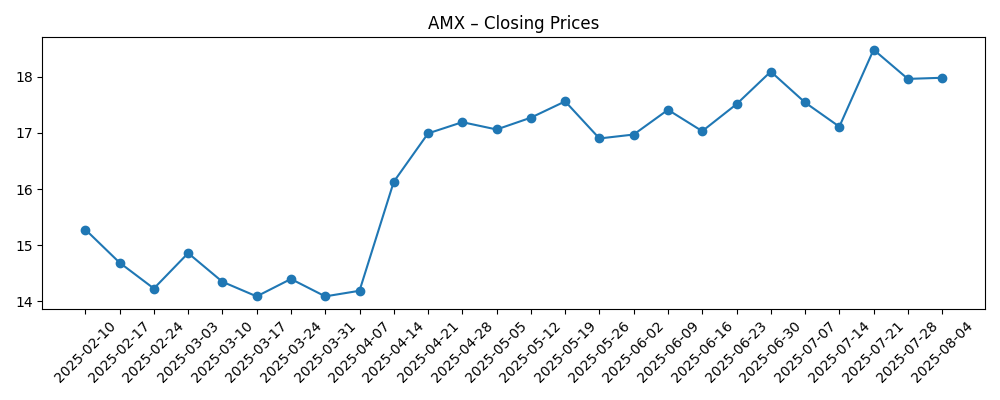

Share price evolution – last 6 months

Notable headlines

- Cerity Partners LLC Purchases 2,941 Shares of America Movil

- Cwm LLC Trims Stock Holdings in America Movil

- Signaturefd LLC Has $142,000 Holdings in America Movil

- Analysts Set Price Target at $16.78

- America Movil Holdings Decreased by Bank of New York Mellon

Opinion

The recent surge in America Movil’s share price reflects positive investor sentiment and market confidence in the company’s growth trajectory. With a solid revenue foundation and a healthy operating margin, America Movil is well-positioned to capitalize on the increasing demand for telecommunications services, particularly in areas where digital transformation is a priority.

However, the company must navigate potential risks, including fluctuating market conditions and competitive pressures from alternative service providers. Sustaining positive revenue growth will depend on how effectively America Movil harnesses new technologies and adapts its service offerings to meet evolving customer needs.

The upcoming quarters will be crucial for America Movil. Existing shareholders and potential investors should closely monitor the company's strategic initiatives and market strategies aimed at enhancing its footprint in the industry. As it stands, the balance between operational efficiency and innovation will likely dictate the company’s future performance.

In conclusion, while America Movil exhibits resilience and strong financial metrics, market dynamics and competitive actions will continue to shape its performance. Strategic shifts may be necessary to address challenges head-on, and the company’s agility in adapting to these changes will be pivotal to maintaining its growth momentum.

What could happen in three years? (horizon August 2025+3)

| Scenario | Outlook | Price Target |

|---|---|---|

| Best | Continued revenue growth and successful market expansion | $25.00 |

| Base | Stable growth with moderate challenges | $20.00 |

| Worse | Increased competition leading to revenue decline | $15.00 |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Competitive landscape changes

- Regulatory developments

- Technological advancements

- Market demand fluctuations

- Operational efficiency improvements

Conclusion

In summary, America Movil's recent performance highlights its resilience and potential for growth in the evolving telecom sector. Robust revenue growth combined with an upward trajectory in share price reflects a favorable investor outlook. However, it remains essential for the company to address the competitive pressures and adapt to market changes effectively. Investors should consider these dynamics while evaluating America Movil's long-term prospects. Strategic initiatives will be key to navigating future challenges and maximizing shareholder value as the company aims for sustainable growth and innovation in its service offerings.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.