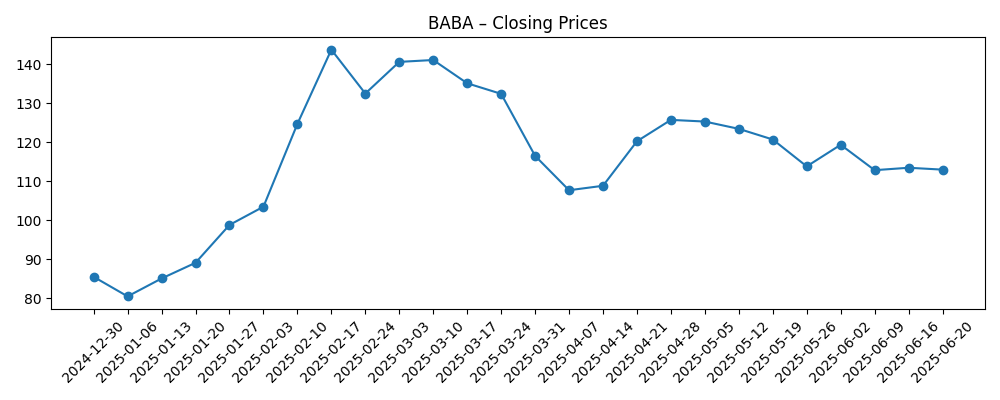

As of June 2025, Alibaba Group Holding Limited (BABA) is at a pivotal point following significant market fluctuations. The stock has experienced volatility amidst growing concerns around US-China trade relations and shifting analyst sentiments. Recent figures indicate that BABA has seen a fluctuation in its share price, ranging from a high of approximately $144 in mid-February to a recent low of around $113. With various factors at play, including competitive pressures and a cautious investment environment, the outlook for Alibaba's stock is under close scrutiny as analysts and investors seek clarity on its future performance.

Key Points as of June 2025

- Revenue: $110 billion

- Profit/Margins: $18 billion, 16.4%

- Sales/Backlog: Strong growth expected in the e-commerce segment

- Share price: Range of $113 – $144 in the last six months

- Analyst view: Mixed sentiments with recent sell-offs

- Market cap: Approximately $300 billion

Share price evolution – last 6 months

Notable headlines

- Loomis Sayles Global Growth Fund Trimmed Alibaba Group Holding Limited (BABA) in Q1. Here’s Why – Yahoo Entertainment

- Analyst Explains Why He Sold Alibaba Group (BABA) – Yahoo Entertainment

- Alibaba (BABA) Down on US-China Trade Caution – Yahoo Entertainment

- China Market Update: Trade Truce Back On – Forbes

Opinion

The fluctuations in Alibaba's stock price reflect broader concerns within the market regarding US-China relations, which have been a significant theme for investors lately. In recent months, the stock saw an upswing that peaked in mid-February but has since retreated. Analysts have pointed out that sentiment has shifted as some key funds have decided to reduce their positions in Alibaba, indicating muted confidence in the immediate term. This trend has raised concerns about the company's growth outlook, especially as it navigates a complex geopolitical landscape that could influence its profitability.

Furthermore, Alibaba's performance in the e-commerce sector remains a critical focus. With increasing competition from both domestic and international players, the company must innovate and adapt to retain its market share. Analysts suggest that while Alibaba has a strong fundamental backing, its price performance will depend significantly on how it manages these challenges and whether it can maintain growth in its core business areas. The development of new strategies that resonate with consumers will be crucial moving forward.

Based on the recent headlines, it's evident that investor sentiment is mixed, reflecting caution around the macroeconomic environment and specific company performance. The reported downgrades and discussions of sales by major funds further highlight the need for Alibaba to clearly communicate its strategic vision moving forward. How the company chooses to respond to these challenges will be a determining factor in its stock's upward trajectory or further decline.

As we look ahead, market watchers will closely monitor Alibaba’s strategic initiatives, particularly in light of trade relations and potential regulatory changes that may arise. The call for clarity on future outlooks becomes ever more important, especially as investors seek stability in an unpredictable market. Investors should watch for signs of recovery and any updates from management on their long-term vision.

What could happen in three years? (horizon June 2025+3)

| Scenario | Outlook |

|---|---|

| Best | Stock price reaches $180 with strong growth in e-commerce and favorable trade agreements. |

| Base | Stock price stabilizes around $140 with steady growth and improved investor sentiment. |

| Worse | Stock price declines to $90 amid ongoing trade tensions and increased competition. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Regulatory changes in China and the US

- Market competition from other e-commerce platforms

- Global economic conditions affecting consumer spending

- Company’s ability to innovate and capture new markets

Conclusion

In conclusion, Alibaba Group Holding Limited faces a challenging yet opportunistic environment as of June 2025. The stock has shown volatility, reflecting investors' concerns about external pressures, particularly US-China relations. While the company has a robust revenue stream, future success hinges on its adaptability to market dynamics and the execution of strategic initiatives aimed at nurturing growth. The outlook remains cautious but allows for potential recovery should the right conditions prevail. Investors should consider these dynamics and keep a close watch on Alibaba’s performance as it navigates the complexities of both domestic and international markets.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.