AIA Group Limited is a leading pan‑Asian life and health insurer headquartered in Hong Kong, offering protection, savings, and accident & health products across multiple Asian markets through agency, bancassurance and partnerships. The company competes with major regional and global life insurers, benefiting from rising insurance penetration, growing middle‑class wealth, and aging demographics. Its balance‑sheet‑driven model is designed to match long‑duration liabilities with diversified investment assets, seeking stable long‑term returns for policyholders and shareholders.

Financially, AIA shows scale and resilience: revenue (ttm) of 25.49B, a 23.76% profit margin, 42.71% operating margin, and 15.10% ROE. The most recent quarter delivered 29.40% year‑over‑year revenue growth, while quarterly earnings fell 23.50% year‑over‑year, highlighting short‑term volatility alongside solid top‑line momentum. Leverage appears manageable with 9.52B in cash versus 19.45B in total debt and a 47.59% debt‑to‑equity ratio; current ratio stands at 3.48. Shares trade on a 14.95x trailing P/E and 12.27x forward P/E, with a 2.50% forward dividend yield and a 36.21% payout ratio. The stock is up 20.70% over 52 weeks within a 48.6–77.5 range.

Key Points as of September 2025

- Revenue: 25.49B (ttm); most recent quarterly revenue up 29.40% year over year.

- Profit/Margins: Profit margin 23.76%; operating margin 42.71%; ROE 15.10% and ROA 2.03% (ttm).

- Cash generation: Operating cash flow 6.63B; levered free cash flow 5.12B supports reinvestment and dividends.

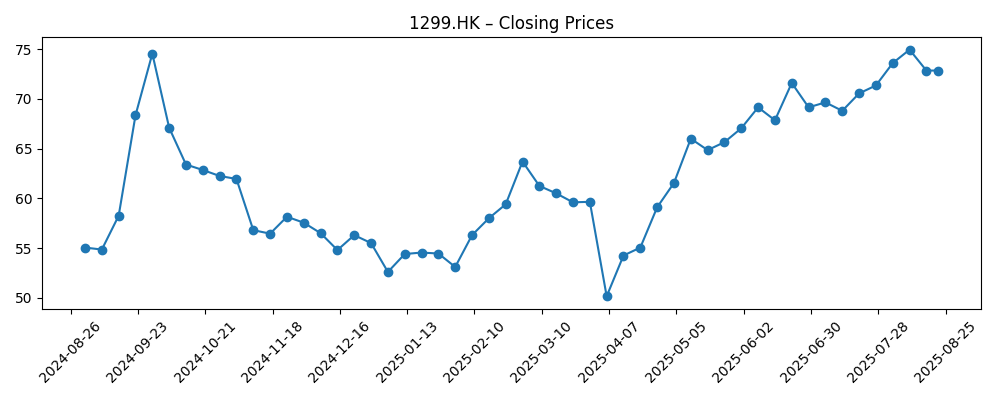

- Share price: HK$70.90 (Sep 23, 2025) vs 50‑day MA 73.004 and 200‑day MA 63.189; 52‑week change +20.70%; beta 0.82; 52‑week range 48.6–77.5.

- Valuation markers (proxy for analyst view): Trailing P/E 14.95; forward P/E 12.27; Price/Book 2.39; EV/Revenue 4.71.

- Market cap and capital structure: Market cap 753.53B; enterprise value 793.69B; total debt 19.45B vs cash 9.52B; current ratio 3.48; debt/equity 47.59%.

- Dividend: Forward annual dividend rate 1.8 (2.50% yield); payout ratio 36.21%; ex‑dividend date 9/5/2025.

- Ownership: Institutional holders 51.41%; insiders 0.07%; float 10.52B shares; shares outstanding 10.47B.

Share price evolution – last 12 months

Notable headlines

- AIA (OTCMKTS:AAGIY) Short Interest Update – ETF Daily News (Sep 5, 2025)

- Short Interest in AIA (OTCMKTS:AAGIY) Rises By 54.1% – ETF Daily News (Sep 15, 2025)

Opinion

AIA’s share price has rebuilt momentum in 2025, recovering from an April weekly close near HK$50.15 to around HK$70.90 by late September, and marking a 20.70% improvement over the past year. The pattern aligns with stabilising risk appetite toward Asian insurers and company‑specific execution that shows up in margins and cash generation. Forward valuation at 12.27x earnings, alongside a 2.50% yield and a 36.21% payout ratio, suggests room for compounding through both earnings and distributions if operating trends hold. The 50‑day average above the 200‑day earlier in the summer underscored the turn; even with recent consolidation below the 50‑day, the longer‑term uptrend remains intact given the 200‑day at 63.189.

The short‑interest headlines on the U.S. OTC line (AAGIY) point to rising hedging or skepticism from a segment of investors, but the absolute signalling power for 1299.HK can be limited. In practice, shorting activity in an ADR can reflect macro overlays—China growth, Hong Kong liquidity, or insurance‑sector beta—rather than issuer‑specific concerns. With AIA’s beta at 0.82 and strong operating margin of 42.71%, fundamental resilience can absorb bouts of sentiment volatility. Still, the news underscores that positioning remains two‑way, and periods around macro data or policy headlines can amplify swings regardless of company‑level progress.

Operationally, the divergence between revenue growth (+29.40% yoy in the most recent quarter) and quarterly earnings growth (‑23.50% yoy) will be central to the three‑year debate. Life insurers can experience timing effects from assumption updates, investment market moves, or new business strain that temporarily weighs on earnings while building future value. AIA’s 23.76% profit margin and 15.10% ROE (ttm) indicate the core engine remains healthy; the question is whether earnings normalise upward as top‑line growth persists. Monitoring expense discipline, product mix (protection vs savings), and investment income sensitivity to rates will help determine whether margin strength is sustainable.

Capital returns round out the case. With 6.63B in operating cash flow and 5.12B in levered free cash flow (ttm), AIA has capacity to fund growth and maintain its dividend. Balance sheet metrics—cash of 9.52B versus 19.45B in debt and a 47.59% debt‑to‑equity ratio—suggest prudent leverage for a life insurer of its scale. Over a three‑year horizon, steady execution could support dividend progression from today’s 2.50% yield and, if earnings recover toward the forward multiple, a valuation re‑rating back toward the upper end of the recent trading range. Conversely, if earnings volatility persists, the stock may track fundamentals with a valuation anchored near current levels.

What could happen in three years? (horizon September 2025+3)

| Scenario | Narrative | Key markers to watch |

|---|---|---|

| Best | Top‑line momentum remains firm, earnings normalise upward as new business strain fades, and investment results are supportive. Valuation expands from the forward multiple, and dividend growth compounds total return. | Consistent double‑digit revenue growth prints; improving earnings cadence; stable or rising margins; policy sales mix skewed to protection; steady dividend increases. |

| Base | Steady growth with periodic volatility. Revenue expands at a measured pace, earnings recover gradually, and valuation stays near historical averages. Dividends rise in line with profit growth. | Revenue growth sustained; earnings variability contained; capital strength maintained; payout ratio broadly stable. |

| Worse | Macro softness and market fluctuations pressure investment income and new business, keeping earnings choppy. Valuation compresses and dividend growth slows, though balance sheet remains sound. | Persistent earnings misses; weaker sales momentum; prolonged risk‑off conditions in Hong Kong/China; cautious dividend actions. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Trajectory of earnings normalisation versus recent quarterly decline (‑23.50% yoy) amid strong revenue growth.

- Interest‑rate and equity‑market conditions affecting investment income and policyholder behaviour.

- Sales mix and distribution productivity across Asian markets, impacting margins and capital strain.

- Capital management: dividend progression (2.50% forward yield; 36.21% payout) and potential buybacks versus growth reinvestment.

- Regulatory or policy changes in core markets that affect solvency assumptions and product economics.

Conclusion

AIA enters the next three years with supportive fundamentals—robust revenue growth, high operating margins, and healthy ROE—balanced against near‑term earnings volatility and shifting investor sentiment. The stock’s recovery in 2025, its sub‑market beta, and a forward P/E of 12.27 collectively suggest investors are paying a reasonable price for quality, especially with a 2.50% forward dividend yield and a moderate 36.21% payout ratio. Cash generation (operating and free cash flow) provides flexibility to fund growth, sustain dividends, and manage through macro cycles. The bear case centres on prolonged earnings choppiness and macro headwinds that limit valuation expansion; the bull case assumes revenue growth translates into steadier profits and incremental capital returns. On balance, the base case is one of steady compounding from current levels, with catalysts tied to earnings stabilisation, margin durability, and consistent distribution policy. Investors should track quarterly earnings cadence against the strong top‑line trend as the clearest signal for re‑rating potential.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.