Siemens enters the next three years with steady fundamentals and a stronger strategic tilt toward electrified mobility and secure, AI-enabled factories. Over the last 12 months, shares rose 30.82% and recently traded near 242.10, close to the 52‑week high of 244.85, outpacing the S&P 500’s 17.90% gain. The company’s trailing revenue stands at 78.3B with operating and net margins of 13.49% and 12.65%, respectively, and operating cash flow of 12.82B. Management continues to balance growth investment with returns, supported by a forward annual dividend of 5.2 (2.16% yield) and a payout ratio of 52.63%. Headline momentum includes Siemens Mobility breaking ground on a train battery factory in Bavaria, new virtualized OT security capabilities, and an AI-led manufacturing partnership with LTTS, all of which could support mix, margins, and recurring revenue through 2026–2028.

Key Points as of October 2025

- Revenue – Trailing twelve-month revenue of 78.3B; quarterly revenue growth (yoy) at 2.50%.

- Profit/Margins – Operating margin 13.49%; profit margin 12.65%; ROE 14.30%; EBITDA 12.42B.

- Sales/Backlog – Backlog not disclosed in the snapshot; growth focus on industrial automation and rail projects, including a train battery factory in Bavaria.

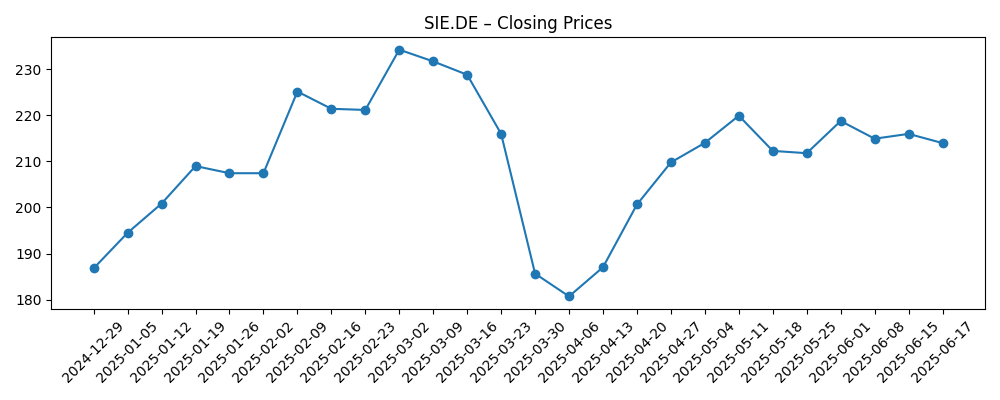

- Share price – Around 242.10 on Oct 6, 2025; 52‑week change 30.82%; 50‑day MA 229.64; 200‑day MA 216.27; 52‑week high/low 244.85/162.38.

- Analyst view – No consensus data provided here; near‑term focus likely on margins, cash conversion (OCF 12.82B), and order intake quality.

- Market cap – Exact figure not provided; float 785.05M; insiders hold 6.37%, institutions 42.51%.

- Dividend – Forward annual dividend 5.2 with 2.16% yield; payout ratio 52.63%; ex‑dividend date 2/14/2025.

- Balance sheet – Total cash 14.64B; total debt 56.69B; current ratio 1.50; debt/equity 85.84%.

Share price evolution – last 12 months

Notable headlines

- Siemens Mobility begins work on train battery factory in Bavaria

- LTTS partners with Siemens to advance AI-led manufacturing solutions

- Siemens simplifies OT security with virtualized, encrypted connectivity

Opinion

The mobility battery-factory build in Bavaria points to Siemens deepening its role in rail electrification and energy storage. For investors, this project suggests a multi‑year order opportunity tied to decarbonization and fleet upgrades, with potential spillovers into power electronics, grid integration, and lifecycle services. While capital intensity and ramp‑up risks are non‑trivial, Siemens’ scale and domain expertise can help smooth execution. If management sequences capacity to match orders, this could support stable utilization and margins. Conversely, delays or policy shifts could push revenue to the right. Over a 12–18 month horizon, progress milestones, pilot deliveries, and customer commitments will likely shape expectations for 2027–2028, when the factory’s contribution to mix and cash generation could become clearer.

The OT security update—a virtualized, encrypted connectivity solution—reinforces Siemens’ positioning at the intersection of industrial automation and cybersecurity. This matters because buyers increasingly require secure-by-design architectures spanning field devices, controls, and cloud. A stronger security portfolio can lift software and services attachment rates, support recurring revenue, and help defend pricing in Digital Industries. It also reduces perceived vendor risk in brownfield upgrades, where secure connectivity is often a gating factor. Execution will hinge on ease of deployment in heterogeneous environments and alignment with regulatory frameworks. If Siemens demonstrates measurable downtime reduction and simplified fleet management, adoption could broaden through 2026–2027, improving customer stickiness and potentially cushioning margins in cyclical slowdowns.

The LTTS partnership around AI‑led manufacturing solutions signals continued ecosystem leverage instead of building every capability in‑house. For Siemens, curated partnerships can accelerate time‑to‑market for digital twins, predictive maintenance, and quality analytics on top of its automation stack. The commercial upside is twofold: higher software/services mix and larger deal sizes that bundle engineering services with Siemens’ platforms. Risks include coordination complexity and ensuring clear value capture for Siemens when partners lead delivery. Watch for reference wins in discrete and process industries and how quickly projects move from pilots to scaled deployments. If attach rates rise and churn remains low, operating leverage could improve even with modest topline growth, complementing the existing 13.49% operating margin profile.

Technically, the stock sits above its 50‑ and 200‑day moving averages (229.64 and 216.27), reflecting constructive momentum after volatility in March–April 2025. With a 2.16% forward yield and 52.63% payout ratio, income remains a supporting pillar alongside cash generation (OCF 12.82B; LFCF 7.06B). Key debates over the next three years include the pace of order intake, execution in rail and digital industries, and balance‑sheet discipline given total debt of 56.69B. Beta at 1.07 suggests near‑market volatility, but macro sensitivity remains meaningful. Absent clear consensus data here, investors may anchor on delivery milestones from the mobility battery project, cybersecurity traction, and AI‑enabled factory wins to justify the stock’s move toward or beyond its 52‑week high of 244.85.

What could happen in three years? (horizon October 2025+3)

| Case | Strategic drivers | Operations/Margins | Capital returns | Share price setup |

|---|---|---|---|---|

| Best | On‑time ramp of the battery factory; strong OT security adoption; AI partnerships scale across verticals. | Stable pricing and high utilization; services and software mix expand; resilient cash conversion. | Dividend growth maintained with disciplined leverage; opportunistic buybacks if conditions allow. | Re‑rates on quality growth and visibility; support near prior highs with room for premium. |

| Base | Selective wins in mobility and digital; steady modernization cycle in Europe/US; cautious China. | Margins broadly in line with recent history; execution variance by project but manageable. | Dividend sustained; balance sheet steady; capital allocation skewed to organic investment. | Range‑bound with moves around delivery milestones and macro data. |

| Worse | Project delays or policy setbacks; slower factory automation spend; cybersecurity sales cycle elongates. | Mix headwinds and under‑absorption; working‑capital friction; lower cash conversion. | Dividend pressure if cash flow weakens; deleveraging takes priority over buybacks. | De‑rates toward prior support levels; volatility rises on missed milestones. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Order intake and execution in rail electrification and automation projects, including the Bavaria battery‑factory ramp.

- Adoption of Siemens’ OT security offerings and broader digital portfolio across brownfield and greenfield sites.

- Macro demand and capex cycles in key regions; timing of policy incentives and infrastructure funding.

- Cash conversion versus investment needs, given total debt of 56.69B and operating cash flow of 12.82B.

- Portfolio moves and partnership outcomes that influence software/services mix and margin durability.

Conclusion

Siemens’ three‑year setup blends steady core performance with new growth vectors in rail electrification, cybersecurity, and AI‑enabled manufacturing. Financially, the company enters this period with 78.3B in trailing revenue, 13.49% operating margin, 12.65% profit margin, and solid cash generation (OCF 12.82B; LFCF 7.06B), supporting a forward dividend of 5.2 at a 2.16% yield. Strategic headlines point to a more software‑and‑services‑rich mix, which can enhance resilience through the cycle if execution remains tight. Shares trade near recent highs, above 50‑ and 200‑day moving averages, leaving the path of least resistance tied to milestone delivery, order quality, and macro steadiness. Over 2026–2028, watch for proof points: progress at the Bavaria battery facility, scaling of OT security deployments, and tangible wins from the LTTS partnership. Clear delivery on these fronts could sustain confidence and support durable shareholder returns.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.