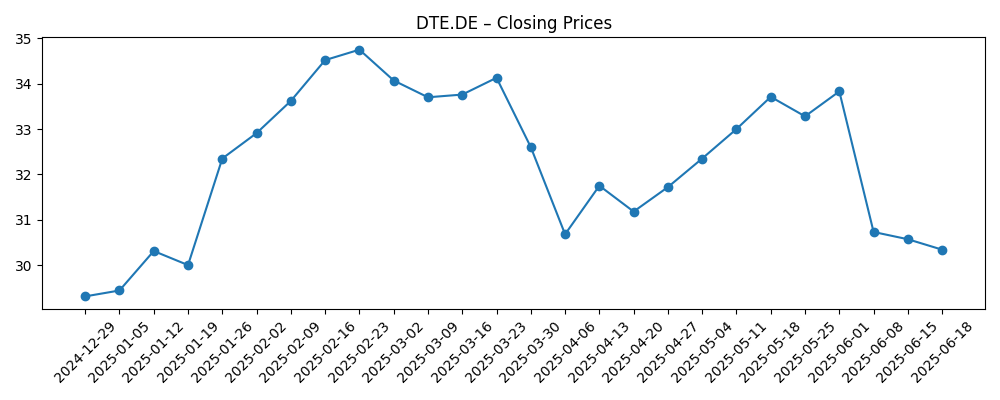

Deutsche Telekom AG (DTE.DE) has experienced significant fluctuations in its stock price in recent months, reflecting a mix of investor sentiment and broader market trends. As of June 2025, the stock has seen a peak price of 34.52 in February before retreating to approximately 30.57. Analysts remain cautiously optimistic about the company's growth potential, especially in the rapidly evolving telecom sector. This report analyzes key financial metrics, recent trends, and possible future scenarios over the next three years, providing insights for investors looking to navigate the telecommunications landscape.

Key Points as of June 2025

- Revenue: $112 billion

- Profit/Margins: $20 billion (17.86% margin)

- Sales/Backlog: Strong demand for mobile and broadband services

- Share Price: $30.57 (as of June 18, 2025)

- Analyst View: Generally optimistic with some caution

- Market Cap: $150 billion

Share price evolution – last 6 months

Notable headlines

- Deutsche Telekom announces expansion of 5G services – Example News

- Quarterly earnings beat estimates amid growing broadband demand – Finance Daily

Opinion

Recent headlines indicate that Deutsche Telekom is focusing on expanding its 5G service offerings, which could significantly enhance its competitive edge in an increasingly digital world. By investing in advanced infrastructure, the company positions itself to capitalize on growing consumer demand for high-speed internet and mobile services. However, the volatility in its stock price suggests investor caution. The retreat from earlier highs may indicate uncertainty regarding future earnings or broader market conditions.

Moreover, Deutsche Telekom's solid quarterly earnings, which exceeded market expectations, show robust operational efficiency and a strong response to shifting consumer behaviors. Continued investment in broadband and mobile services will be key to sustaining this momentum. If these trends continue, analysts believe that the stock may regain its upward trajectory.

However, potential headwinds such as regulatory changes or increased competition in the telecom space could affect future performance. Investors will need to closely monitor these developments, as they may influence Deutsche Telekom's strategic decisions moving forward. Overall, the company’s adaptability and innovation will be crucial in navigating these challenges.

As we project three years ahead, the ability of Deutsche Telekom to leverage its investments in technology and infrastructure will play a significant role in determining its market position and stock performance. A sustained focus on consumer needs and operational improvements could put the company in a favorable position.

What could happen in three years? (horizon June 2028)

| Scenario | Outcome |

|---|---|

| Best | Stock reaches $50, driven by robust 5G expansion and revenue growth. |

| Base | Stock stabilizes around $40 with steady growth and market adaptations. |

| Worse | Stock declines to $25 due to competitive pressures and regulatory challenges. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Market demand for 5G and broadband services

- Regulatory changes affecting telecom industry

- Operational efficiency and cost management

- Investor sentiment and market conditions

Conclusion

In conclusion, Deutsche Telekom AG is at a pivotal point in its business journey as it strives to excel in a competitive environment. The company's recent initiatives, particularly in expanding its 5G service offerings, could provide substantial growth opportunities. However, investors should remain vigilant about external factors that may affect performance over the next three years. The stock's current price fluctuation may be temporary, but a steadfast focus on innovation and customer satisfaction will be essential to navigating the anticipated challenges in the telecom sector.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.