BE Semiconductor Industries (BESI.AS) enters September 2025 with resilient profitability and a stabilizing revenue base. Trailing‑twelve‑month revenue stands near 0.60B alongside a 28.17% profit margin and 29.37% operating margin, while cash (0.49B) and debt (0.54B) are broadly balanced and liquidity is strong (current ratio 5.73). The share price recently closed at 118.15 (Sep 15, 2025), within a 52‑week range of 79.62–152.75 and near its 50‑day and 200‑day moving averages, underscoring an equilibrium after a volatile year. Dividend yield is 1.95% on a payout ratio of 102.35%, placing emphasis on free‑cash‑flow durability through the next leg of the cycle. With quarterly revenue growth at -2.0% year over year and quarterly earnings growth at -23.6%, the three‑year path will hinge on advanced‑packaging demand, customer capex timing, and the company’s ability to defend margins.

Key Points as of September 2025

- Revenue – Trailing‑twelve‑month revenue is ~0.60B; quarterly revenue growth (yoy) is -2.0%.

- Profit/Margins – Profit margin 28.17%; operating margin 29.37%; gross profit ~0.38B; EBITDA ~0.20B; net income ~0.17B.

- Sales/Backlog – Backlog not provided here; quarterly earnings growth (yoy) is -23.6%, indicating cyclical normalization.

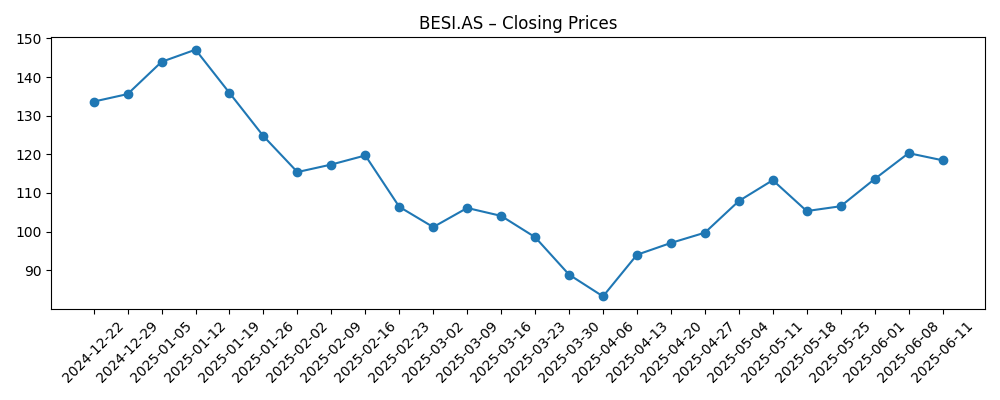

- Share price – Latest close 118.15 (Sep 15, 2025); 52‑week range 79.62–152.75; 50‑day MA 119.17; 200‑day MA 116.34; beta 1.25; 52‑week change 0.54%.

- Cash & Debt – Total cash ~0.49B; total debt ~0.54B; current ratio 5.73.

- Dividend – Forward annual dividend rate 2.18; yield 1.95%; payout ratio 102.35%; ex‑dividend date 4/25/2025.

- Ownership – ~10.84% held by insiders; ~72.33% by institutions; float ~70.32M shares.

- Market cap – Approximately 9.33B based on 78.98M shares and the 118.15 share price on Sep 15, 2025.

Share price evolution – last 12 months

Notable headlines

Opinion

BESI’s investment case over the next three years centers on whether advanced‑packaging intensity continues to rise across AI accelerators, high‑end smartphones, and automotive compute. Despite modest top‑line pressure (quarterly revenue growth at -2.0%), profitability remains robust, with a 28.17% profit margin and 29.37% operating margin. This margin resilience is the strategic buffer that could allow the company to navigate uneven customer capex while sustaining its dividend policy. The recent share price stabilization near key moving averages suggests that investors are reassessing medium‑term earnings power rather than extrapolating the trough. If customer qualification cycles convert to orders and the mix tilts toward higher‑value packaging solutions, BESI could compound operating leverage even without a surge in industry units.

The dividend is a focal point. A 1.95% forward yield paired with a 102.35% payout ratio implies limited headroom if earnings remain subdued, making free‑cash‑flow execution critical. The balance sheet is sound with cash of ~0.49B versus debt of ~0.54B and a high current ratio, offering flexibility to invest through the cycle. However, management will likely prioritize disciplined capital allocation: funding R&D to protect moat, maintaining service/support capacity, and pacing shareholder returns to the cash cycle. In a constructive demand scenario, dividend sustainability should improve naturally; in a slower recovery, prudence on buybacks or payout adjustments would be rational.

Technically, the shares sit between the 50‑day (119.17) and 200‑day (116.34) moving averages after a volatile year that included a 52‑week span of 79.62–152.75. That positioning reflects a market searching for direction rather than capitulation or exuberance. Beta at 1.25 indicates sensitivity to broader semiconductor sentiment, so macro signals on inventory digestion and customer utilization can move the stock quickly. Yet the company’s above‑average margins and liquidity cushion reduce downside risk relative to peers when orders pause. If order momentum improves into calendar 2026, the set‑up for operating leverage could reset the stock’s range higher.

On the strategic front, sustained demand for advanced packaging is the hinge. BESI’s ability to qualify next‑generation platforms with leading customers should determine the slope of recovery more than aggregate wafer‑fab equipment trends. Customer concentration and export‑policy frictions remain watch‑items, but the company’s combination of high margins, strong service capability, and a track record of cash generation (~0.21B operating cash flow; ~0.11B levered free cash flow, both ttm) argues for durability. Over three years, the most plausible path is a gradual revenue rebuild with defended margins, punctuated by periods of volatility around order timing. Patient investors may be rewarded if mix improves and cost discipline persists.

What could happen in three years? (horizon September 2025+3)

| Scenario | Narrative |

|---|---|

| Best case | Advanced‑packaging demand accelerates across AI, mobile, and automotive. Orders broaden and visibility improves. Revenue grows steadily with a favorable mix, supporting high margins and stronger free cash flow. Dividend sustainability improves and optionality for incremental shareholder returns re‑emerges. |

| Base case | Recovery is gradual and uneven as customer capex normalizes. Revenue trends stabilize, margins remain resilient due to mix and cost discipline, and cash generation is adequate to fund R&D and maintain a prudent dividend policy. The share trades around long‑term averages with bursts of momentum around order cycles. |

| Worse case | Prolonged softness in customer programs and policy frictions delay orders. Pricing pressure and adverse mix erode margins. Cash preservation becomes the priority, with tighter capital returns. Shares de‑rate toward the low end of recent ranges until demand visibility improves. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Customer capex timing and order flow for advanced‑packaging tools, particularly linked to AI and high‑end mobile programs.

- Margin mix and pricing power as new platforms ramp versus legacy product cycles.

- Export‑control or geopolitical developments affecting shipment timing and customer qualification.

- Dividend and capital allocation discipline relative to free‑cash‑flow generation.

- Supply‑chain availability and lead times for critical components impacting delivery schedules.

- Sector risk appetite and semiconductor inventory trends, given the stock’s beta profile.

Conclusion

BESI approaches the next three years with clear strengths: high structural margins, solid liquidity, and exposure to secular growth in advanced packaging. The data show a business in transition rather than contraction—revenue near 0.60B (ttm) with strong profitability, but with recent year‑over‑year declines in quarterly revenue and earnings pointing to cyclical normalization. The share price sits near key moving averages and well within a wide 52‑week range, reflecting balanced expectations. The path to upside likely depends on sustained order recovery and favorable mix that preserves margins and reinforces cash generation, enabling a more comfortable dividend profile. Conversely, extended order delays or policy frictions could pressure valuation and test payout resilience. On balance, a patient, cycle‑aware stance appears warranted, with catalysts tied to order wins and product ramps over the next several quarters.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.