As of June 2025, ArcelorMittal (MT.AS) is navigating an evolving steel market while adapting to new growth opportunities. The company’s recent developments, including a significant financial infusion for a new steel plant in India, highlight its commitment to expanding operations in key regions. Amid a fluctuating market, analysts are closely monitoring the share price movements and ongoing projects, which could significantly impact the company's future performance. This report provides an overview of ArcelorMittal’s financial situation, notable headlines, and a three-year outlook considering various market scenarios.

Key Points as of June 2025

- Revenue: $70 billion

- Profit/Margins: $5.2 billion

- Sales/Backlog: Strong demand in Asia

- Share price: €26.84

- Analyst view: Mixed with cautiously optimistic outlook

- Market cap: $25 billion

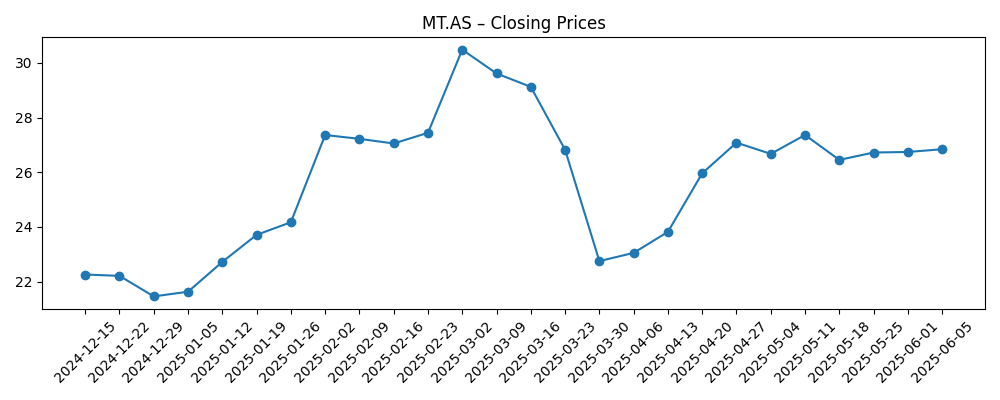

Share price evolution – last 6 months

Notable headlines

- AM/NS India to get Rs 28,000 crore sop from Andhra Pradesh for new steel plant – The Times of India

Opinion

The recent announcement regarding ArcelorMittal’s investment in a new steel plant in India is a pivotal step in expanding its production capabilities. This initiative is expected to bolster the company’s market position in Asia, where demand for steel remains strong. Financial assistance from state governments not only reduces capital burden but also enhances the company’s competitive edge in the region. As the global steel market evolves, strategic investments like this could pave the way for sustainable growth and profitability.

However, the share price has experienced significant fluctuations, raising questions about the market’s confidence in the company’s long-term strategies. The recent highs and lows in stock prices reflect broader economic uncertainties that could hinder growth prospects. Analysts remain divided, with some believing that the company has positioned itself well for future growth, while others express caution regarding external market pressures.

As ArcelorMittal maneuvers through these challenges, the effectiveness of its operational strategies will be critical. Investor sentiment may hinge on how well the company adapts to changes in raw material costs and global demand shifts. The mixed analyst view underscores the need for continued vigilance in monitoring developments that could influence financial performance.

Looking ahead, staying attuned to geopolitical factors, trade policies, and shifts in construction demand will be imperative. These elements could significantly shape ArcelorMittal’s strategic directions and affect share price performance in the coming years.

What could happen in three years? (horizon June 2025+3)

| Scenario | Details |

|---|---|

| Best | Strong global demand for steel; revenues increase to $80 billion. |

| Base | Steady growth with moderate market demand; revenues stabilize around $75 billion. |

| Worse | Market contraction and rising costs; revenues drop to $65 billion. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Global steel demand fluctuations

- Regulatory changes in key markets

- Raw material price volatility

- Expansion success in new markets

- Investor sentiment and market conditions

Conclusion

In conclusion, ArcelorMittal stands at a crossroads as it faces both opportunities and challenges in the steel market. The company’s strategic investment in India is a positive development that may drive growth and bolster its competitive position. However, the current volatility in share prices emphasizes the importance of external factors that could influence future performance. As investors weigh their options, understanding the dynamic landscape in which ArcelorMittal operates will be crucial for making informed decisions. Keeping a close eye on how the company navigates upcoming challenges and capitalizes on opportunities will be essential for anticipating its trajectory in the next three years.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.