Reliance Industries Ltd (RELIANCE.NS) enters the next three years with diversified cash flows across energy, telecom (Jio), and retail/consumer, and a share price consolidating after a volatile year. As of August 2025, the stock trades around ₹1,385.90, within a 52‑week range of ₹1,114.85–₹1,551.00 and a 52‑week change of −8.94%, while its 5‑year beta of 0.22 underlines defensiveness. Operating performance remains resilient: revenue (ttm) ₹9.77T, gross profit ₹3.48T, EBITDA ₹1.71T, profit margin 8.35%, and quarterly revenue growth of 5.10% alongside a 78.30% yoy earnings rebound. Balance‑sheet liquidity is strong with ₹2.25T cash against ₹3.7T total debt; the forward dividend rate is ₹5.5 (0.40% yield), with ex‑dividend on 14 Aug 2025. Near‑term drivers include Jio’s base tariff hike, refining feedstock dynamics, and retail initiatives ahead of the upcoming AGM.

Key Points as of August 2025

- Revenue and growth: TTM revenue ₹9.77T; quarterly revenue growth (yoy) 5.10%.

- Profitability: Gross profit ₹3.48T; EBITDA ₹1.71T; profit margin 8.35%; operating margin 11.93%; EPS 60.24; net income ₹815.04B.

- Balance sheet and dividends: Cash ₹2.25T; total debt ₹3.7T; D/E 36.61%; forward dividend ₹5.5 (0.40% yield); payout 8.30%; ex‑dividend 14 Aug 2025.

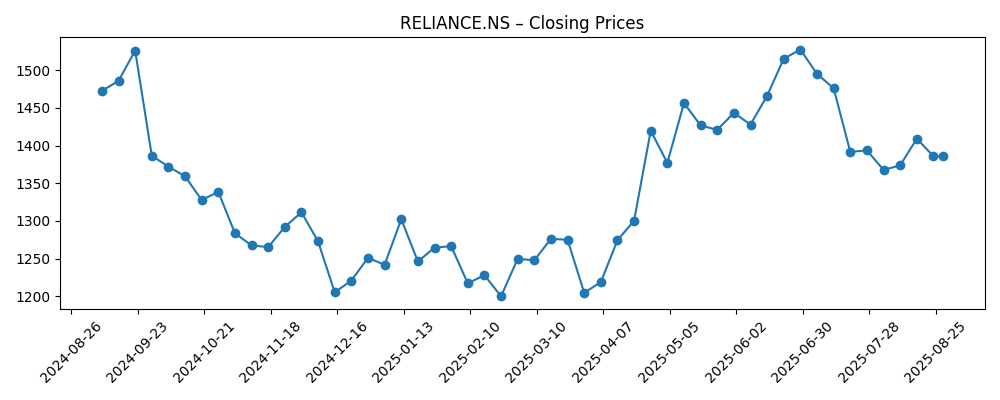

- Share price and liquidity: Recent close ~₹1,385.90; 52‑week range ₹1,114.85–₹1,551.00; 52‑week change −8.94%; 50‑day MA 1,441.63; 200‑day MA 1,329.63; avg 3‑month volume 10.35M.

- Analyst and flow: JP Morgan flagged RIL as attractive; brokerages keep RIL on their trading radar; AGM 2025 in focus.

- Telecom catalyst: Jio base tariff increases prompted a positive share reaction, supporting ARPU and margin uplift potential.

- Refining and macro: Reports of Indian refiners curbing Russian buys could influence feedstock costs and refining margins.

- Market cap and ownership: Implied market cap ~₹18.8T (13.53B shares × ~₹1,385.90); insiders hold 49.66%; institutions 28.59%; float 6.61B; beta 0.22.

Share price evolution – last 12 months

Notable headlines

- RIL stock attractive, JP Morgan points to two main reasons

- Reliance Industries Share Price Gain 2% After Jio Base Tariff Rises

- Stock Market Highlights: Nifty, Sensex Close Higher As RIL Leads

- RIL AGM 2025: Date, Time, What To Expect And Where To Watch Mukesh Ambani's Speech Live

- India Refiners to Curb Russian Buys

- Reliance Consumer Products secures exclusive beverage rights for Hyderabad metro

- Stock Picks Today: Axis Bank, RIL, JSW Infra, NTPC, L&T Tech And More On Brokerages' Radar

- Buy, Sell Or Hold: RIL, NSDL, Titagarh, Godrej Properties, Kalyan Jewellers

Opinion

Jio’s recent base tariff increases are an important near‑term driver. Pricing power in a scale telecom network can support average revenue per user and, over time, operating leverage. For Reliance, that means the digital segment could carry a larger share of incremental earnings, smoothing group volatility relative to the more cyclical energy chain. The equity market’s quick, positive reaction to the tariff news underscores investor appetite for self‑help levers that do not rely on a favorable macro. With a forward dividend in place and a conservative payout ratio, management has room to reinvest in 5G capacity and fiber while sustaining shareholder returns. Over a three‑year horizon, steady tariff discipline—without triggering disruptive price wars—would help improve visibility into cash generation and, by extension, capital allocation across retail, new energy, and upstream digital bets.

The refining complex remains the swing factor. News of Indian refiners curbing Russian purchases could narrow crude discounts and influence product cracks, pressuring refining margins. Reliance’s scale and configuration advantage historically allow it to pivot feedstock slates and target higher‑value exports, which can offset headwinds. Integration with petrochemicals also provides optionality across product cycles. The balance sheet shows ample liquidity (₹2.25T cash) against manageable leverage (total debt ₹3.7T, D/E 36.61%), offering a buffer to maintain capex and absorb margin volatility. If feedstock differentials tighten for longer, investors will watch for throughput optimization, higher petrochem utilization, and tactical hedging. Conversely, any improvement in distillate spreads or easing sanctions bottlenecks could quickly flow through to earnings, reinforcing the conglomerate’s counter‑cyclical profile.

Retail and consumer initiatives continue to broaden the growth base. The exclusive beverage rights for Hyderabad Metro are modest in size but signal deeper distribution and brand‑building in Reliance Consumer Products. Combined with omnichannel reach through JioMart and physical formats, these steps can compound into higher traffic, basket size, and supplier economics. Success here matters strategically: it helps balance the commodity exposure of energy, and it creates cross‑sell opportunities across digital services. Over three years, we expect measured expansion, SKU innovation, and selective partnerships to be more important than headline store counts. Execution discipline—assortment optimization, supply chain resilience, and localized pricing—will likely determine whether consumer and retail maintain their current growth momentum without compressing margins.

From a market perspective, the stock’s 52‑week change of −8.94% and a 5‑year beta of 0.22 depict a low‑volatility, index‑influential name that has nonetheless lagged at times. The tape over the past six months shows a trough near ₹1,200 in March and a rebound towards late June, followed by consolidation around the 200‑day moving average. Catalysts now cluster around the AGM, where investors typically look for clarity on capex pacing, monetization pathways, and any updates on new energy or platform strategies. With a forward dividend yield of 0.40% and a payout ratio of 8.30%, there is room to balance growth and income. Sustained delivery in Jio and stable refining margins could help the shares re‑rate; persistent margin pressure or regulatory surprises could cap that upside.

What could happen in three years? (horizon August 2025+3)

| Scenario | Narrative |

|---|---|

| Best | Telecom pricing holds firm and network usage rises, lifting digital earnings mix. Refining margins remain supportive as feedstock flexibility offsets sourcing constraints. Retail and consumer scale efficiently with improved unit economics. Strong cash generation funds growth and selective buybacks/dividends without raising leverage. |

| Base | Telecom benefits from tariff discipline but faces competitive skirmishes. Refining margins normalize at mid‑cycle levels amid shifting crude flows. Retail expands steadily with disciplined capex. Overall, earnings grow moderately with balance‑sheet strength preserved and capital returns maintained. |

| Worse | Telecom competition intensifies, forcing promotions and delaying monetization. Russian crude availability tightens further, compressing refining spreads. Retail margins soften due to higher input costs and slower demand. Cash flows tighten, limiting optionality and delaying new investments. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Telecom pricing/regulation and the sustainability of Jio tariff increases.

- Refining margins, crude differentials, export policies, and sanctions‑linked supply shifts.

- AGM disclosures on strategy, capex cadence, and potential monetization/partnerships.

- Capital allocation, leverage trends, and dividend policy relative to cash generation.

- Consumer/retail execution, supply chain resilience, and competitive intensity.

- Macro variables: domestic demand, currency, and global energy cycles.

Conclusion

Reliance’s three‑year setup blends self‑help and macro sensitivity. Jio’s tariff action provides a clearer monetization pathway for digital, a segment with structural advantages and scale. The energy chain is the primary swing factor: policy and geopolitics around Russian crude can alter feedstock costs and product spreads, yet Reliance’s complex refining and petrochemical integration offer meaningful flexibility. Retail and consumer add a steady, execution‑driven growth vector that diversifies cash flows. Financially, the company enters this phase with substantial liquidity (₹2.25T cash) and manageable leverage, supporting both reinvestment and shareholder returns (forward yield 0.40%, low payout). The share price has lagged the index but stabilized around long‑term trend levels, leaving room for a sentiment reset if upcoming disclosures—particularly at the AGM—build confidence in earnings durability. On balance, steady telecom monetization and resilient refining outcomes are the key ingredients for a constructive three‑year trajectory.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.