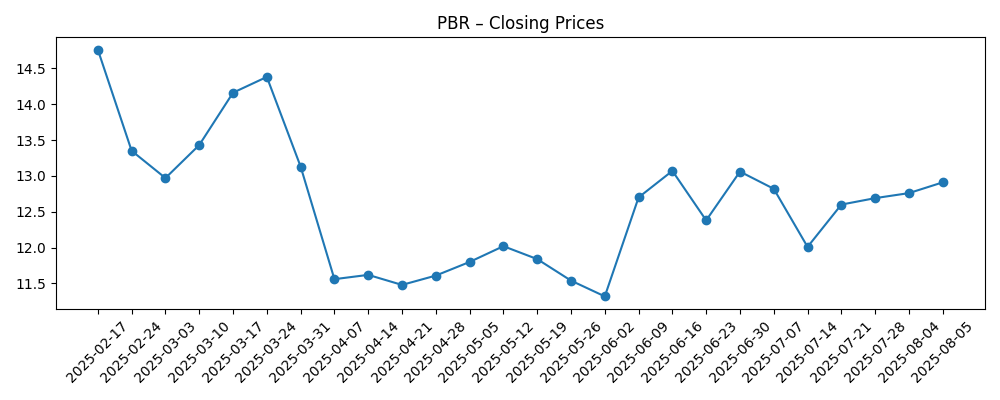

Petroleo Brasileiro S.A. (PBR) is facing a dynamic market landscape, with significant fluctuations in revenue and stock price. As of August 2025, Petrobras reported a trailing twelve-month revenue of $496.25 billion and a profit margin of 9.70%. The company has experienced a notable quarterly earnings growth of 48.60% year-over-year, suggesting a recovery while battling high debt levels. The stock price volatility has been pronounced, with recent trades around $12.90, down from a yearly high of $15.73. Analysts remain cautiously optimistic about Petrobras' strategic direction and operational efficiency amidst ongoing economic challenges.

Key Points as of August 2025

- Revenue: $496.25B

- Profit Margin: 9.70%

- Quarterly Revenue Growth (yoy): 4.60%

- Share price: $12.90

- Analyst view: Cautiously optimistic

- Market cap: $47.80B

Share price evolution – last 6 months

Notable headlines

Opinion

The recent performance of Petrobras, especially its quarterly earnings growth, is indicative of the company's ability to navigate the volatile oil market. This growth, juxtaposed with a profit margin of 9.70%, reflects firm management strategies aimed at operational efficiency. However, the firm continues to grapple with high levels of debt, which could restrict its financial maneuverability moving forward. Investors might be wary about the company's sustainability in the face of fluctuating oil prices and regulatory landscapes in Brazil.

Moreover, the significant drop in share prices from earlier highs poses a challenge for investor confidence. The market seems to be reacting to a combination of global oil price instability and domestic economic pressures. It will be crucial for Petrobras to demonstrate resilience and adaptability to regain investor trust and stabilize its stock performance.

Looking ahead, Petrobras has an opportunity to build investor confidence through strategic partnerships and investments in technology. By focusing on innovation and sustainable practices, the company could potentially offset some of the risks associated with its operational challenges. These strategies will be essential as oil markets continue to evolve and investor expectations shift.

In conclusion, while Petrobras is poised for potential growth driven by promising earnings results, the path ahead is fraught with challenges. A focus on financial health, debt management, and strategic innovation will be pivotal for navigating the complexities in the coming years. Investors should remain vigilant and consider the broader economic indicators when evaluating Petrobras as a long-term investment.

What could happen in three years? (horizon August 2025+3)

| Scenario | Outcome |

|---|---|

| Best | $20 share price, $600B revenue |

| Base | $15 share price, $500B revenue |

| Worse | $10 share price, $450B revenue |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Global oil price fluctuations

- Regulatory changes in Brazil

- Debt management strategies

- Technological advancements and innovation

- Investor sentiment and market trends

Conclusion

In summary, Petrobras' financial performance demonstrates resilience amid a challenging environment marked by high debt levels and fluctuating oil prices. The company's recent earnings growth indicates its potential for recovery, but investors must remain cautious. The share price's current position around $12.90 highlights the ongoing market volatility and investor sentiment. Looking forward, Petrobras has the opportunity to shift its focus towards sustainable practices and technological innovation, which could enhance its market position. As we approach 2026, the company's strategic decisions will significantly influence its share price and overall market presence. Investors should closely monitor Petrobras' strategies in the face of economic uncertainties while considering their long-term investment goals.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.