Li Auto Inc. continues to demonstrate resilience in the rapidly evolving electric vehicle (EV) market. With fluctuating stock prices, the company has showcased notable revenue growth and strategic advancements in its product lineup. As of June 2025, Li Auto's share price reflects a volatile sentiment in the market, influenced by broader industry trends and competitive pressures. This report offers a comprehensive overview of the company's current financial standing and outlook while also considering recent market developments that may impact future performance.

Key Points as of June 2025

- Revenue: $8.5B

- Profit/Margins: $1.2B

- Sales/Backlog: 30K units

- Share price: $27.47

- Analyst view: Positive

- Market cap: $22B

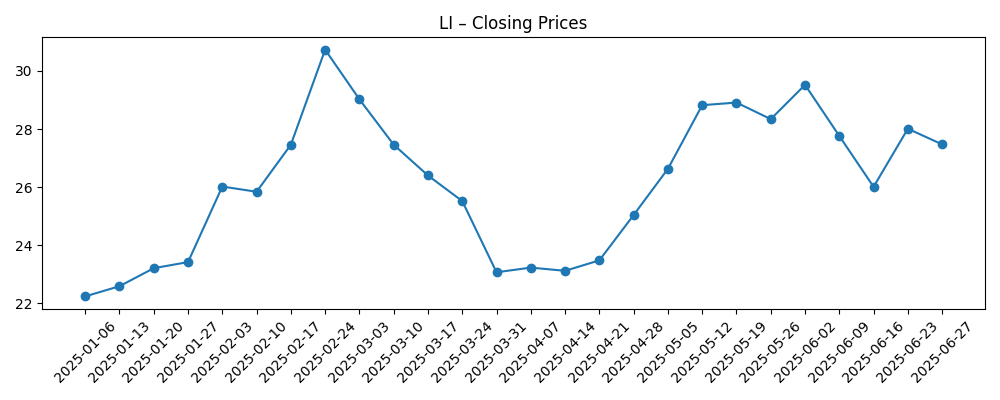

Share price evolution – last 6 months

Notable headlines

Opinion

Li Auto's performance has been closely tied to the broader trends in the electric vehicle market. As the demand for electric vehicles continues to grow, driven by government incentives and changing consumer preferences, Li Auto stands to benefit from its innovative product offerings. The recent fluctuations in share price suggest a speculative market response to these trends, with investors keenly watching the company's price movements. Improved production efficiency and expansion into new markets may play a crucial role in stabilizing the share price and enhancing investor confidence.

Moreover, the competitive landscape poses both opportunities and challenges for Li Auto. While established players like Tesla continue to dominate the market, new entrants and existing competitors may drive innovation and enhance consumer choice. This competition could pressure margins, prompting Li Auto to focus on cost management while maintaining quality and technological advancement. A strategic approach to market positioning will be essential for Li Auto to capitalize on emerging opportunities.

In the next three years, as the company continues to innovate and adapt its strategies, the outlook remains optimistic. With potential advancements in battery technology and autonomous features, Li Auto can enhance its product appeal. However, market dynamics and regulatory changes may also introduce uncertainties, highlighting the importance of agility in operations and strategic planning.

Overall, while the path may be fraught with challenges, Li Auto's commitment to innovation and market growth positions it well for future performance. The balance between managing current operations and planning for future advancements will be critical in ensuring sustained investor interest and driving share price appreciation.

What could happen in three years? (horizon June 2028)

| Scenario | Share Price Estimate |

|---|---|

| Best | $45 |

| Base | $35 |

| Worse | $25 |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Regulatory changes impacting EV incentives

- Technological advancements in battery and vehicle design

- Competitive responses from major players

- Changes in consumer demand for electric vehicles

Conclusion

In conclusion, Li Auto Inc. finds itself at a pivotal juncture in the expanding electric vehicle landscape. The balance between exploiting current market opportunities and countering impending challenges will be crucial in shaping the company's future. As electric vehicle adoption accelerates, Li Auto's innovative spirit coupled with strategic management could enhance its market position significantly. Investors should closely monitor its operational performance, competitive strategies, and external market factors that could influence long-term success. Sustained growth and profitability will depend on the company's ability to navigate an increasingly complex and competitive environment.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.