Intel’s shares have stabilized near $24.08 as of mid-September 2025, up 25.18% over 12 months versus the S&P 500’s 17.09%, but fundamentals remain mixed. Trailing-four-quarter revenue is $53.07B with gross profit of $17.47B, yet net income is negative at -$20.5B and profit margin -38.64% amid heavy investment. Cash of $21.21B offsets part of $50.76B total debt; operating cash flow is $10.08B while levered free cash flow is -$8.32B. Headlines center on reported U.S. government plans to take a 9.9% stake and the rollout of new Xeon 6 processors; analyst stances skew Neutral with price targets clustered at $21–$25. With volatility easing and short interest at 2.46% of float, investors face a classic turnaround setup where policy, execution and capital discipline will likely drive the next three years.

Key Points as of September 2025

- Revenue: $53.07B (ttm); quarterly revenue growth (yoy) at 0.20% signals stabilization off a low base.

- Profit/Margins: Profit margin -38.64%; operating margin (ttm) -3.80%; EBITDA $9.2B; net income -$20.5B; diluted EPS -4.77.

- Sales/Backlog: Management highlights new Xeon 6 processors; demand commentary is cautious and no backlog figures are provided in the latest data.

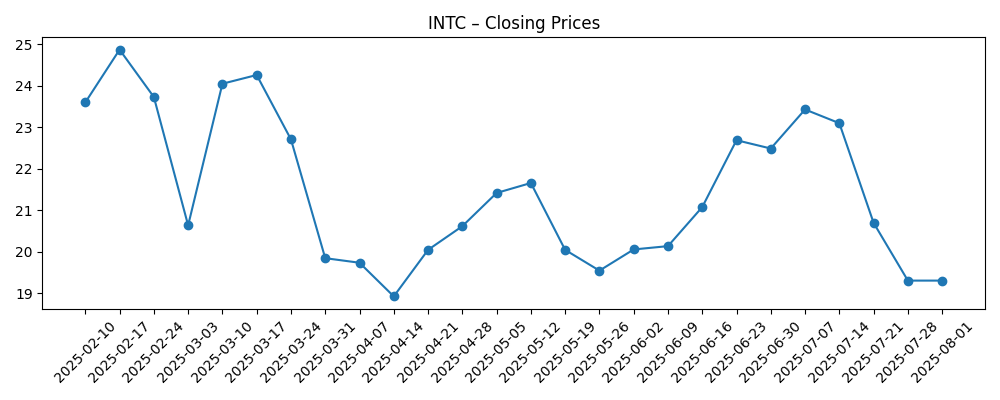

- Share price: Recovered from a six-month trough of $18.93 (April 2025) to ~$24.08; 52-week range 17.67–27.55; 50-day MA 22.83, 200-day MA 21.70; beta 1.23.

- Analyst view: UBS Neutral ($25 PT); Truist cautious ($21 PT); BofA Neutral; KeyBanc Sector Weight; TD Cowen Hold.

- Market cap: Implied ≈$112B (price ~$24.08 × 4.67B shares outstanding).

- Balance sheet: Cash $21.21B vs total debt $50.76B; debt/equity 48.00%; current ratio 1.24.

- Ownership/short interest: Institutions hold 65.25%; short interest 107.67M shares (2.46% of float), down from 120.28M prior month.

- Dividend: Trailing annual dividend $0.12 (0.51% yield); no forward annual dividend rate indicated; payout ratio 208.33% reflects negative earnings.

Share price evolution – last 12 months

Notable headlines

- Intel Corporation (INTC): A Bull Case Theory

- Intel Corporation (INTC) Talks about New Xeon 6 Processors; Bank of American Reaffirms ‘Neutral’ Rating

- Intel (INTC) Stock Holds $21 Target as Truist Stays Cautious

- Intel Corp. (INTC) Falls 7% on Increasing Govt Interference

- KeyBanc Keeps Intel (INTC) at Sector Weight Despite Government Buy-In

- Trump Administration Secures 9.9% Stake in Intel (INTC), Citing Strategic Semiconductor Future

- Intel (INTC) Gets $21 PT as Analysts Weigh Trump Administration Stake Talks

- TD Cowen Reiterates Hold on Intel (INTC) After U.S. Government Stake Deal

- Intel Corporation (INTC): It’s “Better To Take The Government’s Money,” Says Jim Cramer

- UBS Reiterates Neutral on Intel (INTC), Sets $25 Price Target

Opinion

The most consequential development for Intel’s equity story is the reported U.S. government buy-in up to 9.9%. In theory, an anchor shareholder with strategic objectives could de-risk funding for fabs and raise Intel’s priority in federal procurement. In practice, perceived interference has already weighed on sentiment, with shares sliding 7% on one set of headlines about government involvement. The market is asking three questions: what governance rights accompany the stake, how proceeds will be deployed, and whether this capital accelerates time-to-yield for critical nodes. If governance is arm’s-length and funds are earmarked for capacity and packaging where Intel holds advantages, the stake could compress risk premia. If it implies ongoing policy-driven decision making, investors may assign a persistent discount that offsets the financing benefits.

Execution on Xeon 6 is the second pillar. Bank of America’s reaffirmed Neutral rating underlines a wait-and-see stance: the product must convert technical claims into share and margin stabilization. Enterprise and cloud buyers are price- and performance-sensitive; any delay in platform availability, software readiness or memory/IO ecosystems could slow adoption. Conversely, even modest traction in general-purpose and AI-adjacent workloads can help lift factory utilization, improving cost absorption and narrowing operating losses. With quarterly revenue growth barely positive at 0.20% year over year, the near-term hurdle is low, but the bar for a durable re-acceleration is higher. Clear milestones—design wins, top OEM endorsements, and evidence that customers standardize deployments—would likely matter more to the stock than marketing roadmaps.

Valuation and positioning appear tethered to a narrow band of expectations. Multiple firms cluster price targets around $21–$25, echoing price action near the 50- and 200-day moving averages (22.83 and 21.70). Short interest is modest at 2.46% of float and declining, suggesting limited incremental downside pressure from covering flows. Beta at 1.23 implies the stock should move somewhat more than the market on macro swings, but idiosyncratic catalysts will dominate. In the absence of decisive product wins or clarity on the state’s role, Intel could remain range-bound as investors await proof of operating leverage. Any break from that band likely requires either a positive surprise on margins and free cash flow or, on the downside, evidence that policy constraints slow decision-making and capital allocation.

Cash generation vs. investment needs remains the swing factor over a three-year horizon. Operating cash flow of $10.08B is a positive, but levered free cash flow is -$8.32B as Intel builds capacity and pursues foundry ambitions. The balance sheet—$21.21B in cash against $50.76B of total debt—can support transition, yet rising capital intensity leaves little room for execution errors. The trailing annual dividend is a symbolic $0.12 (0.51% yield), and no forward dividend rate is indicated, underscoring a priority on liquidity. If Intel can convert early Xeon 6 traction into higher utilization, improve gross margin mix, and outline a credible path to sustainably positive free cash flow, sentiment could shift from skepticism to optionality. Failing that, neutrality from major brokers may harden into structurally cautious stances.

What could happen in three years? (horizon September 2025+3)

| Scenario | Outcome by September 2028 |

|---|---|

| Best | Government stake terms are transparent and non-intrusive; subsidies and procurement accelerate capacity ramps. Xeon 6 gains meaningful enterprise and cloud traction, lifting utilization and restoring operating leverage. Foundry customers expand, and margins inflect to sustainably positive with clearer free-cash-flow visibility. Sentiment improves as analysts move from Neutral to constructive. |

| Base | The buy-in is largely symbolic beyond funding, with limited governance entanglements. Product execution is steady but mixed; data center and PC demand stabilize. Revenue growth is modest, profitability improves gradually, and valuation tracks broader semiconductor peers without a major re-rating. |

| Worse | Governance constraints slow decision speed; product ramps slip. Cost overruns and weak utilization keep free cash flow negative. Analysts lean cautious, and the shares revisit prior lows as investors discount prolonged policy risk and execution uncertainty. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Structure and conditions of the U.S. government’s reported 9.9% stake, including governance rights and use of proceeds.

- Execution and customer adoption of Xeon 6 platforms across enterprise and cloud workloads.

- Free cash flow trajectory as capex, operating efficiency and factory utilization evolve.

- Competitive intensity in CPUs and AI-adjacent silicon, and pricing discipline across end markets.

- Macro demand in PCs and data centers, impacting shipment mix and gross margin.

- Balance sheet flexibility given $50.76B total debt vs $21.21B cash and access to external funding.

Conclusion

Intel enters the next three years with a binary setup: if policy-backed funding and product execution align, the company can convert today’s negative profitability into operating leverage; if they clash, the policy premium may morph into a discount. The tape reflects this tension—shares near $24 sit between a 52-week 17.67–27.55 range while consensus leans Neutral with targets around $21–$25. Trailing revenue of $53.07B and gross profit of $17.47B show ongoing scale, but losses (-$20.5B net income) and negative levered free cash flow (-$8.32B) underscore the transition risk. The balance sheet (cash $21.21B; debt $50.76B) provides time, not immunity, to deliver on Xeon 6 and capacity ramp milestones. Clarity on the government’s role, visible customer wins, and a glide path to positive free cash flow are the catalysts most likely to reset expectations—up or down.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.