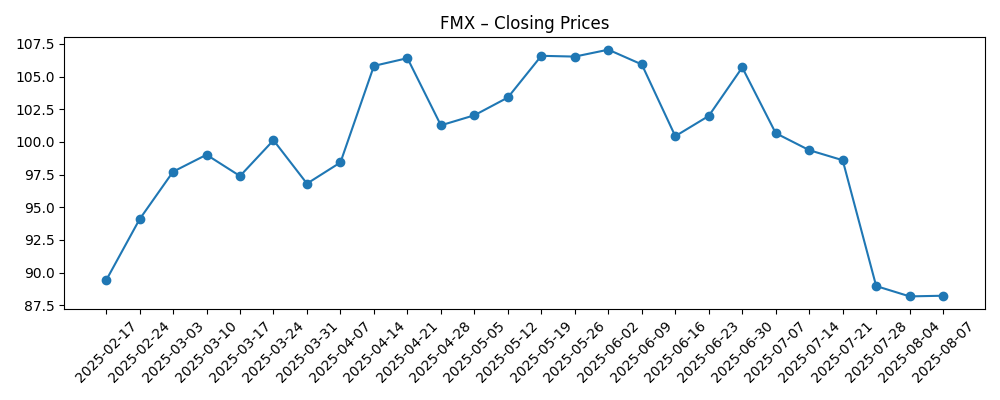

Fomento Economico Mexicano S.A. (FMX) recently reported its second quarter 2025 results, revealing significant challenges reflected in its earnings growth and share price fluctuations. With a current profit margin of 2.43% and a yearly revenue of $812.89 billion, FMX is showing signs of resilience despite facing a considerable quarterly earnings decline of 78.5%. The company’s share price has seen volatility, currently sitting at approximately $88.23, down from a 52-week high of $114.33. As FMX looks ahead to 2028, investors are keenly observing its strategies to boost margins and revenue growth while managing debt levels and market positioning effectively.

Key Points as of August 2025

- Revenue: $812.89B

- Profit Margin: 2.43%

- Quarterly Revenue Growth (YoY): 6.30%

- Share Price: $88.23

- Analyst View: Cautiously optimistic

- Market Cap: About $153.45B

Share price evolution – last 6 months

Notable headlines

- FEMSA Announces Second Quarter 2025 Results

- FEMSA Schedules Conference Call to Discuss Second Quarter Financial Results

- Fomento Economico Mexicano (FMX) Projected to Post Quarterly Earnings on Monday

- Envestnet Asset Management Inc. Trims Stock Position in Fomento Economico Mexicano S.A.B. de C.V. (NYSE:FMX)

- Choreo LLC Purchases 509 Shares of Fomento Economico Mexicano S.A.B. de C.V. (NYSE:FMX)

Opinion

The recent earnings report for Fomento Economico Mexicano S.A. has stirred various reactions among analysts and investors alike. Despite the substantial year-over-year decline in earnings, the company's overall revenue growth trajectory and market positioning in the beverage and retail sector suggest a potential for recovery. FMX's ability to adapt to market changes and consumer preferences will be crucial in the upcoming years. Additionally, its strategic initiatives to enhance operational efficiency could potentially mitigate the impacts of its current profit margins.

As FMX's share price fluctuates, closely monitoring its performance relative to broader economic indicators, such as consumer spending and inflation trends, will be vital. Many analysts believe that enhancing product offerings and expanding market share could drive improved profitability. The next quarter will be a critical period for FMX as it aims to regain investor confidence through transparent communication and strategic decisions.

Looking forward, FMX faces the ongoing challenge of managing its debt levels while seeking growth in an evolving market landscape. The company’s current total debt stands at approximately $265.48 billion, which raises concerns regarding credit ratings and future borrowing costs. Balancing capital expenditures with shareholder returns, particularly amid substantial payout ratios, will be essential in preserving long-term shareholder value.

In conclusion, Fomento Economico Mexicano S.A. is at a crossroads as it approaches the end of 2025. The company must execute effectively on its strategic initiatives to counteract poor quarterly earnings and stabilize its share price. With a proactive approach to managing debt and a focus on innovation, FMX could position itself for a more favorable outcome by 2028.

What could happen in three years? (horizon August 2028)

| Scenario | Outlook |

|---|---|

| Best | Share price reaches $130, with improved margins and debt reduced significantly. |

| Base | Share price stabilizes around $100, maintaining current revenue growth and steady margins. |

| Worse | Share price declines to $75, impacted by further earnings pressure and market competition. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Performance of quarterly earnings and revenue growth

- Market dynamics and consumer trends

- Debt level management and financial stability

- Strategic initiatives and operational efficiency

- Regulatory impacts on the beverage and retail industry

Conclusion

Fomento Economico Mexicano S.A. is facing a critical juncture as it navigates fluctuating market conditions. While the quarterly earnings report highlighted some troubling trends, the company's capacity for revenue growth and strategic commitment to operational efficiency present potential avenues for recovery. Investors will need to scrutinize FMX's future actions closely to gauge its ability to enhance profitability and ultimately drive share price appreciation. As FMX embarks on the second half of 2025, focus will be on debt management, ongoing operational improvements, and adaptability to shifting market demands. In doing so, FMX has the potential to turn around its fortunes in the coming years, positioning itself for a robust future.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.