As Alphabet Inc. (GOOGL) continues to navigate a rapidly evolving tech landscape, the company is strategically positioning itself to leverage artificial intelligence and cloud services to drive future growth. With a robust fiscal performance in 2024, highlighted by a revenue of $359.71 billion and a significant profit margin of 30.86%, Alphabet is well-equipped to tackle competitive pressures. Recent partnerships and technological innovations, such as its collaboration with Volvo for Android Automotive, signal a transformative phase aimed at enhancing its market share and investor confidence. This article explores the company's financial health, key market events, and projections for the next three years.

Key Points as of June 2025

- Revenue: $359.71B

- Profit Margin: 30.86%

- Quarterly Revenue Growth (YoY): 12.00%

- Share Price: $174.67

- Analyst View: Generally positive outlook due to AI advancements

- Market Cap: Approximately $1.015T

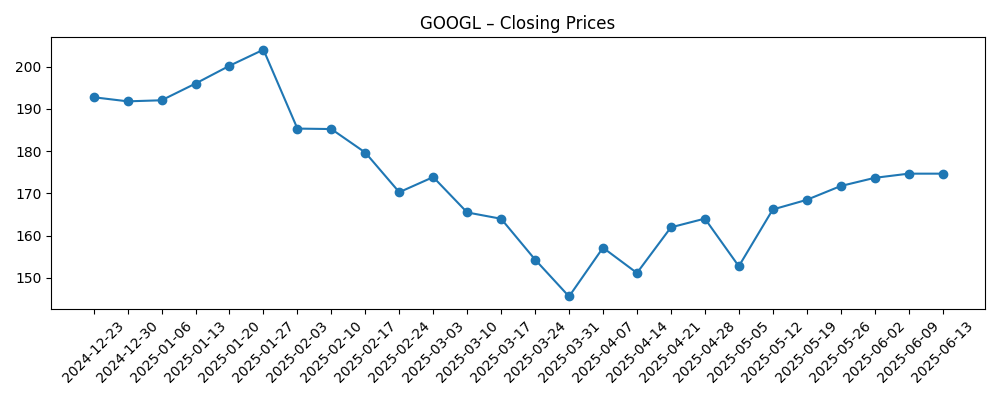

Share price evolution – last 6 months

Notable headlines

- Why Google could help Alphabet win the AI race – Yahoo Entertainment

- Alphabet (GOOGL) Lands Surprise Win as OpenAI Picks Google Cloud for AI Expansion – Yahoo Entertainment

- Alphabet Shares Cross Above 200 DMA – Forbes

- Alphabet Inc. (GOOGL) Taps Volvo as Lead Partner for Android Automotive – Yahoo Entertainment

- Alphabet Inc. (GOOGL): Jim Cramer Reveals Big AI Feature That “Saved” The Company – Yahoo Entertainment

Opinion

As Alphabet continues to harness the potential of artificial intelligence, the recent headlines indicate a renewed investor interest alongside an upward trend in stock performance. The collaboration with OpenAI to bolster Google Cloud services positions Alphabet as a key player in the burgeoning AI market. This strategic move not only secures contracts that could significantly increase revenues but also enhances the company's technological prowess, potentially outperforming competitors.

The marked increase in share price, with recent crossings above key moving averages, suggests a positive sentiment among investors. Analysts are optimistic about Alphabet's ability to leverage its core strengths in search and advertising while integrating AI solutions that cater to evolving consumer demands. The company’s focus on cloud services further enhances its revenue diversification, insulating it against fluctuations in traditional ad revenues.

However, Alphabet must remain vigilant of regulatory pressures and competitive threats that challenge its market position. The ongoing antitrust investigations could hinder growth prospects if not managed effectively. Yet, if Alphabet successfully navigates these waters, the stock could see considerable appreciation reflecting its strategic initiatives and growth potential.

In conclusion, while the outlook remains promising, investors should remain cautious given the inherent risks in tech investments. As the AI landscape matures, Alphabet's proactive strategies will be crucial in determining its long-term trajectory and shareholder value.

What could happen in three years? (horizon June 2025+3)

| Scenario | Projected Share Price |

|---|---|

| Best | $250 |

| Base | $200 |

| Worst | $150 |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Innovation in AI and cloud service offerings

- Regulatory developments impacting operations

- Market competition in digital advertising

- Global economic conditions affecting consumer spend

Conclusion

In conclusion, Alphabet Inc. (GOOGL) is at a pivotal juncture as it aligns its strategy towards artificial intelligence and cloud computing. With impressive revenue figures and positive growth indicators, the company is well-positioned to capitalize on emerging trends. The recent headlines demonstrate Alphabet's commitment to innovation and strategic partnerships, which could enhance its competitive edge. However, the potential impact of regulatory scrutiny remains a challenge that could affect performance in the medium term. As such, investors should closely monitor these developments while considering the associated risks and opportunities. Overall, the outlook for Alphabet appears bolstered by its strategic focus, making it a pivotal player in the tech industry moving forward.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.