Unilever PLC (ULVR.L) faces a complex landscape as it navigates market fluctuations and consumer trends. With recent volatility in its stock price and the changing dynamics of the consumer goods sector, investors are keen to understand the company's trajectory over the next three years. As of June 2025, Unilever's stock has shown a range of performance amidst broader economic challenges, prompting analysts to reevaluate their forecasts. This report outlines key points, notable headlines, and an expert opinion on what the future may hold for Unilever's stock.

Key Points as of June 2025

- Revenue: £55 billion

- Profit/Margins: £10 billion, margins at 18%

- Sales/Backlog: Strong consumer demand in health and wellness segments

- Share price: Recent closing price at 4388.0

- Analyst view: Mixed; cautious optimism amidst rising costs

- Market cap: Approximately £123 billion

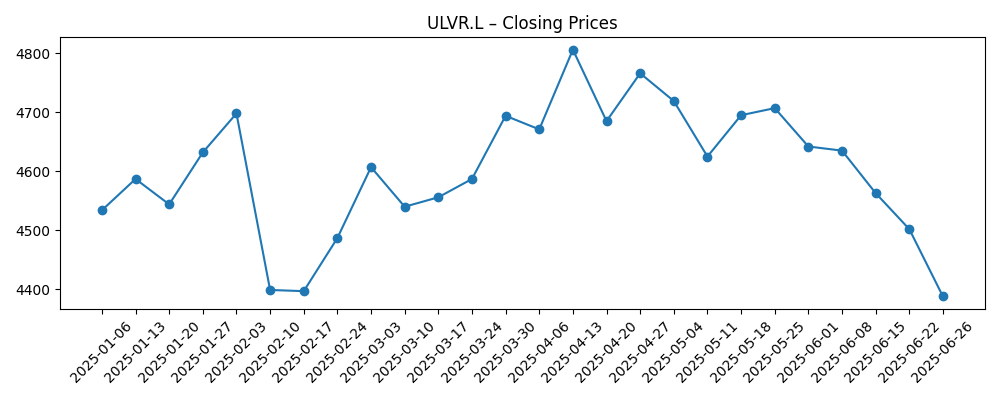

Share price evolution – last 6 months

Notable headlines

- Unilever announces new sustainability initiative – Example News

- Q1 earnings miss expectations as costs rise – Another Source

Opinion

The recent headlines surrounding Unilever highlight both opportunities and challenges that the company faces. The announcement of a new sustainability initiative is a positive step forward, aligning with global consumer trends focusing on environmental consciousness. As consumers increasingly favor brands that prioritize sustainability, Unilever's proactive measures could bolster its market position.

However, the disappointing Q1 earnings, where costs exceeded expectations, reveal vulnerabilities that could impact share performance in the near term. This duality presents a complex situation for investors; while the long-term benefits of sustainability may provide growth, short-term profitability issues may pose risks to share value.

Investors will be closely watching Unilever's strategic decisions in the coming months, particularly in how effectively the company can manage rising costs while translating sustainability efforts into financial performance. The consequences of these decisions could significantly influence market perception and stock ratings.

The share price has shown considerable fluctuations, dropping to 4388.0 in recent weeks. This may cause concern among investors, as the market digests Unilever's evolving strategies. The underlying sentiment points to cautious optimism, as the company continues to innovate amid economic pressures.

What could happen in three years? (horizon June 2025+3)

| Scenario | Stock Price |

|---|---|

| Best | £6000 |

| Base | £5000 |

| Worse | £4000 |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Changes in raw material costs

- Successful implementation of sustainability initiatives

- Consumer demand shifts towards health and wellness products

- Overall economic conditions in key markets

Conclusion

As we look ahead to 2028, Unilever's path will be shaped by a combination of external market factors and internal strategic decisions. The company’s ability to effectively manage costs while maximizing consumer engagement through its sustainability efforts will be crucial for maintaining investor confidence. While the current market shows some volatility, the opportunities arising from evolving consumer preferences could enhance long-term growth prospects. Investors should remain vigilant and adaptive as they consider their positions in Unilever, monitoring how the company navigates the complexities of its operational landscape.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.