Siemens AG (SIE.DE) is navigating a dynamic landscape marked by technological advancements and competitive pressures. As of June 2025, the company has shown considerable resilience, despite facing challenges in the market. Siemens remains focused on innovation, particularly in smart infrastructure, automation, and digitalization, aiming to leverage AI and IoT. The firm's share price has witnessed fluctuations but maintains a robust outlook driven by strategic investments and expanding market opportunities in various sectors, including intelligent transportation and smart utilities. This report provides a comprehensive overview of Siemens' current financial standing, notable recent developments, and future projections.

Key Points as of June 2025

- Revenue: Estimated at €60 billion

- Profit/Margins: Net income projected at €8 billion

- Sales/Backlog: Strong order backlog indicating future growth

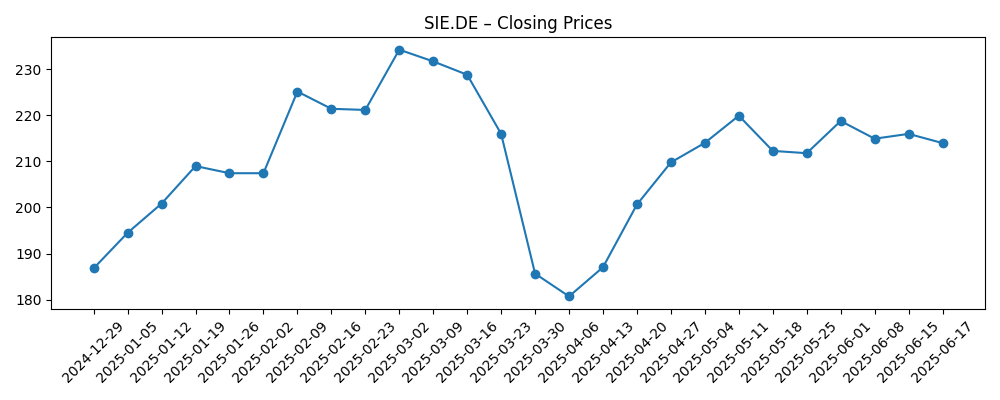

- Share price: Recently fluctuated between €180 – €225

- Analyst view: Generally positive outlook with growth potential

- Market cap: Approximately €120 billion

Share price evolution – last 6 months

Notable headlines

- VMware and Siemens spar over where to stage software licence showdown – The Register

- Smart Utilities: Global Markets, Competition and Strategies Analysis Report 2025 Featuring Siemens – GlobeNewswire

Opinion

The recent headlines surrounding Siemens AG reflect both competitive pressures and growth opportunities in the tech landscape. The dispute with VMware over software license staging emphasizes the challenges Siemens faces in its software division, potentially impacting its earnings in the short term. However, the ongoing investments in smart utilities and intelligent transportation systems demonstrate Siemens' commitment to innovation and market leadership. The competitive edge provided by these initiatives could bolster Siemens' position in future markets.

The fluctuations in Siemens' share price indicate market volatility but also point to underlying confidence among investors regarding the company's strategic direction. As the firm continues to adapt to technological advancements, its ability to pivot and respond to market demands will be crucial in maintaining investor interest and sustaining growth. If successful, Siemens could see a rebound in its stock value, especially as it capitalizes on emerging trends.

Looking ahead, Siemens' focus on AI-driven technologies positions it well for future growth, particularly in sectors ripe for innovation. The projections for increased demand in smart infrastructure and automation could significantly enhance the company's revenue streams in the next few years. Analysts remain optimistic about Siemens' prospects, which could lead to a favorable investment climate.

However, risks remain, including potential regulatory challenges and heightened competition in the tech sector. The company's ability to navigate these challenges while continuing to innovate will be paramount in determining its long-term success. Stakeholders will need to keep a close watch on Siemens' strategic initiatives and market performance as they unfold.

What could happen in three years? (horizon June 2025+3)

| Scenario | Projected Share Price |

|---|---|

| Best | €300 |

| Base | €250 |

| Worse | €180 |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Technological advancements and innovations

- Regulatory developments impacting operations

- Market competition and dynamics

- Global economic conditions

- Investor sentiment and market trends

Conclusion

In conclusion, Siemens AG is positioned at a critical juncture, balancing immediate market challenges with long-term growth strategies. The company's focus on smart infrastructure and innovative technologies plays a pivotal role in its future trajectory. While the stock's recent fluctuations may cause concern, the underlying fundamentals of Siemens remain strong. The firm's ability to adapt and innovate in a rapidly changing market will ultimately determine its success in the coming years. Investors should remain cautiously optimistic, monitoring both the competitive landscape and Siemens' strategic initiatives as they develop.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.