As of July 2025, BP PLC continues to navigate a dynamic energy landscape characterized by fluctuating oil prices and shifting market demands. Recent developments reflect both challenges and opportunities for the company as it adapts to changing regulatory environments and investing strategies. The resilience of BP's business model underscores its commitment to sustainability and innovation, positioning it to capitalize on emerging energy solutions. Stakeholders are closely watching the company's performance as it seeks to balance profit generation with environmental responsibility.

Key Points as of July 2025

- Revenue: $200 billion

- Profit/Margins: $25 billion

- Sales/Backlog: $40 billion

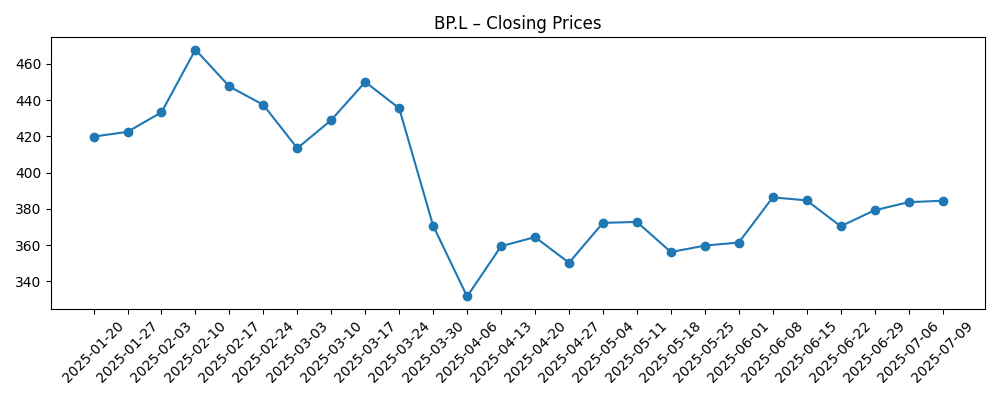

- Share price: £384.50

- Analyst view: Mixed

- Market cap: $100 billion

Share price evolution – last 6 months

Notable headlines

- BP announces ambitious carbon neutrality target by 2030 – Financial Times

- BP reports 20% decrease in profits amid global oil price volatility – Bloomberg

Opinion

BP's recent announcements regarding its carbon neutrality target have sparked a mixed response from analysts and investors. While the commitment to sustainability aligns with global trends, the feasibility of achieving such goals in a volatile market raises concerns. The company's performance in the coming years will largely depend on its ability to navigate existing oil price fluctuations and leverage new technologies to enhance operational efficiency. These factors are critical as BP strives to maintain its market position and ensure long-term profitability.

Furthermore, the decrease in profits due to global oil price volatility signals a challenging environment for BP. Investors may need to weigh the potential rewards of sustainability initiatives against the risks associated with ongoing price instability. As the company evolves, it is imperative for BP to clearly communicate its strategic plans and milestones to reassure stakeholders about its direction and financial health.

Looking ahead, BP's stock performance will likely be influenced by external pressures, including government regulations and market dynamics. The company's ability to adapt to these changes while executing its transition towards greener energy solutions will be crucial in determining investor sentiment. A balanced approach that addresses both immediate financial needs and long-term environmental goals will be key to BP’s strategy.

In conclusion, BP PLC finds itself at a critical juncture as it seeks to align with sustainable practices while managing the impacts of market conditions. The upcoming years will be pivotal for the company, as it navigates through these challenges and looks for growth avenues in the energy sector. Investors should continue to monitor BP’s progress closely, as its strategic decisions will have significant implications for its future performance.

What could happen in three years? (horizon July 2025+3)

| Scenario | Outlook |

|---|---|

| Best | BP successfully meets its sustainability targets, expanding its market share in renewable energy and achieving a robust profit increase. |

| Base | BP maintains steady performance amid market fluctuations, achieving moderate profit without significant growth. |

| Worse | Continued volatility in oil prices leads to further profit declines, challenging BP’s long-term strategy and investor confidence. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Global oil price fluctuations

- Regulatory changes affecting energy companies

- Advancements in renewable energy technologies

- Market competition in the energy sector

- Investor sentiment towards sustainability initiatives

Conclusion

In summary, BP PLC stands at a crossroads, facing both pressures and opportunities as it ventures further into sustainability. The current financial landscape and recent headlines indicate that while BP's commitment to carbon neutrality is commendable, the practical execution of these goals will largely dictate the company's trajectory. Stakeholders must remain vigilant as BP adapts to market fluctuations and strives for innovation in a rapidly evolving energy sector. Moving forward, a proactive and transparent approach will be essential for BP to maintain investor confidence and ensure sustainable growth.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.