As of June 2025, Airbus SE finds itself in a dynamic position within the aviation industry, influenced by recent fleet expansions and growing demand for aircraft. The company's performance will be shaped by its ability to address competitive pressures while capitalizing on orders from airlines looking to modernize their fleets. This report examines key financial metrics, notable headlines, and offers a three-year outlook on Airbus SE's prospects.

Key Points as of June 2025

- Revenue: $69.94B

- Profit Margin: 6.33%

- Quarterly Revenue Growth (yoy): 5.50%

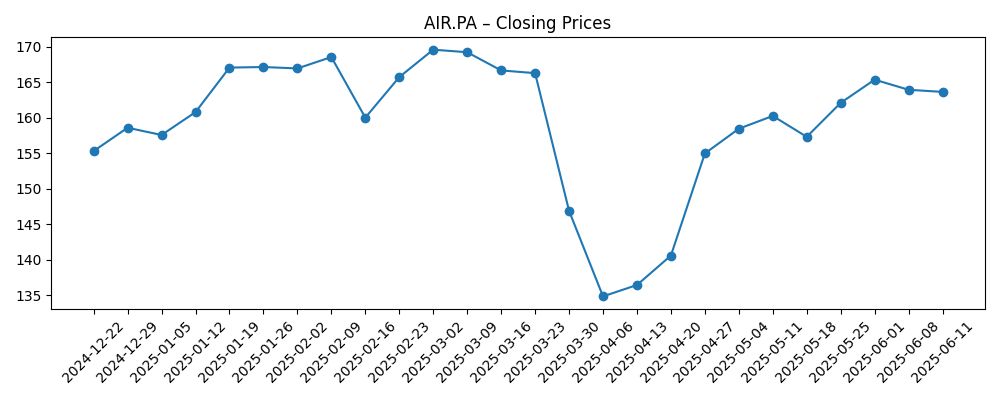

- Share price: 163.62

- Analyst view: Hold, as rated by Citigroup

- Market cap: Estimated at $129.22B

Share price evolution – last 6 months

Notable headlines

- Chinese airlines considering ordering hundreds of Airbus jets – CNA

- Vietjet doubles order for Airbus A330neo to 40 – Biztoc.com

- Airbus (OTCMKTS:EADSY) Rating Lowered to Hold at Citigroup – ETF Daily News

Opinion

The recent headlines reflect a growing optimism surrounding Airbus, particularly with the potential orders from Chinese airlines, which could significantly bolster revenues in the coming years. The company's ability to ramp up production in response to this demand will be vital for sustaining growth. However, uncertainties in global travel recovery and geopolitical tensions could pose challenges.

Despite these challenges, the raising demand highlighted by Vietjet's doubled order is a strong indicator of Airbus's competitive edge in the market. Maintaining high production rates will likely enhance Airbus's reputation as a reliable aircraft supplier, potentially leading to more lucrative contracts. Analysts' cautious outlook, reflected in the recent downgrade to hold, suggests a wait-and-see approach amid fluctuating demand in the aviation sector.

The share price's recovery from lower levels earlier in the year indicates investor confidence, but volatility remains prevalent. The market's reaction to upcoming earnings reports and order announcements will be critical in shaping investor sentiment going forward, especially in a sector that is sensitive to macroeconomic conditions.

Overall, while Airbus SE faces headwinds, the strategic partnerships and potential new orders indicate a path forward that could bolster its market positioning. The next three years will be telling as Airbus navigates these opportunities against the backdrop of a recovering airline industry.

What could happen in three years? (horizon June 2025+3)

| Scenario | Outlook |

|---|---|

| Best | Revenue reaches $90B with expanded global market share. |

| Base | Revenue stabilizes around $80B as demand grows steadily. |

| Worse | Revenue declines to $70B if market challenges persist. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Global airline demand recovery

- Production capacity and efficiency

- Geopolitical stability

- Market competition and contract wins

Conclusion

In conclusion, Airbus SE stands at a crossroads of opportunity and challenge as it looks toward the next few years. The demand for new aircraft continues to rise, driven by airlines eager to modernize their fleets and adapt to changing travel patterns. However, Airbus must remain vigilant in managing production and responding to market dynamics. The recent headlines highlight both the positive developments and the cautious sentiment among analysts, suggesting that while there is potential for growth, strategic execution will be key to realizing it. Companies in the aviation sector must remain agile to capture opportunities and mitigate risks as they arise in this rapidly evolving landscape.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.