As of June 2025, MediaTek Inc. continues to navigate a challenging market landscape. Despite favorable trends in the multicore and application processor sectors, the company's share price has faced significant pressure, declining to a recent low of 1250.0. Analysts remain cautiously optimistic, projecting a possible recovery aligned with industry growth. With the multicore processors market expected to reach USD 267.25 billion by 2032, MediaTek's strategic positioning becomes increasingly critical. This report provides an outlook on MediaTek's financial performance and market dynamics.

Key Points as of June 2025

- Revenue: Estimated to remain stable amidst market growth

- Profit/Margins: Margins under pressure from competition

- Sales/Backlog: Steady sales but with concerns on backlog growth

- Share price: Recent low at 1250.0

- Analyst view: Cautious optimism for recovery

- Market cap: Strong position in a growing sector

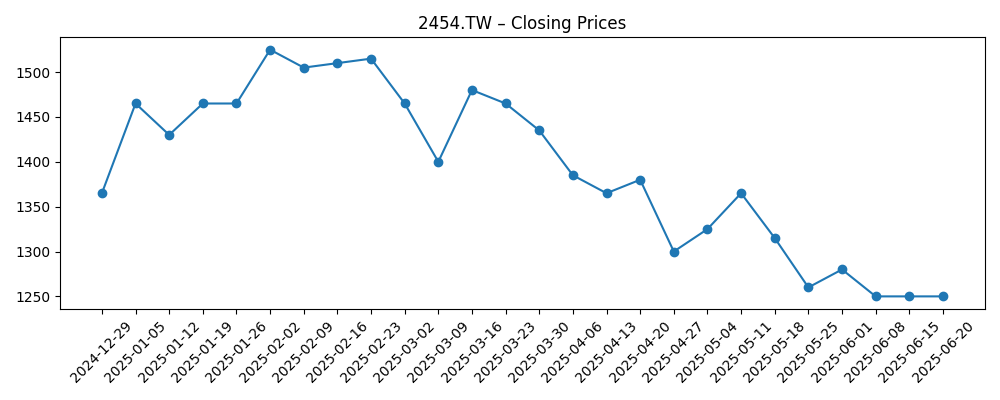

Share price evolution – last 6 months

Notable headlines

- Multicore Processors Market Size to Hit USD 267.25 Billion by 2032, at a CAGR of 13.41% – GlobeNewswire

- Application Processor Market to Surpass USD 55.34 Billion by 2032, at a CAGR of 4.47% – GlobeNewswire

- Baseband Processor Industry Report 2025: Open RAN Adoption Opens New Avenues for Disaggregated Baseband Architectures – GlobeNewswire

Opinion

The recent decline in MediaTek's share price has raised concerns among investors, reflecting broader industry uncertainties. As the multicore processors market continues to expand, MediaTek must leverage its innovative capabilities to regain investor confidence. The projected growth of the application processor market could provide a significant opportunity for MediaTek, particularly if the company can capitalize on emerging trends in AI and 5G technologies.

However, competition remains fierce, and external factors, including supply chain disruptions and geopolitical issues, could pose risks to expected growth. Investors should monitor how effectively MediaTek responds to these challenges while navigating the changing landscape of semiconductor demand.

In light of these developments, maintaining a close watch on analysts' forecasts and market shifts is important. The lack of significant upward movement in share price in recent weeks suggests cautious investor sentiment, likely due to prevailing uncertainties regarding future revenue streams.

Ultimately, MediaTek's ability to adapt to the evolving market will be crucial. If the company can align its product strategy with market demands, it could recover and thrive, despite current challenges. This delicate balance will determine MediaTek's trajectory in the years to come.

What could happen in three years? (horizon June 2025+3)

| Scenario | Outlook |

|---|---|

| Best | Share price recovers to 1600.0 with strong sales growth and improved margins |

| Base | Stable performance with a share price around 1350.0 amidst modest growth |

| Worse | Further declines to 1100.0 due to intensified competition and market pressures |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Market competition and pricing pressure

- Supply chain stability and semiconductor availability

- Technological advancements and innovation pace

- Geopolitical factors affecting trade

Conclusion

In conclusion, MediaTek Inc. finds itself at a critical juncture as it strives to maintain its competitive edge in an increasingly crowded marketplace. While the outlook for the multicore and application processors markets remains positive, internal and external challenges must be navigated carefully. Investors should stay informed about industry developments and MediaTek's strategic responses as they could significantly affect share price and overall market confidence. Continued monitoring of these dynamics will be essential for making informed investing decisions moving forward.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.